Summary

- UST (US Treasury) yields rose in June. The US Federal Reserve (Fed) raised interest rates by 75 basis points (bps). The European Central Bank (ECB) announced the conclusion of its asset purchases and commencement of raising rates in July. Concerns of a potential recession surfaced after release of economic data from USand other developed markets. At the end of June, the benchmark 2-year and 10-year UST yields were at 2.957% and 3.016%, respectively, 39.9 bps and 16.9 bps higher compared to end-May.

- Inflationary pressures accelerated in May across the region (notably in South Korea, Thailand, Indonesia, Singapore, Malaysia and the Philippines), due to higher transport and food prices. Central banks of Thailand, Indonesia, the Philippines and India revised their inflation forecasts higher, driven by elevated food and energy prices. Separately, Bank Indonesia (BI) and Bank of Thailand (BOT) kept their policy rates unchanged. Reserve Bank of India (RBI) and Bangko Sentral ng Pilipinas’ (BSP) both hiked their policy rates.

- In June, Chinese policymakers signalled further support for the economy; the steps included rolling out of additional measures to boost consumption, further acceleration of fiscal spending and sale of special local government bonds. The People's Bank of China (PBOC) said that it will maintain a supportive monetary policy. Although China reaffirmed its zero-COVID policy, it eased quarantine measures for inbound travellers towards the month-end.

- We maintain our preference for Malaysian bonds, as we believe that inflation will be better contained in Malaysia compared to other countries. We are also gradually turning less bearish on duration overall. On currencies, we prefer the Singapore dollar (SGD), Chinese yuan (CNY) and South Korean won (KRW) over the Thai baht (THB), Indonesian rupiah (IDR) and Philippine peso (PHP).

- Asian credits retreated by 2.28% in total return, as credit spreads widened and UST yields moved sharply higher. Spreads within the region, except Malaysia and Taiwan, widened in June. S&P upgraded Malaysia’s credit rating outlook.

- Despite greater downside risks to fundamentals, we expect the existing fundamental buffers and further policy easing in China will help contain near-term widening in Asia credit spreads, although the pressure will nonetheless be felt, especially with the spread widening observed in developed credit markets. On a more positive note, with market concerns beginning to shift from inflation to growth, upside risk to UST yields may be curtailed, thereby mitigating downside risks to total returns going forward.

Asian rates and FX

Market review

The US Treasury yield curve shifts higher in June

UST yields moved significantly higher in June, with the yield curve ending flatter as front-end yields underperformed. The US headline consumer price index (CPI) for May was considerably stronger than expected at 8.6% year-on-year (YoY), triggering fears that the Fed could tighten monetary policy more swiftly. Simultaneously, the ECB announced it would conclude asset purchases and commence raising rates in June. These developments prompted a significant repricing in global bond yields. Mid-month, the Fed delivered the largest rate hike since 1994, raising interest rates by 75 bps. UST yields retraced part of their earlier rise after Fed Chair Jerome Powell recalibrated expectations on future hikes, declaring that “either a 50 or 75 basis point increase seems most likely at our next meeting”. Subsequently, soft economic data from the US and other developed markets sparked fears of a potential recession in key economies, prompting some easing in global bond yields. At the end of June, the benchmark 2-year and 10-year UST yields were at 2.957% and 3.016%, respectively, 39.9 bps and 16.9 bps higher compared to end-May.

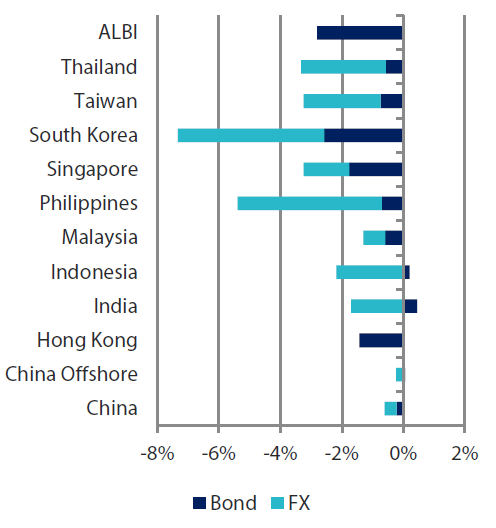

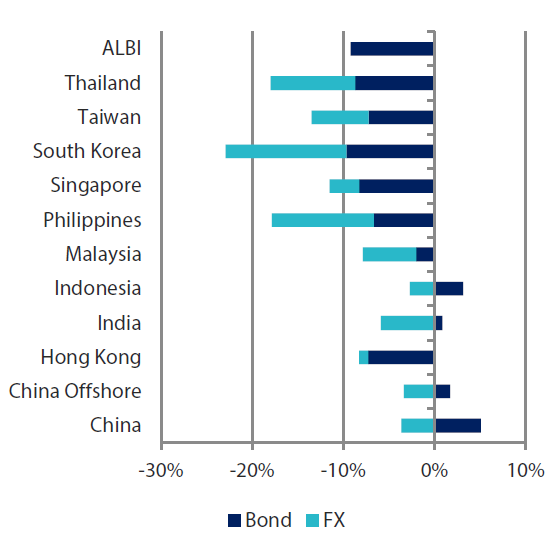

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 June 2022 | For one year ending 30 June 2022 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 June 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures rise in May

