Snapshot

The East and West appear to be headed in different directions in terms of their economic prospects. The East may benefit from China’s easing and supportive growth characteristics. Meanwhile, the West is mired in slowing growth, excessive levels of inflation and central banks ever more eager to take down inflation through conventional tool kits designed to slow demand. Of course, this significantly raises the odds of a recession should they collectively follow through on the tightening plans which the markets have currently priced in. So, this is the question: to what degree would inflation, or the economy, need to fall in order to induce a pivot to something more dovish?

In terms of the recent data flow, there is little to stand in the way of the US Federal Reserve (Fed) proceeding on course. Payrolls look healthy, and yet again inflation surprised to the upside. We do see metrics suggesting inflation could/should begin to ease, but the Fed has set its course and is likely to stick to it until firmer data points to the contrary. This does change the outlook and the construct of portfolios moving forward—to remain defensive— but we do (cautiously) focus on opportunities, such as China, which has a much more sanguine macro profile.

The risks to the downside are many and we remain wholly focused on them. Chief among them is the risk to global demand and growth. There are also systemic risks building up, mainly embedded in Europe where the European Central Bank (ECB) is preparing to tighten monetary policy but is facing difficult choices as it reduces easing facilities employed since 2012 to keep the European Union intact.

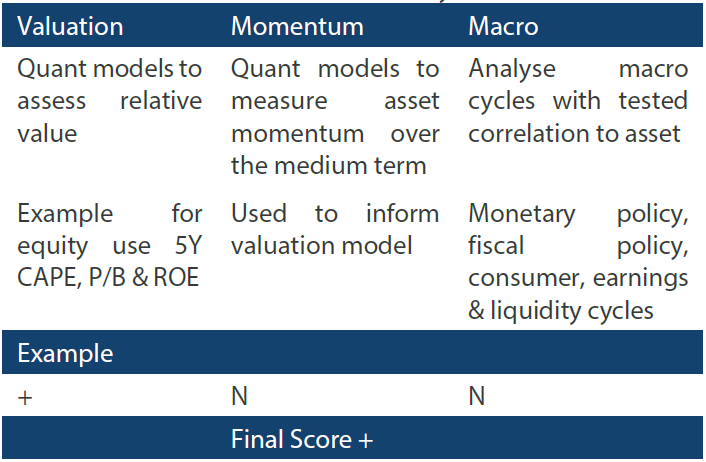

Cross-asset 1

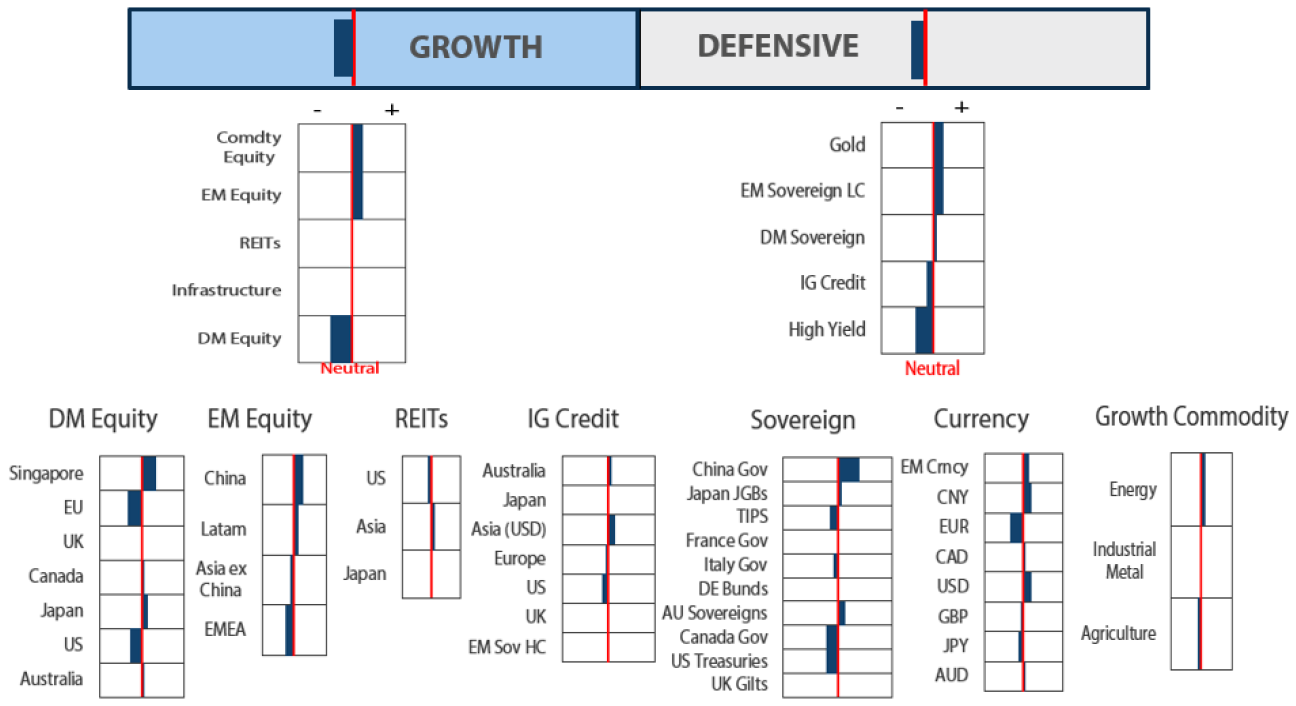

We downgraded growth assets to a larger underweight as well as defensive assets to just below neutral. As rates continued to lift off on a higher inflation print, in June the Fed pivoted to a more aggressive stance—hiking by 75 basis points (bps) as opposed to the 50 bps expected just days before—taking a hard stance to use tight policy to reduce inflation while acknowledging that the risk of a hard landing would be on the rise.

Oddly, markets welcomed the pivot, bidding rates and to some extent equities, on the premise that there likely will be a recession, so they are now aiming to price the easing that will soon follow. Markets do price in the future, but without any meaningful declines in jobs or earnings expectations, it is difficult to see how they can price through the pain ahead; the decline in equities is meaningful but it is still far from having taken out the excesses in the stimulus frenzy.

