Summary

- US Treasuries (USTs) rallied at the start of the month, with the surge primarily driven by major central banks’ statements. The rally was reversed following the release of steady US inflation data, which raised concerns about a potential upward adjustment to the dot plot. Eventually, Federal Reserve (Fed) officials signalled in their latest projections that they still see three rate cuts in 2024. At the end of March, the benchmark 2- and 10-year UST yields settled at 4.62% and 4.20%, respectively, 0.1 basis points (bps) higher and 5.0 bps lower compared to the end of February.

- We maintain a positive outlook for Asian local government bonds, particularly those from India, Indonesia and the Philippines. In our view, the disinflation trends in these countries should provide their central banks with the flexibility to shift towards rate cuts later in the year. We expect this backdrop of a slow but steady easing of monetary policy, coupled with reasonable growth, to be positive for the bonds of these countries.

- Asian credits registered total returns of +1.06% in March as credit spreads tightened 9 bps. Asian investment-grade (IG) credit slightly underperformed its Asian high-yield (HY) counterpart, rising 0.94% as spreads narrowed 4.6 bps. Meanwhile, Asian HY credit gained 1.81% as spreads tightened 55 bps.

- From a technical perspective, we expect Asia credit to remain well-supported due to subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. The realisation of certain negative risk factors may exert some widening pressure Asia credit spreads, particularly in the IG segment.

Asian rates and FX

Market review

The Fed holds to forecast of three rates cuts in 2024

USTs rallied at the start of the month, with the surge primarily driven by major central banks’ statements. Despite their cautious approach to accommodative measures, the central banks confirmed that easing would be implemented this year. The US jobs report led to a further drop in yields. Although US labour data mostly exceeded expectations, investors interpreted softer wage growth and a higher unemployment rate as signs of a potential softening in the jobs market.

The rally by USTs the start of March completely reversed course following the release of steady US inflation data, which raised concerns about a potential upward revision to the dot plot at the Federal Open Market Committee meeting. UST yields pulled back slightly after the Fed maintained its relatively dovish stance. Despite improvements to their growth and inflation projections, the latest dot plot showed policymakers still anticipating three rate cuts by the end of 2024.

The Bank of Japan (BOJ) took a notable turn away from negative rates in March, implementing its first rate hike in 17 years. It also ended its yield curve control policy, which involved purchasing Japanese government bonds to manage interest rates. The Japanese yen showed a brief initial response but the markets mostly shrugged off the BOJ’s decision. UST yields subsequently traded within a relatively narrow range until the end of the month. At the end of March, the benchmark 2-year and 10-year UST yields settled at 4.62% and 4.20%, respectively, 0.1 bps higher and 5 bps lower compared to the end of February.

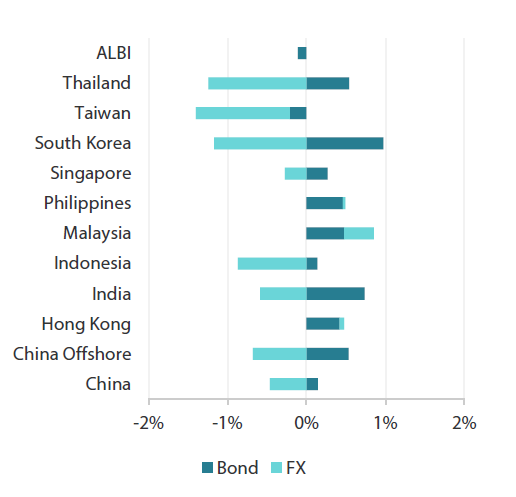

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 31 March 2024

|

For the year ending 31 March 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 March 2024

Central banks in Malaysia and Indonesia leave policy rates unchanged

Bank Negara Malaysia maintained its overnight policy rate at 3.00%, indicating that its monetary policy stance continues to support the economy. The central bank also noted that the Malaysian ringgit is undervalued, considering the country’s robust economic fundamentals and growth outlook. Furthermore, it emphasised its collaboration with the government in implementing coordinated measures, which are “contributing to greater inflows, lending support to a firmer ringgit”. Meanwhile, Bank Indonesia held policy steady at its March meeting, focusing on stabilising the rupiah and controlling inflation. However, it hinted at potential rate cuts in the second half of the year. In the meantime, the central bank plans to expand liquidity incentives to banks to ensure that high borrowing costs do not stifle credit availability and economic growth.

