Two social issues threatening human beings and drug discovery demand

After numbering around 1.6 billion at the beginning of the 20th century, the global human population reached 8 billion in 2022, accompanied by a high level of economic growth. This was thanks in part to some good fortune, including a demographic bonus and technological innovation. People's lives have stabilised and the global population is expected to grow gradually until the middle of this century. On the other hand, future demographic challenges (aging populations) are also beginning to manifest themselves. With Japan's population aging exponentially and the age of the world’s population expected to continue advancing, how can people live healthy lives in their later years while compensating for the decline in physical functions that comes with aging? This is an issue that needs to be urgently addressed for all human beings.

Another social issue that cannot be overlooked is the recent surge in refractory diseases, especially among the young. Cancer is a common example of such diseases. Recent studies have shown that many cancers are caused by genetic mutations. This means that there has been a sharp increase in acquired mutations. These are not inherited from parents or ancestors, but are caused by damage to genes (DNA) from the external environment during life, resulting in disease.

Given growing proof of a strong causal relationship between genetic mutations and the living environments of modern humans, such environments are now believed to be causing the jump in many refractory diseases in addition to cancer. The problem with genetic mutations is that they cannot all be addressed with the conventional development of new drugs given individual variations in mutations. It is also difficult to address them without custom-made drug discovery and therapeutic technologies. This has led to significant investments and the emergence of new ventures in the development of gene-based therapeutic technologies at more of an upstream level in addition to the cell-based therapeutic technologies that are already available. There is also a need to build drug discovery platforms that can seamlessly deliver drugs and customised therapeutic technologies able to meet increasing medical needs in a shorter time frame.

Structural changes in pharmaceutical market and CDMOs

The pharmaceutical market has seen strong expansion so far in line with population growth. These new changes are expected to spur new growth in R&D and further market expansion.

