Summary

- US Treasury (UST) yields fell in May amid a dip in the US consumer price index (CPI) inflation data, weakness in US equities and renewed growth concerns. As of end-May, the benchmark 2-year and 10-year UST yields were at 2.559% and 2.847%, respectively, 15.9 basis points (bps) and 9.1 bps lower compared to end-April.

- Inflationary pressures rose in April for India, Indonesia, Malaysia, South Korea and the Philippines, due mainly to increasing energy and food prices. The threat of higher and more persistent inflation prompted central banks in India, South Korea, Malaysia, Indonesia and the Philippines to tighten monetary conditions in May.

- In May the Chinese authorities announced measures to support the country’s property sector. China’s central bank lowered minimum mortgage rates for first-time home buyers and reduced the 5-year Loan Prime Rate (LPR); other measures included the easing of purchasing restrictions of properties by some local governments and support of real estate developers through reasonable financing needs. At the end of the month, the Chinese government announced a raft of new stimulus measures to support six major areas of the economy.

- We prefer Malaysian bonds, as we are of the view that inflation will be relatively better contained in Malaysia. We are keeping a neutral view on duration for low-yielding regions and countries such as Hong Kong, Singapore and Thailand. On currencies, we favour the Chinese yuan (CNY), Thai baht (THB) and Singapore dollar (SGD) to Philippine peso (PHP) and Indian rupee (INR).

- Asian credits retreated by 0.29% in total return, as credit spreads widened. Spreads within the region, except Indonesia, Philippines and Taiwan, widened in May. Sri Lanka and Pakistan continued to experience acute pressure on the external front.

- With greater downside risks to fundamentals, we expect the existing buffers and the anticipated policy response in China to counter the growth headwinds could prevent meaningful spread widening. We continued to believe that the all-in yield for Asia credit has risen to attractive levels historically and provides a favourable entry point for investors with a medium-to-long term perspective.

Asian rates and FX

Market review

UST yields fall in May

In May, the US Federal Reserve (Fed) delivered its first 50 bps rate hike since May 2000. Fed Chair Jerome Powell pushed back on expectations of larger hikes, although he suggested that the Fed could hike rates by 50 bps at each of the next two meetings. Subsequently, US CPI inflation data eased to 8.3% year-on-year (YoY) in April from 8.5% in the prior month. This, together with broadly weak risk sentiment, triggered a decline in yields. Thereafter, weakness in US equities and renewed growth concerns sustained the further easing in rates. At the end of May, the benchmark 2-year and 10-year UST yields were at 2.559% and 2.847%, respectively, 15.9 bps and 9.1 bps lower compared to end-April.

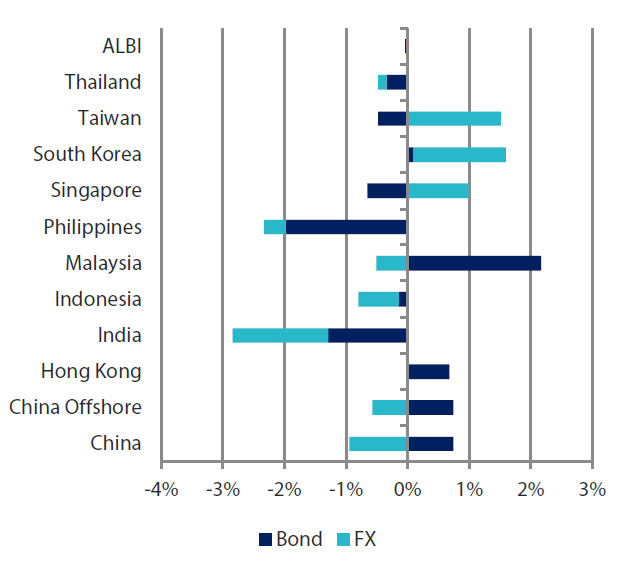

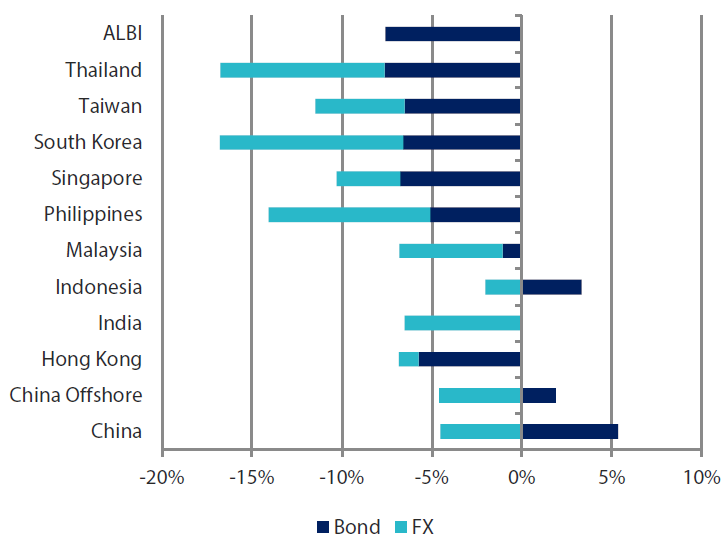

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 May 2022 | For one year ending 31 May 2022 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 May 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures rise in April

