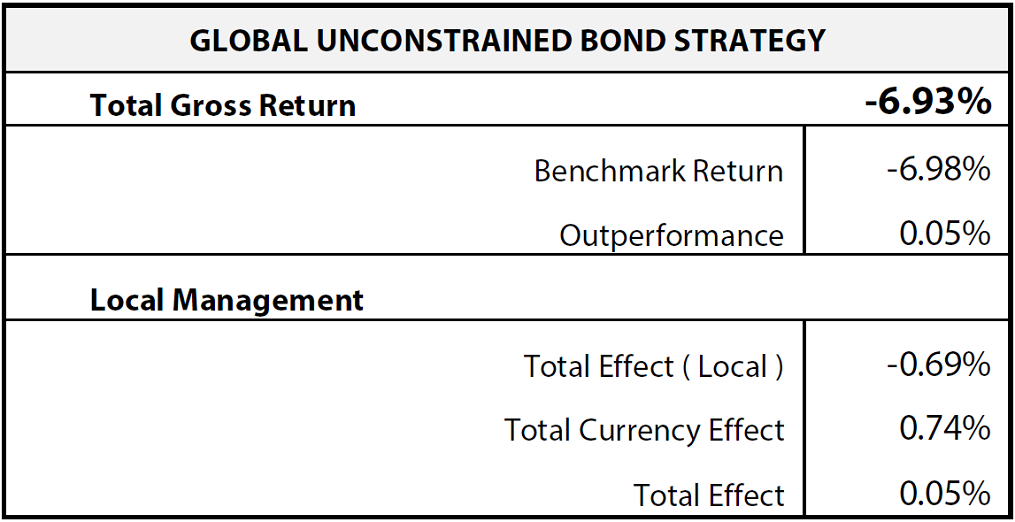

Q3 performance summary

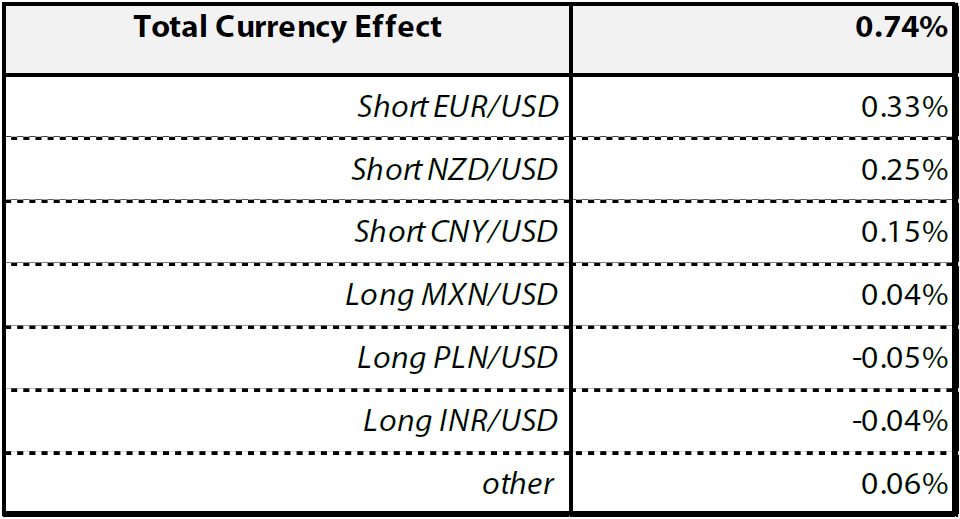

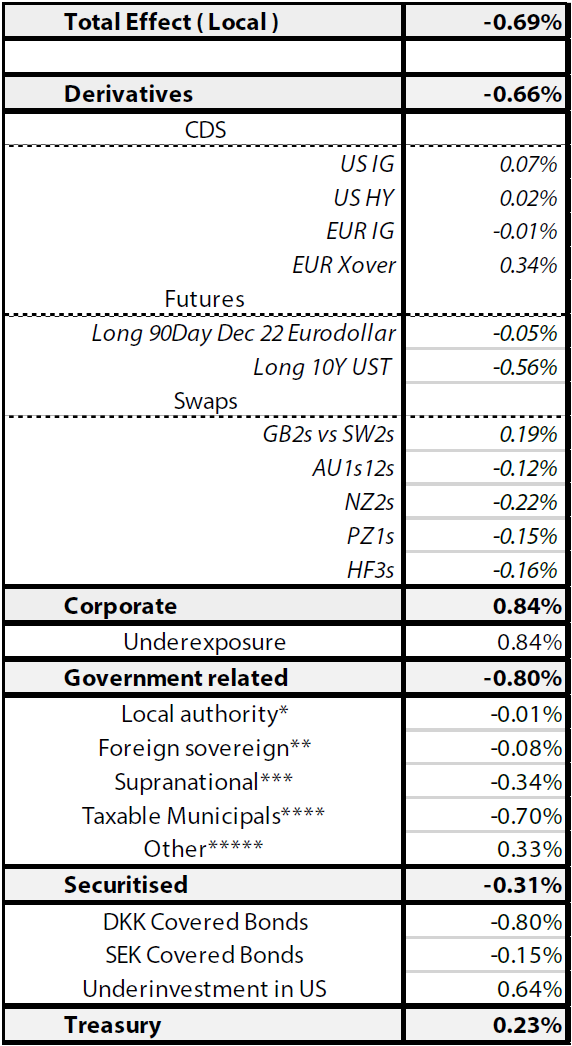

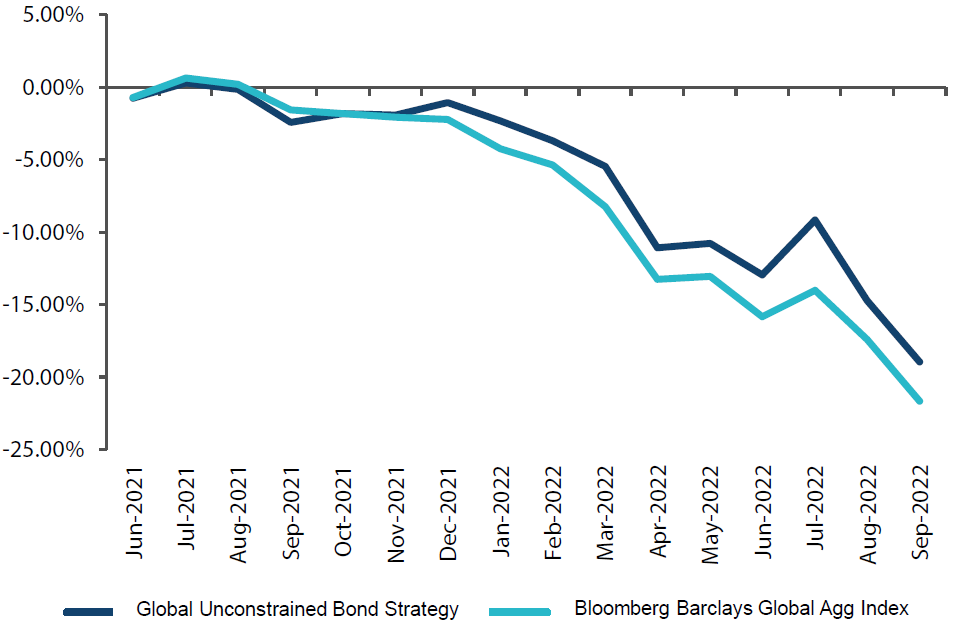

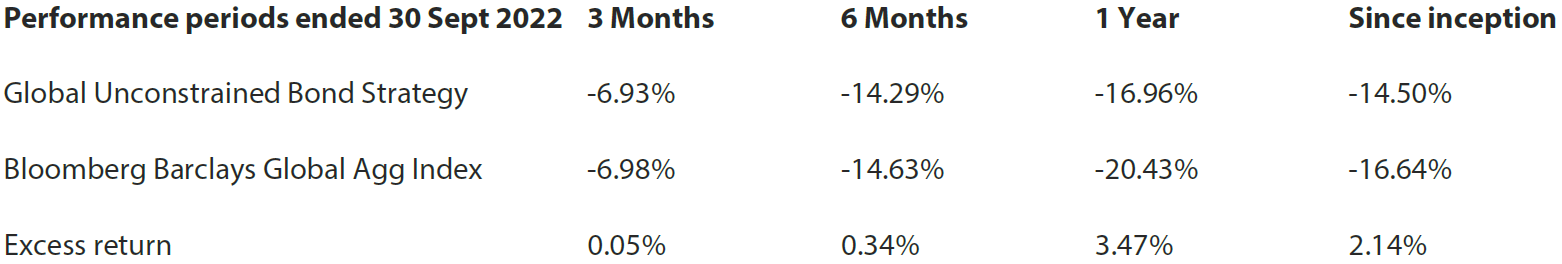

The ongoing challenging environment for global bonds, saw the strategy return a negative 6.93% in total return terms against the benchmark performance of negative 6.98%. The favourable currency moves contributed 74 basis points (bps) of outperformance, however, a negative contribution from local bond market positioning offset all the gains, netting a modest relative return of 5 bps in total.

| Global Unconstrained Bond Strategy Q3 performance | Total currency effect on relative performance | |

|

|

|

Source: Nikko AM, as at 30 September 2022

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on a representative account of the Global Unconstrained Bond strategy. In addition, returns are US Dollar based and are presented gross of management fees only. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future returns. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

| Total effect in detail | Gross cumulative returns since incpetion | |

|