We downgraded developed market (DM) equities in favour of those from emerging markets (EM), mainly for the massive policy divergence between China and other continues, and because of relatively benign inflation conditions. We also reduced commodity-linked equities in favour of more stable REITs given the impending recessionary hit to demand. On the defensive side, we reduced DM sovereigns and investment grade (IG) credit as rates in favour of EM local currency (LC), which offer better yield with rates showing remarkably less volatility than their DM counterparts, and also gold, which is a natural hedge to a policy mistake.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Outside of China, the June sell-off spared few markets. But the behaviour of the market since the abatement from the worst of the sell-off was informative. First, our preferred equity exposure, which is a value tilt, sold off on par with “growthier” peers (different than its YTD relative resiliency). Second, the energy sector, another of our preferred equity exposure, sold off aggressively (worse than the broad market) and the recovery since has been meagre at best. Both of these equity exposures benefit from improving demand—and if demand is at risk, these equity classes are also at risk.

Of course, market sentiment can shift on a dime, but the notion of deteriorating demand is certainly a growing risk that is consistent with a surprisingly hawkish Fed. The situation in China could not be more diametric with inflation in a normal range, while the People's Bank of China (PBOC) and the broader government have taken strong actions to support growth in stark contrast to the West.

We certainly view Asia favourably, and more specifically China, pending the spread of new demand to its neighbours. However, we stay cautious on growth exposures in general, based on the extent of the rising risk that Western economies may fall into recession.

China: A world apart

China has spent the better part of the decade attending to imbalances, such as reducing excess investment in favour of consumption and “quality growth” and limiting credit to control systemic risks. At the same time, China has also taken on corruption and speculation issues in addition to a number of other market features that has impeded prospects for self-sustaining growth. Combined with trade wars, other geopolitical frictions and (more recently) zero-tolerance for COVID-19, China was an easy “pass” for many investors when it came to allocating capital.

However, we believe that investment prospects are changing for the better. China is not without many lingering risks from a system that is still in the process of repair. But in contrast to much of the rest of the world, perhaps China’s key achievement in recent years was developing a sense of restraint in their response to COVID-19, with Beijing sticking to orthodox monetary policies while resisting the temptation of an outsized fiscal splurge to manage through the storm.