Increasing energy and food prices were key factors that prompted the acceleration in headline CPI numbers in India, Indonesia, Malaysia, South Korea and the Philippines. Indonesia’s headline number increased to 3.47% YoY in April, the highest since December 2017. In South Korea, CPI inflation accelerated to 4.8% YoY, the highest level since September 2008. India’s CPI inflation reached an eight-year high, registering 7.79% YoY, reflecting a broad-based rise across food, fuel and core inflation. In Malaysia, April headline CPI registered 2.3% YoY while a similar gauge of overall inflation printed 4.9% YoY in the Philippines. In Singapore, the headline number for April was unchanged at 5.4% YoY, as higher accommodation costs and core inflation were offset by lower private road transport price inflation.

Most central banks tighten monetary conditions

The threat of higher and more persistent inflation prompted central banks in India, South Korea, Malaysia, Indonesia and the Philippines to tighten monetary conditions in May. The Reserve Bank of India (RBI), in an unscheduled meeting, hiked the policy repo rate by 40 bps and the cash reserve ratio by 50 bps. According to the RBI, domestic growth is becoming more broad-based and private consumption is recovering, while core inflation is seen remaining elevated in the coming months. Bank Negara Malaysia raised its policy rate by 25 bps, declaring that domestic growth is now “on a firmer footing”. It added that improvement in growth amid lingering cost pressures would result in underlying inflation trending higher. The Philippine central bank similarly lifted the key rate by 25 bps, a move which the central bank governor expects to “help arrest further second-round effects and temper the build-up in inflation expectations”. The Bank of Korea delivered a 25 bps rate hike, and raised its inflation forecasts for 2022 and 2023, to reflect higher energy and food prices. Although Bank Indonesia left its policy rate unchanged—noting that core inflation remains “under control”—it announced a more aggressive policy path for reserve requirement ratio hikes.

China’s central bank lowers some mortgage rates, reduces 5-year Loan Prime Rate

Chinese policymakers announced measures to prop up the property sector. The People’s Bank of China (PBOC) lowered the minimum mortgage rates for first-time homebuyers by 20 bps. Subsequently, it also reduced the 5-year LPR by 15 bps to 4.45%, while it kept the 1-year LPR unchanged. In addition, more local governments announced measures to ease purchase restrictions for properties. Separately, the China Securities Regulatory Commission announced that it would support reasonable financing needs by real estate developers. Notably, the month saw a number of major private property developers issue onshore bonds with credit protection.

China announces a raft of new stimulus measures

Towards month-end, Chinese Premier Li Keqiang cautioned that economic challenges in some areas were “greater than when the pandemic hit hard in 2020”, communicating the need for officials to ensure positive growth in the second quarter. Following this, the government announced a package of 33 policies to support six major areas of the economy. This includes fast-tracking of infrastructure projects, deferment of select principal and interest payments for businesses and individuals affected by lockdowns and the doubling of lending quota for banks to support small and medium enterprises.

Market outlook

Prefer Malaysia bonds; also prefer CNY, THB and SGD to PHP and INR

Following months of sharp increases, UST yields have been relatively stable in recent weeks, benefitting Asian rates. We have a preference for Malaysia bonds, with the view that inflation will be better contained in Malaysia compared to other regional countries. On the other hand, we are keeping a neutral view on duration for low-yielding regions and countries such as Hong Kong, Singapore and Thailand.

The US dollar is also demonstrating signs of consolidation at current levels, on the back of concerns over US growth momentum. Within the region, we prefer the CNY, THB and SGD to the PHP and INR. The outperformance of SGD would be supported by expectations of further FX tightening by the Monetary Authority of Singapore as core inflation in Singapore remains elevated. Meanwhile, we expect the continued easing of border restrictions globally to bode well for the recovery of Thai tourism and the THB.

Asian credits

Market review

Asian credits end lower as credit spreads widen

Asian credits retreated by 0.29% in total return, as credit spreads widened by 8.6 bps. Asian high-grades (HG) outperformed their high-yield (HY) counterparts, returning +0.23% despite spreads widening 7.5 bps as UST yields fell. Asian HY returned -2.78%, as spreads widened 40.8 bps.

Asian credits remained under pressure for most of May. Investor sentiment continued to be affected by concerns about rapidly tightening global financial conditions as major central banks embarked on a near synchronized and aggressive monetary policy tightening cycle. China growth slowdown concerns also weighed on sentiment as the Chinese authorities continued to battle the latest COVID outbreak with lockdowns and strict mobility restrictions across major cities. This concern was reinforced by China’s April activity data which came out weaker than the already lowered expectations. Uncertainty about China’s macro fundamentals outweighed comparatively stronger GDP growth data from a number of other Asian economies including the Philippines and Malaysia. Global risk sentiment improved somewhat towards the second half of the month as UST yields stabilised and there was a pause in the relentless US dollar strength as investor focus shifted slightly from anxiety about US inflation to the growth outlook following the release of softening of some business and consumer sentiment indicators in the US. Meanwhile, the Chinese policymakers acted to support the property sector. The PBOC reduced the 5-year (LPR and lowered the minimum mortgage rates for first-time homebuyers. In addition, more local governments announced measures to ease the purchase restrictions for properties.