Higher transport and food inflation remained the key factors that prompted the acceleration in May headline CPI numbers in South Korea, Thailand, Indonesia, Singapore, Malaysia and the Philippines. Headline CPI inflation in the Philippines picked up to 5.4% YoY in May from 4.9% YoY in April, well above the central bank’s 2–4% target range. Overall inflation in Thailand accelerated to 7.1% YoY in May from April’s 4.7% YoY, driven mostly by higher prices of energy and food items. In Singapore, headline CPI inflation rose to 5.6% YoY, on the back of increases in both accommodation and private road transport inflation, while a similar gauge in Indonesia picked up to 3.55% YoY in May.

Central banks raise their inflation forecasts

Elevated food and energy prices prompted monetary authorities in the region to revise up their inflation forecasts. The BOT raised its inflation forecasts for 2022 and now expects the headline and core numbers to be 6.2% (from 4.9%) and 2.2% (from 2.0%), respectively. In Indonesia, BI is projecting headline CPI to breach its 2–4% target, registering 4.2% by year-end, driven mainly by higher food and energy prices. Meanwhile, BSP’s outgoing Governor Benjamin Diokno declared that the bank’s baseline forecasts for inflation have shifted higher. Average inflation is now projected to breach the upper end of the BSP’s 2–4% target and reach 5% in 2022 and 4.2% in 2023. Elsewhere, the RBI declared it is now projecting the headline CPI number to register 6.7% (from 5.7%) for fiscal year 2023.

Central banks in Indonesia and Thailand keep policy rates unchanged; BSP and RBI hike rates

The RBI raised the policy repo rate by 50 bps to 4.90% and left the case reserve ratio unchanged, removing the phrase “remain accommodative” from its policy statement. The BSP also hiked its policy rate by 25 bps to 2.5%. Meanwhile, BI left its policy rate unchanged, reiterating the need to support the economic recovery and promote rupiah stability. Similarly, the BOT’s rate-setting committee voted 4 to 3 to keep rates unchanged. That said, the bank stated that it sees a lower need for accommodative policy going forward, suggesting a possible rate hike later in the year.

Chinese policymakers signal further support for the economy

Chinese President Xi Jinping pledged to “step up macroeconomic policy adjustment and adopt more effective measures to deliver the economic and social development goals for the whole year and minimise the impact of COVID-19”. Separately, Chinese Premier Li Keqiang, in a State Council meeting, urged authorities to roll out additional measures to boost consumption, declaring it an important driving force for the economic recovery. Similarly, Finance Minister Liu Kun said authorities are studying new policy tools to support the economy, adding that the government will further accelerate fiscal spending and the sale of special local government bonds. PBOC Governor Yi Gang also declared that the central bank would maintain a supportive monetary policy “to support economic recovery in (an) aggregate sense”. Towards the end of June, authorities eased quarantine time for international arrivals, prompting some hopes that China could be cautiously looking to shift to a living-with-COVID approach. That said, President Xi subsequently reaffirmed the country’s zero-COVID policy, declaring that it is the “most economic and effective” policy for the country.

Market outlook

Prefer Malaysia bonds; prefer Chinese yuan, Korean won and Singapore dollar to Thai baht, Indonesian rupiah and Philippine peso

We believe that markets have largely priced in hawkish Fed expectations, with US breakeven inflation rates having eased since mid-June. Hence, we are gradually turning less bearish on duration overall. Within the region, we maintain our preference for Malaysian bonds on the view that inflation would be better contained in Malaysia vis-à-vis other countries.

On currencies, we prefer the SGD, CNY and KRW over the THB, IDR and PHP. The outperformance of SGD could be supported by expectations of further FX tightening by the Monetary Authority of Singapore (MAS) as core inflation in Singapore remains elevated. Meanwhile, China has relaxed quarantine requirements for inbound travellers. This, together with increasing expectations that the Biden administration could roll back some of the extra tariffs on Chinese exports to the US, is likely to be supportive of the CNY going forward.

In contrast, we expect sentiment towards the THB, IDR and PHP to be weighed down by deterioration in the external balances of the respective countries. Renewed focus on infrastructure spending in the Philippines and Indonesia is likely to result in higher import growth for both countries, and elevated energy prices will remain a risk for both THB and PHP. BOT and BI being laggards in the Asia rate hike cycle is another factor that could weigh on both THB and IDR.