* Canadian provinces, New Zealand local government funding agency ** EM external debt *** Asia, EBRD, IFC **** State of California & New York *****Underexposure to EUR/GBP/AUD denominated issues Source: Nikko AM, as at 30 September 2022 |

Source: Nikko AM, as at 30 September 2022 |

Gross annualised rolling returns since incpetion

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on a representative account of the Global Unconstrained Bond strategy. In addition, returns are US Dollar based and are presented gross of management fees only. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future returns. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Portfolio positioning

During the quarter markets experienced greatly increased volatility, with all major asset classes posting excessive declines. This very fragile global market sentiment came about as investors became increasingly alarmed with looming recessionary fears driven by an ever more hawkish stance of key central banks. The major supply disruptions of energy flows to Europe and more recently market volatility caused by the UK government’s fiscal announcement in late September, further added fuel to the fire. Given the uncertain environment, investors continued to de-risk in favour of safe haven assets, including the US dollar itself, pushing the dollar index to levels not seen in decades. In fixed income, the relentless rise in global price pressures kept bond yields on an upward trajectory, with the yield of US 10-year Treasuries soaring 100 bps since the end of June. Bond yields in Europe also marked an equally sharp correction, with 10-year German Bunds selling off from 1.3% at the end of June to 2.1% at the quarter end.

In terms of FX positioning, the team preferred a higher allocation to the US dollar, particularly versus the euro as Russia’s weaponisation of energy supplies continued to question Europe’s position to secure enough sources of energy to last through the winter. We also maintained our underweight allocation to the Chinese Renminbi, as the ongoing zero Covid policy, and in turn, recurrent lockdowns, have continued to weigh down the currency on the back of waning growth momentum, despite policy maker’s efforts to stimulate activity via monetary and fiscal policy measures. Weak China generally exerts downward pressure on the regional economies, particularly those with strong trade linkages. On this basis, we also decided to reduce allocation to the New Zealand dollar itself, expecting the latter to struggle in this environment.