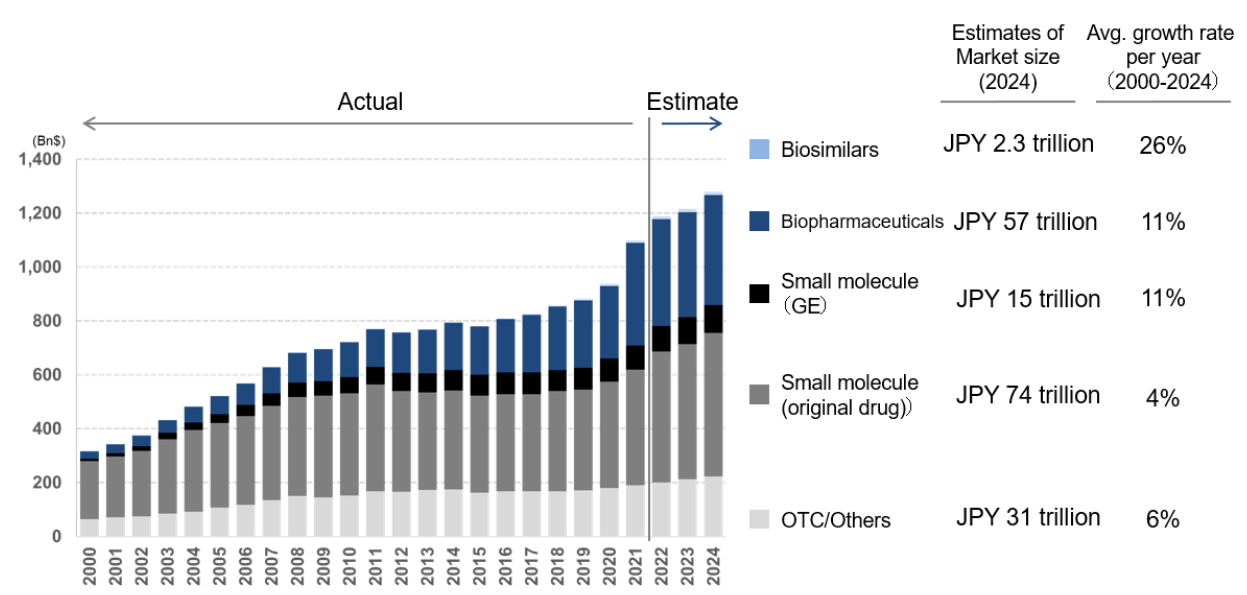

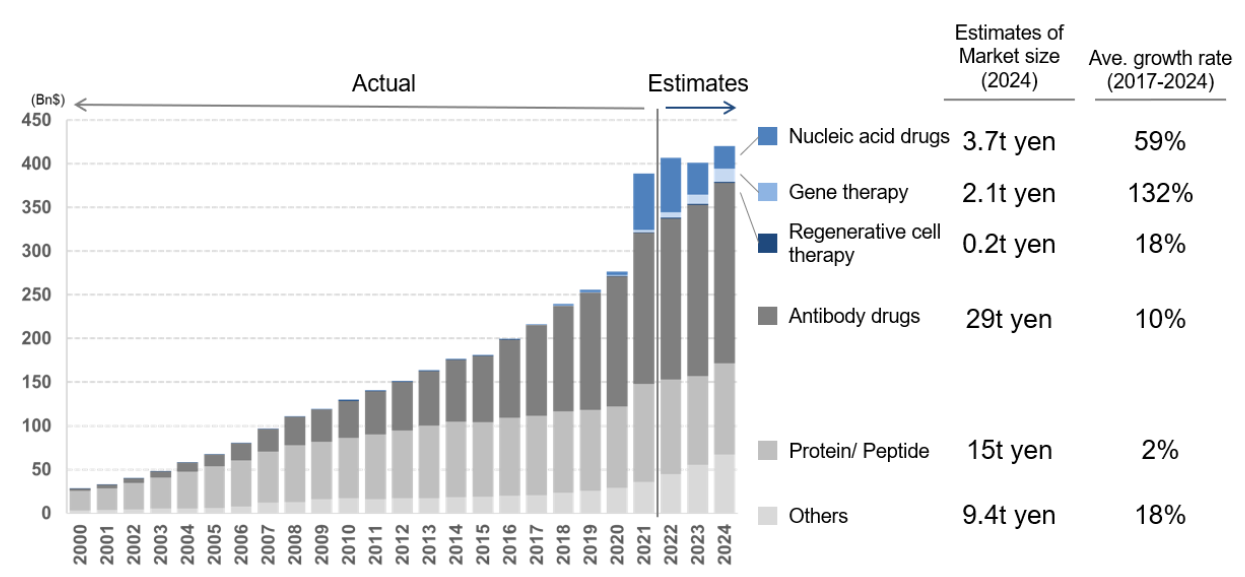

The global pharmaceutical market is estimated at USD 1.2 trillion as of end-2022. Looking ahead, the field of biopharmaceutical drug discovery is expected to dominate the market, taking the leading role away from traditional small molecule drugs. Many of the small-molecule drugs currently in everyday use are designed to suppress the symptoms of diseases occurring at the cellular level. Given their small molecular weight and the fact that they act even on healthy cells, they always involve the problem of side effects. As discussed below, drug makers expose themselves to a strong risk of having to undertake many years of work at a significant cost in developing such drugs. Even if a company takes the risk of launching a product, growth in sales of the drug tend to be dampened by its limited utility given the increasing diversity of disease variations. As biopharmaceuticals take a gene-based approach to treating disease, the market for such products is expected to see strong growth and take a leading role in the pharmaceuticals market as a whole (Chart 1). We believe that patients would like to see a seamless supply of customised pharmaceuticals that can be adapted to individual abnormalities through a variety of mechanisms of action. The CDMO business has begun to attract attention as an efficient drug discovery platform for the provision of such a supply.

Chart 1: Pharmaceutical market performance and forecasts

Source: “CDMO overview” by Mizuho Securities Equity Research senior analyst Shinya Tsuzuki, page 3, 13 December 2022

Supply-side issues and demand for CDMOs

The path to the creation of just one pharmaceutical product involves a development period of nine to 16 years, a success rate of one in 24,500 and average development costs exceeding JPY 50 billion (USD 388 million). The process of small-molecule drug development begins with two to three years of basic research (the creation of new substances with new drug potential and the selection of candidate substances). This is followed by three to five years of preclinical testing (scientific research of candidate substances using animals to determine aspects such as safety). A further three to seven years are then needed for clinical trials (phase 1 to 3 trials as well as safety and efficacy verification through patient participation) before application and approval; revenue from such products is not recorded until they are available for sale.