The result: China does not have the same inflation problem as much of the rest of the world and is currently in a position to ease, which it is doing responsibly both monetarily and fiscally. Zero tolerance measures for COVID-19, which included rolling out lockdowns, were certainly enough to give investors a pause. However, even that appears to be evolving for the better—whether it be in a refined execution to limit the economic impact of shutdowns and/or slowly drifting policy to the notion of “learning to live with the virus”.

The other recent concern is the stress in the property market, which has spread from financially stretched developers to financial institutions including state-owned asset management companies (AMCs) and regional/rural banks. These issues are not new but continue to grab headlines. In our view such issues remain far from the “impending systemic risks” as it is sometimes portrayed in the media, given that large banks are quite healthy.

These financial stresses do present headwinds to economic growth in terms of the slow pick up in private sector loan demand. However, most importantly, China is working through the issues, encouraging mergers and finding the right balance between discouraging bad behaviours while not letting the problems metastasise beyond its control. On a relative basis, these issues pale in comparison to the deeper issues being faced elsewhere.

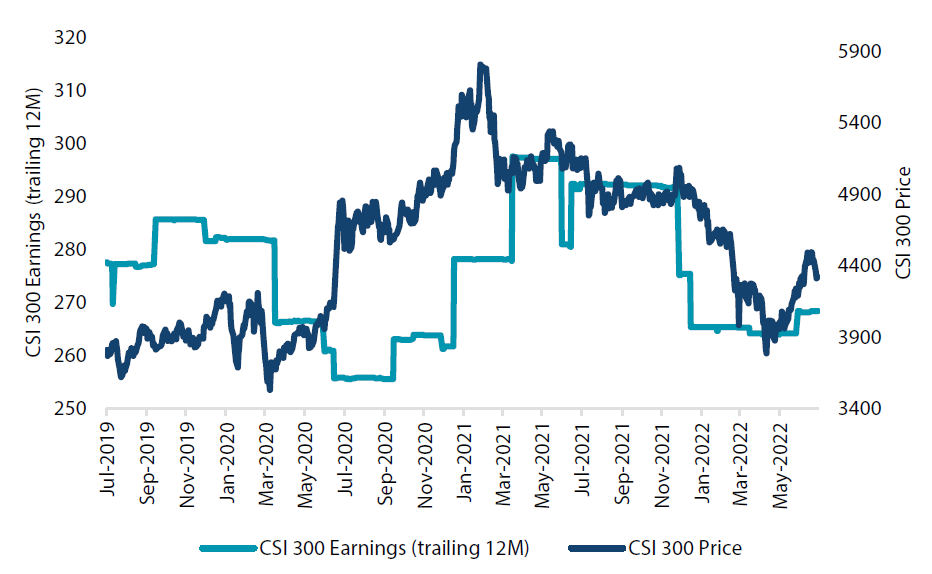

China equities have struggled since February 2021. They fell 35% from their peak in February 2021 to their trough in late April 2022. Overall, over the last three years they have risen 14%, roughly matching the gains made from the rebound from their late April trough. Earnings followed prices lower, partly because of regulatory crackdowns that are beginning to dissipate. Earnings look to have bottomed with justifiable upside driven by better growth prospects amid policy easing.

Chart 1: China equities (CSI 300 Index)