Headline inflation rates accelerate in February

The month of February witnessed a rise in headline inflation rates across the region. Singapore’s consumer price index (CPI) climbed 3.4% year-on-year (YoY), exceeding January’s 2.9% increase and consensus estimates of a 3.2% rise. Policymakers attributed the increase to an acceleration in accommodation inflation and higher core prices. Additionally, higher services and food inflation, partially resulting from seasonal effects associated with Lunar New Year, contributed to the rise in core inflation.

In Malaysia, headline inflation edged up to 1.8% YoY in February, driven in part by the increase in domestic water tariffs, while core inflation remained stable at 1.8% from January. Indonesia’s headline inflation rose to 2.75% YoY in February, up from 2.57% in January, driven by higher food and transport inflation, even though core inflation remained unchanged at 1.68% YoY.

In the Philippines, the headline CPI rose to a higher-than-expected 3.4% YoY in February, up from 2.8% in January, propelled by a surge in food and non-alcoholic beverages prices along with increased transport inflation, while core inflation slowed to 3.6% from 3.8% over the same period.

Thailand’s headline CPI declined 0.77% YoY in February, falling for the fifth consecutive month. When excluding raw food and energy prices, core inflation in Thailand moderated to 0.43% YoY in February from 0.52% in January.

China unveils a 2024 growth target of “about 5%”

Early in March, Chinese Premier Li Qiang presented his first Government Work Report at the annual National People’s Congress. The report for 2024 revealed a growth target of “about 5%”, with the official fiscal deficit maintained at 3% of GDP. An estimate of last year’s fiscal deficit, which includes off-balance sheet items, was lower than expected at roughly 7%. However, this year’s budget points to a larger deficit of 8.2% if fully executed. A notable announcement for long-term growth and stimulus was the plan to issue “ultra-long” (30– to 50–year) special sovereign bonds over the next few years. The CPI inflation target for 2024 was kept unchanged from the previous year at “around 3%”. Additionally, monetary policy is expected to remain accommodative, described as “flexible, appropriate and precise”.

Market outlook

Remain positive on India, Indonesia and Philippine bonds

We maintain a positive outlook for Asian local government bonds. The anticipated decrease in developed bond market yields, as major central banks, including the Fed, pivot towards rate cuts amid easing inflationary pressures, coupled with increased foreign inflows, is expected to bolster demand for Asian bonds.

We expect the disinflation trend in India, Indonesia and the Philippines to persist. In our view, this should provide the Reserve Bank of India, Bank Indonesia and Bangko Sentral ng Pilipinas the flexibility to shift towards rate cuts later in the year. A backdrop of slow but steady easing of monetary policy, coupled with reasonable growth, should be positive for local currency bonds in these countries. Additionally, the attractive real yields of these bonds in comparison to their regional peers should further bolster demand.

Asian credits

Market review

Asian credit spreads tighten further in March

Asian credits delivered total returns of 1.06% in March as credit spreads tightened 9 bps. Asian IG credit slightly underperformed Asian HY, with a return of 0.94% as spreads narrowed 4.6 bps. Asian HY credit gained 1.81% as spreads tightened 55 bps.

Asian credit spreads widened in early March, partly dragged by weakness in the Chinese property sector due to concerns about a large developer. However, they recovered later in the month on growing indications that banks would support the developer. Notably, the lack of significant measures at the National People’s Congress to address increasing economic headwinds did not negatively impact Chinese credits. Meanwhile, Hong Kong credits rallied, driven by strong property sales following the removal of all property cooling measures.

Philippines HY credits also rallied as a major conglomerate based in the country reported a large equity investment and announced a call on its perpetual bond. Reports of US prosecutors investigating India’s Adani Group for potential bribery soured sentiment toward Indian credits, resulting in their underperformance. The overall resilience of Asian credits was supported by strong technicals, as new supply remained relatively limited while fund inflows increased. By the end of March, spreads for all major country segments, excluding those of India, South Korea and Thailand, had tightened.

Primary market activity picks up in March

Activity in the primary market picked up slightly in March. The IG space saw 11 new issues amounting to US dollar (USD) 5.5 billion, including a USD 1.4 billion three-tranche issue from Korea National Oil Corp and a USD 1.0 billion issue from AIA Group. Meanwhile, the HY space saw four new issues amounting to USD 1.4 billion.

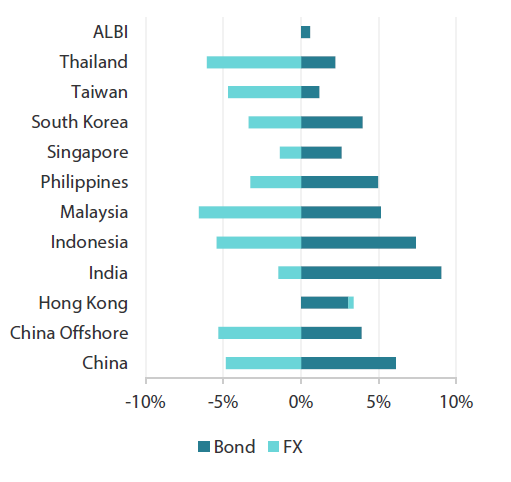

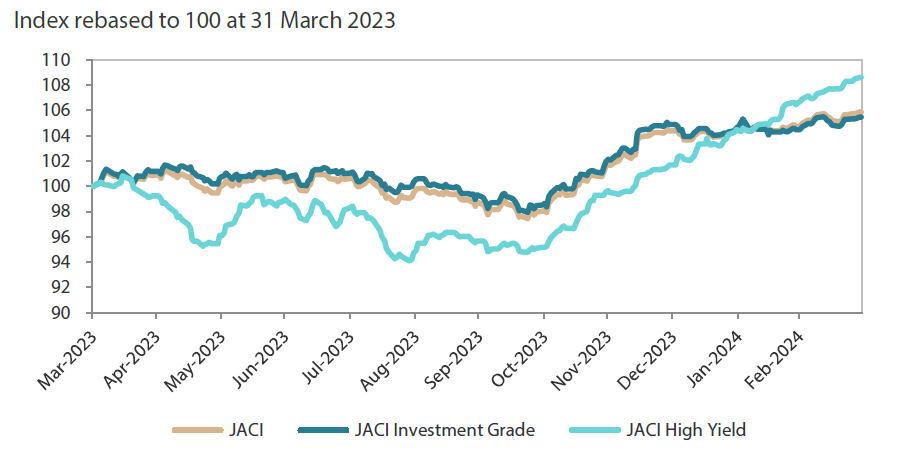

Chart 2: JP Morgan Asia Credit Index (JACI)

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2024.

Market outlook

Supportive Asia credit fundamentals and strong technicals, but tight valuation calls for cautious positioning

The fundamental backdrop for Asian credit remains supportive. In China, the aforementioned announcements at the National People’s Congress suggest that policymakers are aware of the challenging environment. China’s growth target still appears ambitious, as the property sector continues to weigh on the economy despite a recent recovery in the country’s Purchasing Managers’ Index (PMI).

Meanwhile, macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient with a recovery in exports growth potentially offsetting softer domestic conditions. Non-financial corporates may experience a slight weakening in both leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs. However, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with a stable deposit base, solid capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

From a technical perspective, we expect Asia credit to remain well-supported due to subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains strong from regional institutional investors looking to lock in attractive yields. However, following the sharp rally in recent months, these positive factors have been largely priced in. The realisation of certain negative risk factors such as a weaker-than-expected global economy, as well as local political uncertainties and geopolitical tensions, may exert some widening pressure on Asia credit spreads, particularly in the IG segment.