Source: Shutterstock

For the last 27 years I have been trundling back and forth on a little commuter train across the iconic Forth Bridge from Fife to Edinburgh on my daily journey to work. There is a soothing familiarity in the routine which allows one to contemplate the day ahead or to decompress on the return journey from another day dealing with the hurly burly of capital markets. The most observant readers (who should probably get out more) might recall that we featured this exact journey back in 2015 when we observed the changes in the way commuters were consuming media—an observation that helped us make an investment in the company formerly known as Facebook.

Source: author

In a post-pandemic world, I am now only taking the train three days a week. I also have a small dog called Benji (pictured) who joins me on the journey and has become our de facto office mascot. Life is different now. Equity markets and economies are different too; geopolitics have deteriorated and barriers to trade have increased while the threat of global warming looms ever larger. This short essay is an attempt to bring some perspective to this while giving a view on where we are in markets today and what might happen next.

My train is still filled with people messaging, shopping or consuming media on their phones. But the conversations with other passengers which are struck up because of my four-legged co-commuter are most definitely a welcome change. I recently bumped into a former nurse who had changed careers to work on the railways citing better pay and conditions.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

This is a cause for concern. In developed countries, we have many things we need to do over the next decade – we must develop more efficient and lower emitting power, transport, industrial and real estate infrastructure. We also have a responsibility to provide better healthcare to our increasingly aging populations. Bottlenecks in labour markets could potentially delay progress in these areas and hearing that skilled labour is being forced to quit one in favour of the other is unhelpful. One can only hope that immigration policies become more liberal as politicians act in the long-term interest of their populations rather than simple short term political expediency. Unfortunately, this outcome seems less than certain if past is in any way prologue.

Returning to markets, as an active investor and an avid fan of one of Scotland’s lowest ranked football team, I am more than familiar with the phrase “it’s the hope that kills you”. Currently there is more than a nagging sense that this could be applicable in markets today. A year ago (in “History rhymes”) we identified that parts of the equity market looked like they were in a bubble. The most speculative and risky assets like Bitcoin and early-stage technology companies subsequently fell dramatically as higher interest rates and tightening liquidity caused previously virtuous cycles to become vicious. High-flying market leaders fell sharply in 2022 with Tesla, Alphabet, Amazon and Meta platforms all declining between 39 and 65%. The downturn in cryptocurrencies and the related collapse of intermediary businesses was also well documented as Bitcoin itself fell 65% during the year. Correctly identifying this outcome and avoiding the most overvalued areas helped us weather the storm in 2022 relatively well (though it was still challenging as a manager of growth and quality companies).

Fast forward to Q1 2023 and—if observed in isolation—investors would be forgiven for wondering if 2022 had even happened. The spillover of stresses in the financial system led to the failure of SVB Financial and the bail out of Credit Suisse through its merger with UBS. Challenges in the regional banking sector in the US continue and look like they will have meaningful ramifications in the commercial real estate sector going forward. Meantime, the desire to own defensive quality companies combined with the perception that we are approaching a peak in inflation and interest rates prompted a stampede into the very companies that had fallen the most in 2022. In Q1, Tesla, Alphabet, Amazon and Meta rose by between 17 and 76% in three months. With seven stocks accounting for more than 85% of the market’s advance, (of which we only owned Microsoft) this represented a very challenging period for our strategy. We remain concerned that the top line growth and future margin assumptions for many of these businesses look too high and it may be difficult for these companies to maintain leadership in the market should earnings and cash flow disappoint. Time will tell but the fact remains that our strategy has not been this wrong-footed in any one quarter since Brexit and the election of Donald Trump as US president.

So, what are we doing now? Well, we are grappling with the following difficult questions…

- Could we be wrong that the hope being placed on FANNMAG stocks (or whatever other acronym people care to shoehorn in) or in AI may be overly exuberant?

- Are markets in the equivalent regime of the LTCM and Asian currency crisis of the late 1990s—the policy response to which (along with the Y2K effect) caused the internet stock bubble of 1999–2000? Might we be only in the foothills of an even greater speculation about to unfold?

- Or are we in the aftermath of the bursting of a psychological market bubble in speculative assets during which we typically see dramatic short-term rallies of between 80 to 100% before the downtrend resumes? This is akin to 2002 post the internet stock bubble bursting and can be seen in a range of downturns from Japanese equities to commodities and emerging market assets at various points over the last 40 years. In this scenario, we are almost certainly facing a recession and the potential for further falls in profits and cash flows.

- If this is 2002 and the tech bubble has burst, what will take up the position of market leadership over the cycle that subsequently follows? Could it be energy transition companies that help us solve the major social and environmental problems we face? Might it be the healthcare sector which must innovate to solve the conundrum of caring for more acutely ill aging people with fewer resources? Could emerging market assets come back into fashion after a decade or more in the wilderness?