Towards month-end, China declared it would provide additional fiscal stimulus to support the economy. Asian HG spreads recovered towards late May in response to these developments, but Asia HY spreads remained pressured by credit events in the China property sector and a lack of improvement in property sales despite the easing measures announced so far.

Spreads within the region, except for Indonesia, Philippines and Taiwan, widened in May. Indonesia and Philippines sovereign spreads widened in early May but more than recovered in the latter half of the month following the turnaround in global risk sentiment. Indian credits had weaker technicals, in part reflecting the pressure on the country’s macro and fiscal strength from high energy prices and rising inflation. During the month, S&P upgraded Vietnam’s long-term foreign currency debt rating to “BB+”, one level below investment grade, declaring that the lifting of domestic and cross-border mobility restrictions and shift from the country’s zero-COVID policy places the economy “on course for a steady recovery”. The other frontier economies in Asia, notably Sri Lanka and Pakistan, however, continued to experience acute pressure on the external front.

The Fed delivered its first 50 bps rate hike since May 2000. Fed Chair Powell pushed back on expectations of larger hikes, although he suggested that the Fed could hike rates by 50 bps at each of the next two meetings. Subsequently, US CPI inflation data reflected an improvement, easing to 8.3% YoY in April from 8.5% YoY in the prior month. This, together with broad weak risk sentiment, triggered a decline in yields. Thereafter, weakness in US equities coupled with renewed growth concerns sustained the further easing in rates. At the end of the period, the benchmark 10-year UST yield was at 2.847%, 9.1 bps lower compared to end-April.

Primary market activity moderates further in May

Cautious investor sentiment prompted a further moderation in primary market activity in May. The HG space saw 17 new issues amounting to US dollar (USD) 10.19 billion, including the USD 3.25 billion two-tranche sovereign issue from Indonesia’s Perusahaan Penerbit SBSN, the USD 1.80 billion two-tranche issue from Industrial and Commercial Bank of China and the USD 1.0 billion issue from China Construction Bank. Meanwhile, the HY space saw approximately USD 2.04 billion worth of new issues raised from 11 issues.

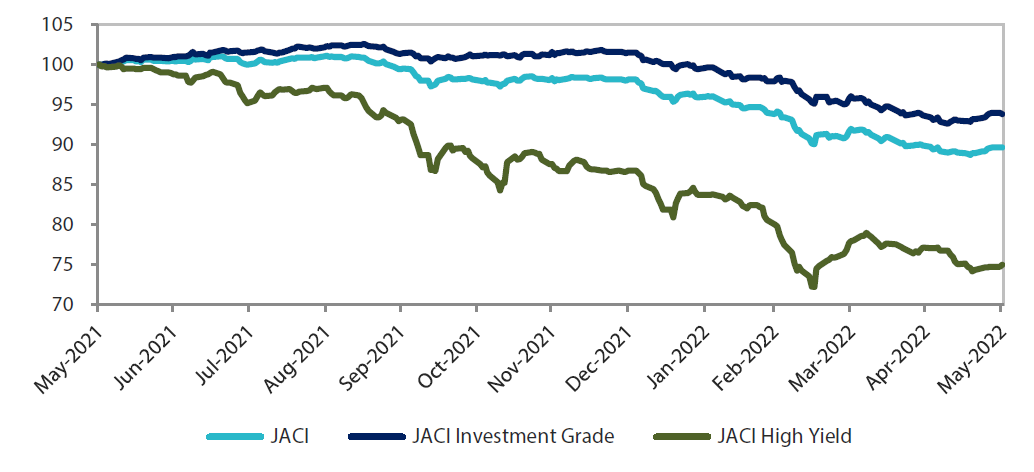

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 May 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2022

Market outlook

Greater downside risks to fundamentals but existing buffers to prevent meaningful spread widening

The combination of geopolitical tensions amidst the ongoing Russia-Ukraine war and tighter financial conditions as central banks globally embark on an aggressive and synchronised monetary policy tightening to control inflation will likely keep broader risk sentiment subdued in the near term. With the recent drop in the number of new COVID cases, gradual easing of lockdowns and mobility restrictions in China is underway. However, the underlying recovery momentum remains fragile despite the announced policy easing measures. Private sector confidence has been dented and there remains the risk of more lockdowns ahead, given China’s adherence to its zero-COVID strategy. These global and regional developments are expected to present greater downside risks to the macro backdrop and corporate credit fundamentals across Asia, and there will likely be greater differentiation across countries and sectors. However, given existing buffers and the anticipated further policy response in China to counter the growth headwinds, any near-term widening in Asia credit spreads will likely be contained, in our view. In addition, while an aggressive US rate hike cycle is underway, the US rates market may have already repriced significantly and this could limit the upside risk to UST yields from here. The all-in yield for Asia credit has also risen to attractive levels historically and we believe this provides a favourable entry point for investors with a medium-to-long term perspective.