Source: Bloomberg, July 2022

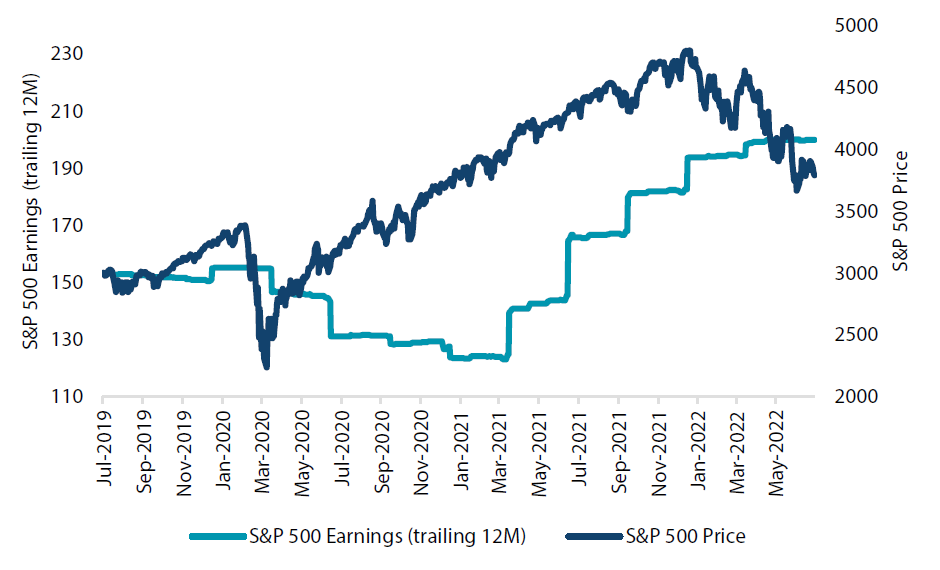

In contrast, US equities are down over 20% peak-to-trough from the beginning of the year. Overall, US equities are still up 28% over the last three years. Earnings have peaked on the prospect of significant tightening ahead and slowing growth, and current high levels of inflation are likely to curb top line revenues and profit margins.

Chart 2: US equities (S&P 500 Index)

Source: Bloomberg, July 2022

From a valuation perspective, China and US equities both currently have forward price-to-earnings (PE) ratios of just over 16x, although analysts are likely to be upgrading the former and downgrading the latter. Policy divergence is extreme, with China continuing to ease while the Fed prepares for its most aggressive tightening cycle in decades. China equities therefore look more favourable from an exposure perspective, both in terms of policy divergence and valuation with respect to divergence in earnings growth prospects.

Conviction views on growth assets

- Prefer China and eventual beneficiaries: China is the preferred equity market exposure, primarily for the extraordinary policy divergence with the rest of the world, with China easing—seemingly with limited inflation issues—while the rest of the world is tightening aggressively to contain inflation. Valuations are attractive and the earnings outlook is positive both on an absolute basis, and particularly on a relative basis. Depending on how demand in China evolves, we believe other regional beneficiaries will emerge. A significant decline in external demand remains a key risk for China.

- Stay defensive: Outside China, we prefer defensive equity exposures, which include a combination of steady yielders such as REITs and infrastructure, along with defensive noncyclical sector exposures including healthcare and consumer staples.

Defensive assets

The outlook for sovereign bonds remains challenging. Volatility levels are still high due to a combination of upside surprises in inflation, central banks committed to tightening and growing concerns of recession, which is looking likely in Europe and to a lesser degree in the US. These countervailing pressures have yet to fully reconcile on the long-end of the curve, while investors struggle to interpret data that continues to remain volatile since the onset of COVID-19.

We further downgraded IG credit and now sovereigns because increased uncertainty and volatility offers less protection in a portfolio context. Credit fundamentals still remain robust, but economic headwinds are a challenge for the future as the potential further widening in spreads lessens the attraction from pick-up in yields.

We upgraded EM sovereigns in the context of the advancement in earlier tightening versus DM peers. However, a key risk is the strong US dollar and the depths of the potential downturn, so we remain cautious. We also upgraded gold, again cautiously, as tight policy, rising real yields and a strong dollar are potential headwinds. We do like the asset for its defensive characteristics against policy error.

China bonds

We have long preferred China bonds for the PBOC’s increasingly orthodox policies as compared to its DM peers that are quickly reversing exceptionally easy policy—arguably late—to reduce inflationary pressures, which were thought to be transitory but are proving persistent enough.

However, in May, we had downgraded China bonds given the stresses attributable to a sizable devaluation in China’s renminbi. Also contributing to the downgrade was a sell-off in rates amid significant foreign outflows, driven partly by concerns of a potentially more sizable devaluation and a negative shift in China’s bond spread relative to US Treasuries.