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

While we research these big questions (many of which are imponderable), we remain focused on our search for companies that we feel can improve their return on capital through the cycle. For consumer-facing businesses, we favour those in the service sector where the recovery from the pandemic continues to play out. Travel-related companies, auto parts distribution and food service firms all look to have solid demand outlooks with improving returns on capital. These are the features we like. Similarly in financials, our lack of banking exposure has been helpful, and we continue to be invested in insurers and increasingly in banks with a skew towards emerging markets like HDFC in India and Bank Mandiri in Indonesia.

The lagged effects of the pandemic and the tightening of financial conditions for startup firms have caused some of our healthcare holdings to experience volatility. But as these factors begin to normalise, we are confident in the longer-term prospects for these firms and valuations are looking much more attractive. Equally in industrials, some of our cyclical exposure feels a little early but we need to look over the horizon to what may lead in the next cycle, and we still believe that solving the major challenges of energy transition will represent significant opportunity in the future. The secular trend of reshoring supply chains is also supportive.

Technology remains a conundrum. To expect a sudden increase in internet advertising to justify recent share price moves seems a little naive. First quarter results from Netflix and Tesla suggest some of the Q1 high flyers may have gotten too close to the sun. AI, however, could represent a very large and disruptive product cycle with applications as yet undiscovered. We plan to do more work in this area but in the meantime have added to our position in Microsoft given the potential market share gains they might make in internet search using their ChatGPT platform.

You can probably tell that I did not use AI to write this article—perhaps I should have. Meantime I will continue to take my train to work with Benji searching for companies we believe can stand the test of time. I am looking forward to the conversations we will have along the way as well. There is something uniquely human about that which is in itself soothing and a source of comfort which I am not sure AI or a fleet of robotaxis could provide. Now if only my train driver would show up for their work more regularly…

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

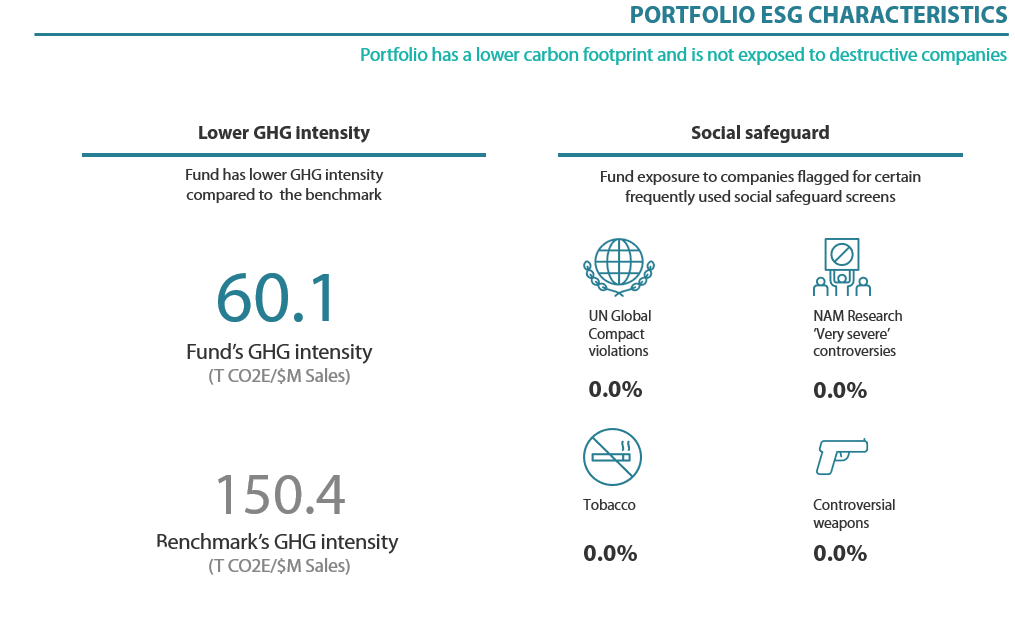

Source: MSCI ESG Research, NAM Research March 2023. Fund is a representative account of the Nikko AM Global Equity Strategy. Benchmark is the MSCI ACWI. Net Total Return.