During the period, government bonds markets remained under heavy selling pressure as inflation continued to surprise the upside. On the expectation for an imminent pivot by the Federal Reserve (Fed), we initiated a number of curve strategies such as long 90-day December Eurodollar futures in addition to long 10-year US bond futures. However, the stickiness of inflation has seen increased hawkish rhetoric from the Fed, pushing the potential Fed pivot further down the line. The short-dated swap positions in New Zealand, Poland and Hungary have also been impacted by the grind higher in the US interest rates, further detracting from the relative performance. Due to supportive valuations, we remained overweight in government-related and securities credits; however, these continued to sell off in tandem with higher global interest rates. In the Treasury space, we maintained an under-exposure to Europe's interest rate risk due to the clouded outlook for inflation, on the back of elevated energy prices—a natural consequence of the war in Ukraine. This, together with our decision to sell out of Italy ahead of domestic elections, has contributed positively to relative performance, partially offsetting losses accrued from curve positioning in CEE and the dollar bloc countries.

Q4 outlook

The team sees global inflation falling in the coming quarters however there remains a significant degree of uncertainty as to when core inflation pressures will begin to decelerate given the persistence of consumer demand, particularly in services. The US is leading the way in terms of disinflation in goods, due to both the strength of the US dollar and greater energy independence, with gasoline prices tracking oil prices lower in recent months, while core consumer goods prices are likely to see relief from an ongoing easing in global supply chains. Services inflation, however, remains far more persistent as record tightness in labour markets translates into firmer wage dynamics, though we are starting to see tentative signs of declining job vacancies.

In Europe goods inflation remains more unpredictable given the region’s greater dependency on energy supplies, driven in particular by an urgent need to replace Russian natural gas supplies. Nevertheless, even here we are seeing tightness in labour markets translate into higher services inflation. Yet, once again we see hopeful signs of a near-term peak in energy prices as a front loading of energy supplies during the summer months, coupled with the prospects of both a mild winter and voluntary reductions in energy consumption which could keep imported gas prices contained through the winter months.

Given the lags in their relative monetary policy cycle, the team continues to prefer US duration over its European counterpart as the European Central Bank (ECB) appears to be on the path for further hikes while the team believes the Fed is closer to the end of its hiking cycle, with an inverted yield curve flashing warning sign of a potential overtightening. Danish covered market is an attractive relative value option versus European government duration. We continue to favour municipal spread risk over corporate risk given the near zero default rate for municipal credits.

Outside of the US and Europe the team also sees select opportunities in other developed rates markets. New Zealand screens as the cheapest developed local rates market. Meanwhile, we are seeing significant weakness in the domestic property market which, in the team's opinion, is likely to result in a reversal of monetary policy tightening in the coming quarters as consumer spending is squeezed significantly. Following the recent turmoil in the UK rates market, the team is positioned for a tactical normalisation of elevated policy risks as the UK government continues to reverse its controversial tax cuts. This should elevate pressure on the Bank of England in the coming months, with short-term rate expectations unlikely to be realised, in the team’s opinion.

The team sees significant value in several emerging market local rates markets given the pre-emptive tightening cycle of many emerging central banks. The team believes that short-term interest rate expectations in Poland and Hungary are excessive given the domestic growth outlook is set to deteriorate sharply in the coming months, though a resolutely hawkish ECB is continuing to push regional terminal rate expectations higher in the near term. Value in both South Africa and Mexico local government bonds gave the domestic inflation outlook remains benign relative to developed markets, yet both already trade at a significantly higher real rate. The team is far more selective in both EM currencies and sovereign bonds given the external pressure coming from the Fed’s aggressive hiking cycle, favouring a select group of countries with strong ties to the US, such as Mexico.

We expect the credit market to remain volatile in the final quarter of the year. The market may only stabilise when central banks reach the pivotal point in their efforts to raise rates and cap inflation. The latter point might only be reached in 2023. However, some parts of the market are starting to look attractive. Investment grade bonds sold off over proportional to high yield bonds and now offer value for total return investors. For the high yield market, we are less optimistic; we expect default rates to go up and bond valuation may remain under pressure.