Asian credits

Market review

Asian credits end lower as credit spreads widen and US Treasury (UST) yields jump

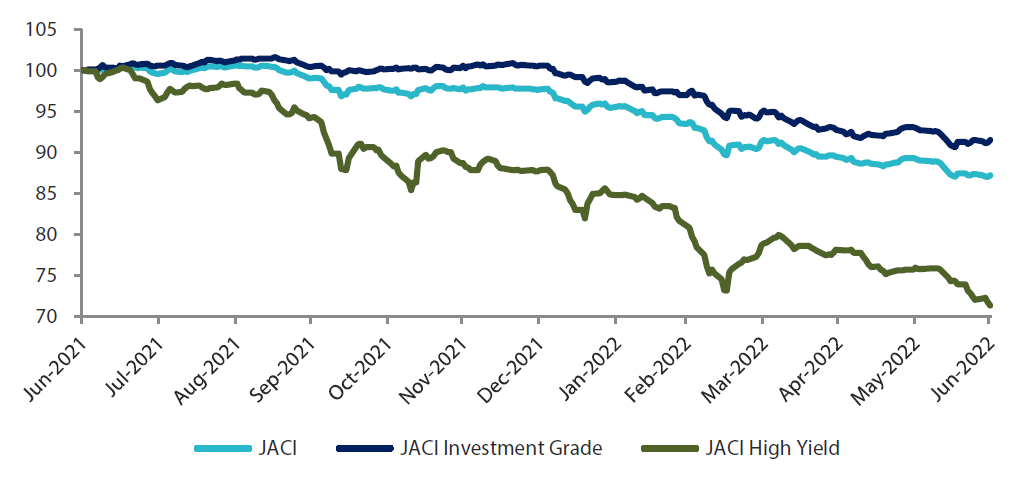

Asian credits retreated by 2.28% in total return, as credit spreads widened by 21.2 bps and UST yields readjusted sharply higher. Asian high-grade (HG) declined 1.54%, with spreads rising 5.4 bps. Asian high-yield (HY) significantly underperformed, returning -6.09%, as spreads widened 125.8 bps on increasing concerns that stress in China HY is expanding beyond the property sector.

Asian credit spreads initially traded tighter, supported by the rebound in Chinese purchasing managers’ index (PMI) numbers and Shanghai’s emergence from a two-month COVID lockdown. Overall risk sentiment subsequently soured, with markets focusing on rapidly tightening global financial conditions and fresh signs of entrenched inflation, in response to the US May CPI print that exceeded market expectations. As UST yields adjusted sharply higher, credit spreads started widening. Global risk sentiment improved somewhat in the latter half of June as investors shifted their focus to weak growth. That said, Asian credit spreads—dragged largely by Chinese HY credits—continued to rise on the back of idiosyncratic developments and acceleration in outflows from Emerging Market (EM) bond funds. Moody’s placing China’s Fosun under review for a downgrade also led to pressure in industrial and consumer names as part of repositioning by investors, given the rising risk of higher rates and recession risk. In China, May activity data pointed to a modest recovery; this, coupled with stronger-than-expected credit data and positive regulatory headlines in the technology sector, led to continued demand in high quality China HG corporates credits. Meanwhile, top leaders signalled readiness to step up government stimulus, with President Xi vowing to adopt “more forceful measures” to hit the country’s economic targets for the year. Towards end of June, authorities partially relaxed quarantine requirements for inbound travellers—which investors took as an important step towards China’s reopening efforts.

Spreads within the region, except for Malaysia and Taiwan, widened in June. S&P upgraded Malaysia’s credit rating outlook to “stable” from “negative” due to “expectations that Malaysia’s steady growth momentum and strong external position will hold over the next two years”. Indian credits underperformed, although Fitch Ratings upgraded India’s sovereign credit rating outlook to “stable” from “negative” and also upgraded the outlook of government-related entities. A sharp correction in prices of base metals, prompted by global recession concerns, weighed heavily on some Indian corporates. In addition, pressure on the country’s macro and fiscal strength from high energy prices and rising inflation continued to weigh on overall Indian credits. In frontier markets, the International Monetary Fund (IMF) announced progress toward an aid program for Sri Lanka. Nonetheless, soaring inflation expectations in the country resulted to a marked widening in credit spreads.

Primary market activity considerately moderates in June

Volatility in US rates prompted a further moderation in primary market activity in June. The HG space saw 23 new issues amounting to USD 8.78 billion, including the USD 800 million two-tranche issue from Korea Electric and the USD 750 million subordinated debt issue from Overseas Chinese Banking Corporation Limited. The HY space saw approximately USD 2.21 billion worth of new issues raised from 18 new issues.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 June 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2022

Market outlook

Existing buffers prevent meaningful spread widening despite greater downside risks to fundamentals

Headwinds from the combination of geopolitical tensions and tighter financial conditions remain intense as central banks globally embark on an aggressive and synchronized monetary policy tightening to control inflation and rising recession risk in major developed economies. China’s economic recovery with the recent easing of lockdowns and mobility restrictions should provide some support, in our view, but it is unlikely to be sufficient enough to offset the challenges facing the global economy. China’s perseverance with its zero-COVID strategy also means the recovery momentum remains vulnerable to renewed outbreaks. These global and regional developments may present greater downside risks to the macro backdrop and corporate credit fundamentals across Asia, and there will likely be greater differentiation across countries and sectors. While we believe existing fundamental buffers and further policy easing in China will help contain near-term widening in Asia credit spreads, the pressure will nonetheless be felt, especially with the spread widening observed in developed credit markets. On a more positive note, with market concerns beginning to shift from inflation to growth, upside risk to UST yields may be curtailed, thereby mitigating downside risks to total returns going forward.