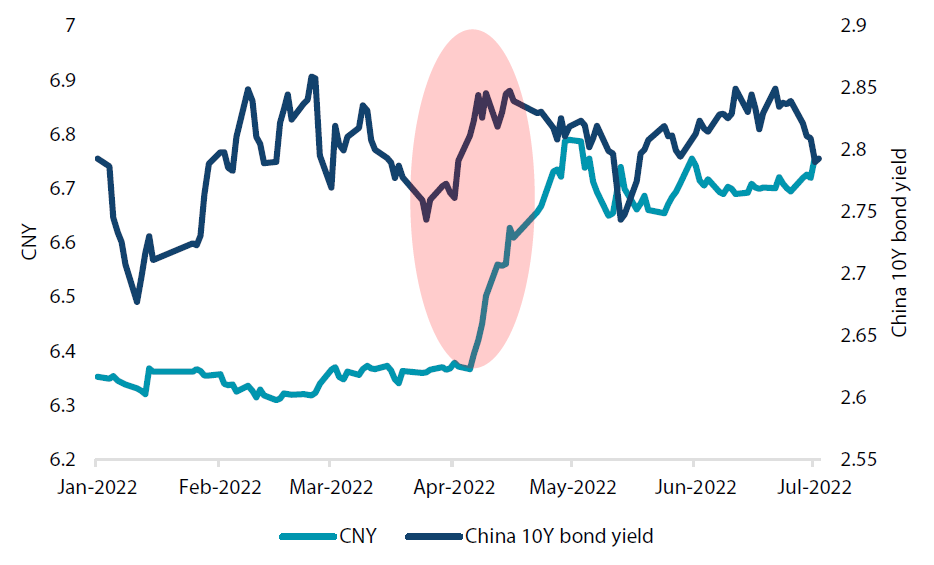

Chart 3: China 10-year sovereign bond yield versus its currency (CNY)

Source: Bloomberg, July 2022

The devaluation was concerning as China, at that time, was struggling with fresh lockdowns on top of already weak growth, which suggested that it may be leaning on a weaker currency to help lift growth. In hindsight, it appears most likely that policymakers might let the renminbi weaken to normalise the competitiveness of its currency relative to its trade partners after it became quite rich earlier in the year.

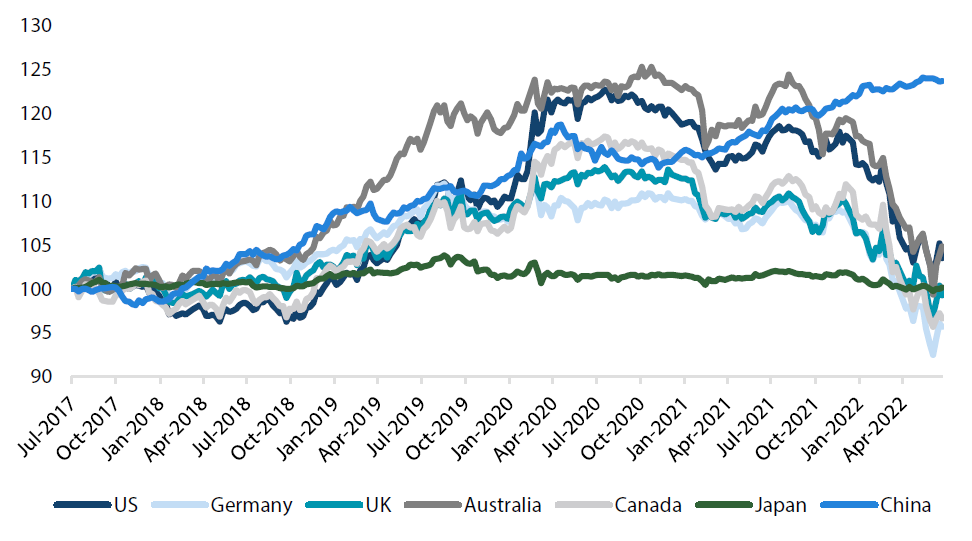

Nevertheless, even despite this brief scare, relative performance of China bonds is quite impressive compared to their DM sovereign peers, particularly over the last year, delivering positive performance compared to all other markets, which were all significantly negative.

Chart 4: Global 7- to 10-year sovereign bonds (hedged in USD)

Source: Bloomberg, July 2022

In a portfolio context, sovereign bonds provide yield. But most importantly they provide protection relative to riskier portions, notably equities. This year, many sovereign bonds have become risky assets themselves, contributing to the downside even as equities sold off. Indeed, inflation is high and central banks were seemingly late to remove overly easy policy. Opportunities for sovereign bonds, however, may rise again—particularly if tightening by central banks reduce demand and therefore inflation, which will likely bring yields down as well depending on how much growth slows. For now, we prefer China bonds, which we believe are a decent risk mitigator—particularly to China equities.

Conviction views on defensive assets

- Remaining cautious on duration: While core inflation measures have shown signs of peaking, headline inflation is still on the rise. Central banks are responding to these headline pressures and seem willing to apply the monetary policy brakes strongly in response.

Process

In-house research to understand the key drivers of return: