Japan equities slip amid US-China tensions

The Japanese equity market dropped in July, with the TOPIX (w/dividends) declining 4.02% on-month and the Nikkei 225 (w/dividends) falling 2.60%. Stocks initially benefitted from positive US jobs reports and improved Chinese PMI data, which helped ease concerns around the global economic outlook. Expectations around development of a coronavirus vaccine and treatment also bolstered share prices. However, stocks declined toward the end of the month on escalating tensions between the US and China, including the US rejecting China’s claim to the South China Sea. Other negative factors included news of the US’s sharp GDP contraction and worries that a resurgence of COVID-19 cases in Japan and elsewhere will depress economic activity. Of the 33 Tokyo Stock Exchange sectors, only three sectors rose: Information & Communication, Electric Appliances, and Securities & Commodity Futures. In contrast, 30 sectors declined, including Land Transportation, Air Transportation, and Real Estate.

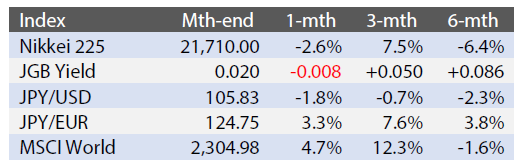

Exhibit 1: Major Indices (Last Month and Historic Changes)

Source: Bloomberg, as of 31July 2020

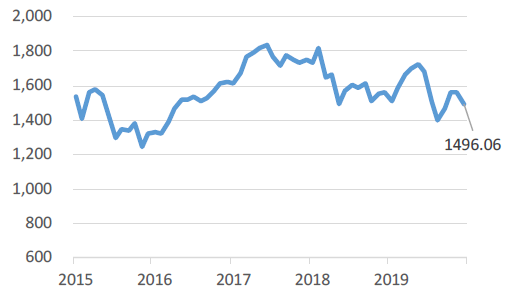

Exhibit 2: Nikkei 225

Source: Bloomberg, as of 31July 2020

Japan’s market and the US elections

The approaching US presidential election is one of the key events of 2020 and something the financial markets, including Japan’s, will be following closely. Joe Biden is leading the polls and currently the markets appear to be trying to price in a Democratic Party win. For the Japanese economy, the election outcome might not make such a big difference. Some argue that a Biden win might favour Japan as he could hike the US corporate tax rate—a move that could drive up prices of US goods and nudge consumers towards products made in countries such as Japan and Germany.

However, at least in the short term, Japan’s equity market is likely to view a potential Biden victory differently, focusing more on the negative impact a corporate tax hike could have on the US economy. But in the longer term, an initially negative reaction to a Biden win could fade, as he is unlikely to raise the tax rate immediately after taking office. What could be more important for the Japanese market is not who wins the election, but how the world’s largest economy copes with the pandemic. The market’s focus, in our view, will be on which US and Japanese sectors could benefit in a socially-distancing post-pandemic world. In the case of the US, internet-related sectors come to mind; while for Japan, such sectors as robotics and machinery could benefit as the pandemic boosts the need for automation in manufacturing.

Events that could help Japan’s competitiveness

According the "World Competitiveness Ranking 2020", released recently by Swiss business school IMD, Japan fell four places to 34th. While such a low ranking is debatable, it has to be said that Japan is not particularly business-friendly and its companies are not very efficient. Japan needs to improve its legal and financial reporting service standards if it wants to attract top-level businesses from abroad. It also needs to address low profitability per worker despite high employee production.

Several recent developments could improve Japan’s competitiveness, in our view. First is the COVID-19 pandemic. The virus outbreak could be an inflection point for Japan, as the massive shift to teleworking challenges traditional concepts of wage vs salary and addresses many of the irrationalities long associated with Japan Inc. The second point is related to the aforementioned US presidential election: a Biden win could revive the importance of the Trans-Pacific Partnership (TPP), which the US declined to join under President Trump. A revived TPP, should the US opt to rejoin it under Biden, could expand Japan’s playing field and increase its international competitiveness.

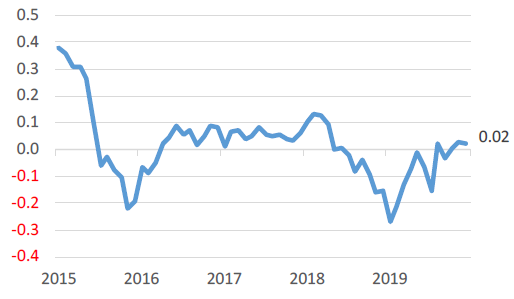

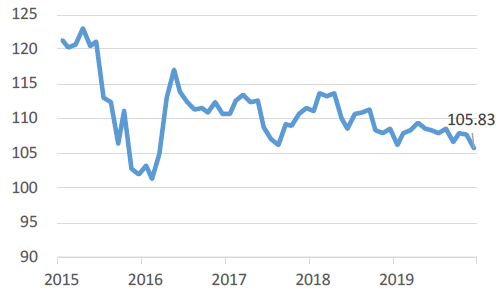

Exhibit 3: Major Market Indices

TOPIX

JGB Yield

USD/JPY

Japan Equity Net Purchase from Overseas (JPY billions)

Source: Bloomberg, as of 31July 2020

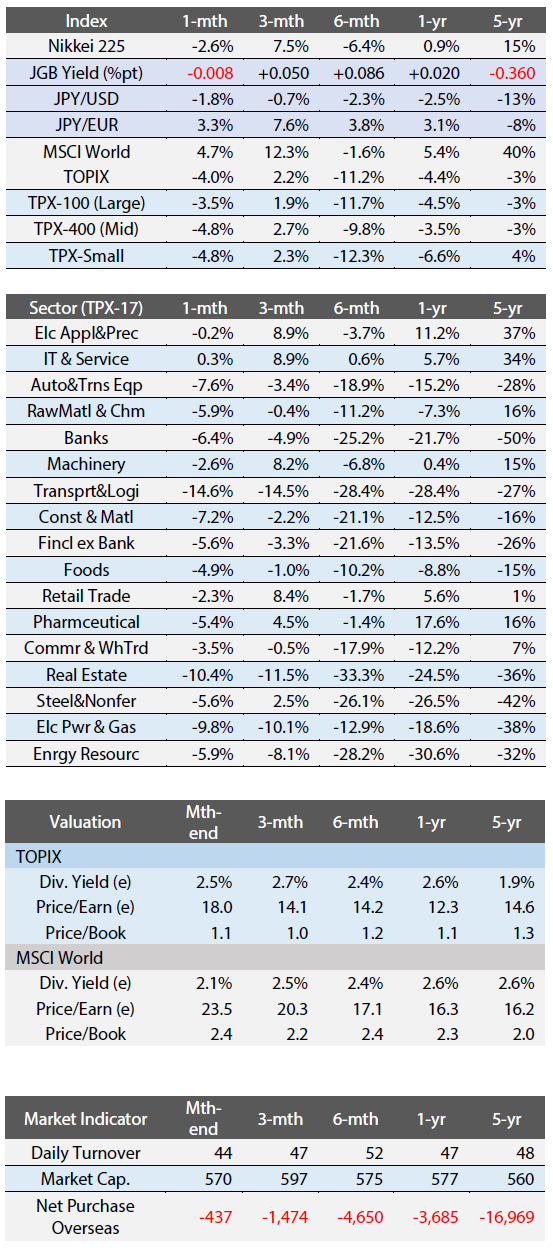

Exhibit 4: Major Index Performance, Indicators, and Valuation

Source: Bloomberg, as of 31July 2020

(e) stands for consensus estimates by Bloomberg.

Turnover and market cap in JPY trillions.

Net Purchase (JPY billions) from overseas is cumulative monthly.