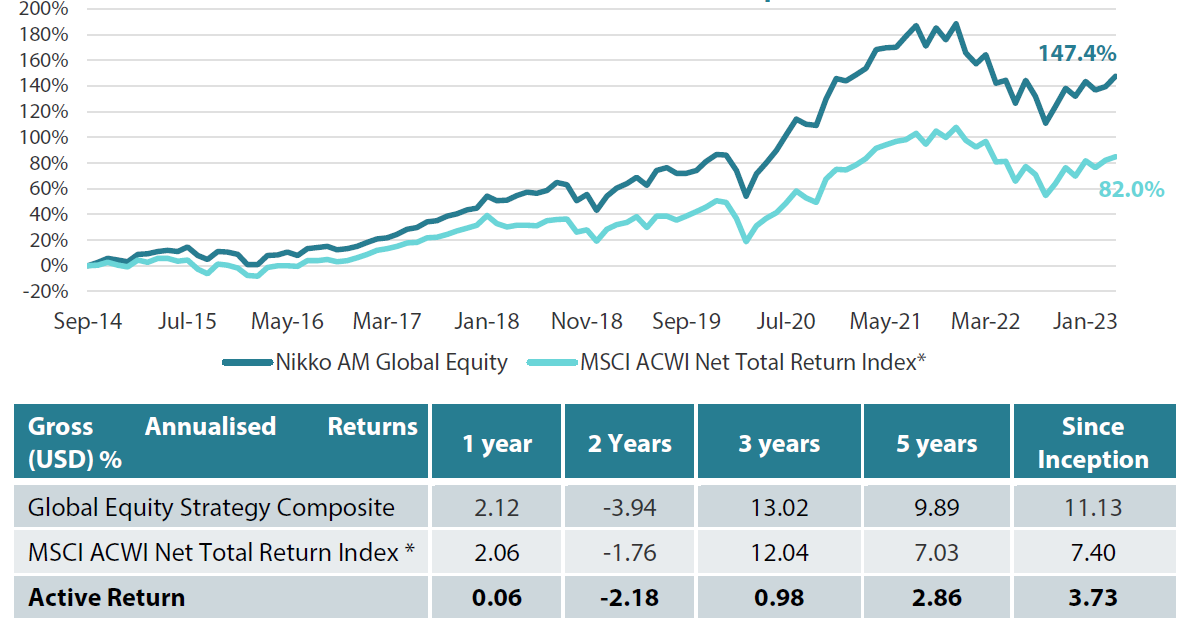

Global Equity strategy composite performance to April 2023

Cumulative Returns October 2014 to April2023

Past performance is not a guide to future returns.

*The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014.

Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 30 April 2023.

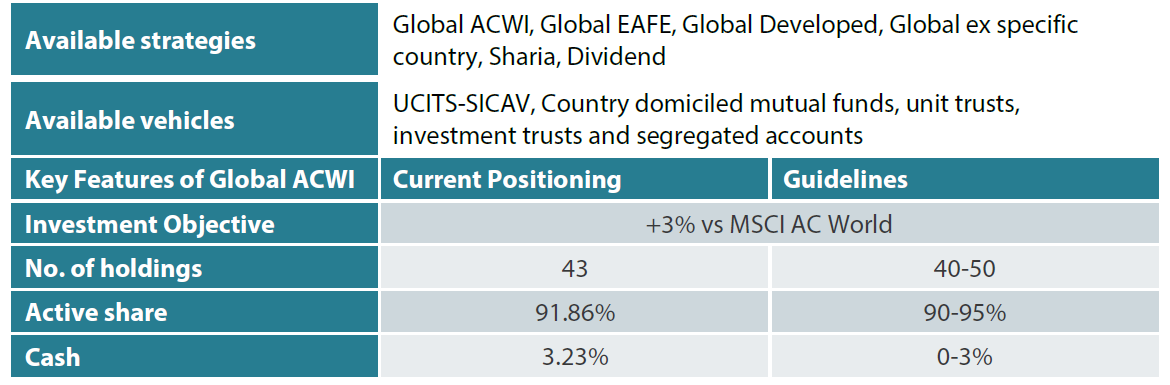

Nikko AM Global Equity: Capability profile and available vehicles (as at April 2023)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

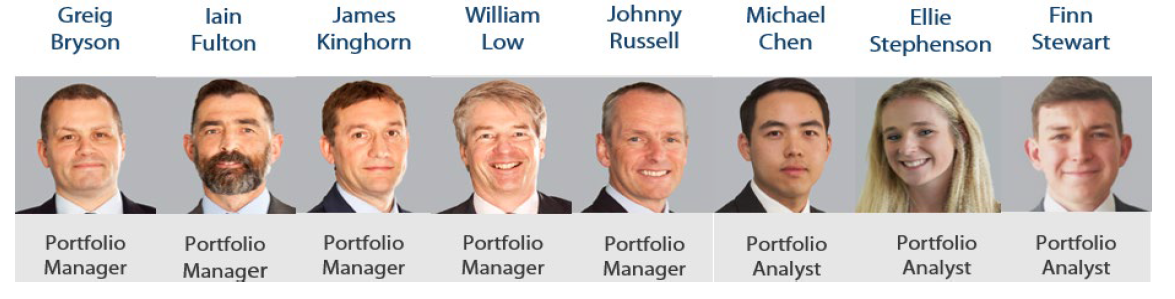

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

There are four key areas that make our strategy different:- a focus on Future Quality companies – a different and clear philosophy

- a distinctive team culture – a tight-knit team with a process built on openness and respect

- unique execution, including rigorous team challenge of every idea

- differentiated portfolios, with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone’s interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

About Nikko Asset Management

With USD 209.4 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers,

providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 March 2023.

Risks

- Emerging markets risk: the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

- Currency risk: this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

- Operational risk: due to issues such as natural disasters, technical problems and fraud.

- Liquidity risk: investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

- UN SDG Risk: In the event the degree of positive impact towards the UN SDGs of a company and/or its technology changes resulting in the Investment Manager having to sell the security, neither the Sub-Fund, the Investment Manager, Management Company nor the Investment Adviser accepts liability in relation to such change.