Although this was not an issue when the demographic bonus was driving appropriate economic growth, the economy is now maturing and demographics are set to become a challenge rather than a bonus. This will result in a sharp increase in patient numbers, which will make it too burdensome in terms of both time and money to develop new pharmaceuticals for everyone who needs them, thereby creating a serious problem in which drugs cannot be provided to all consumers equally at a fair price. This situation would also prevent drug makers from providing timely responses to new physical disorders—notably the increase in rare diseases including genetic mutations.

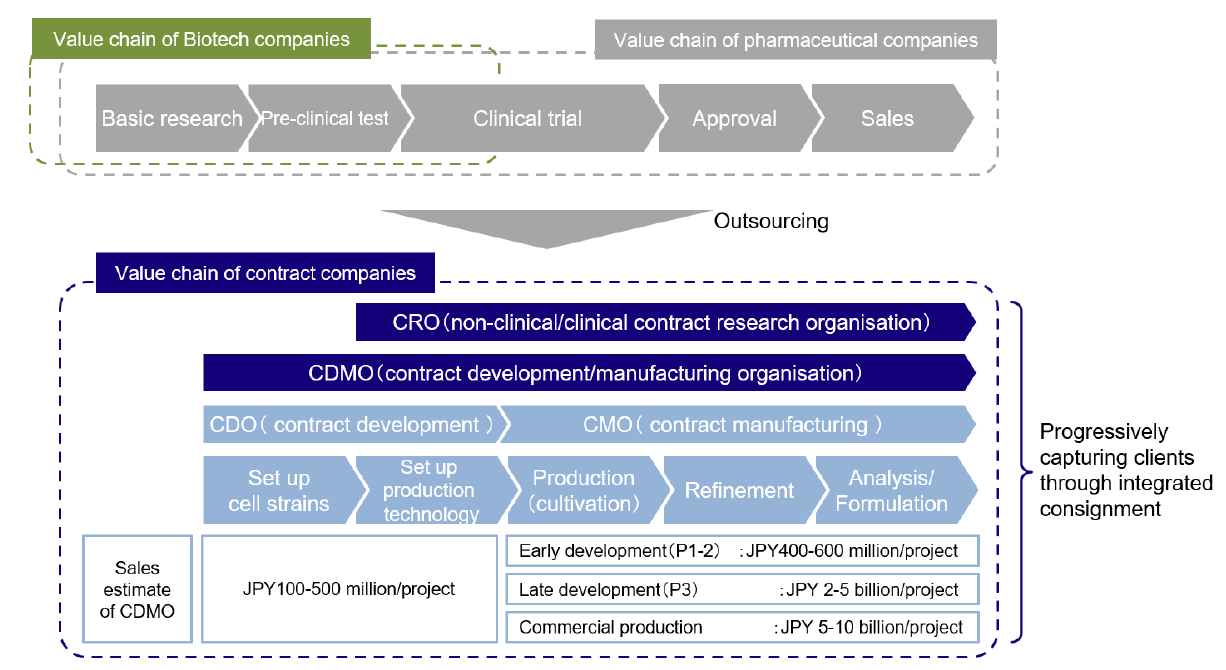

On the cost front, given that the ratio of R&D expenses to sales for the world’s top 20 pharmaceutical companies is already more than 20%, the industry experiences a far greater R&D cost burden than other sectors. Companies on the production side are moving aggressively to outsource development and production functions in order to boost success rates in new drug discovery by concentrating their business resources on the field, which is a source of competitiveness for them given strong demand for new products. This trend is behind the shift to CDMOs. In order to be selected as contractors, CDMOs need to demonstrate deep knowledge of molecular science and track records in the field. Given the high market entry barriers and the possibility of profit creation and high margins at each stage of the process, in addition to the potential to speed up the process of generating turnover from new drug launches, the market is expected to see significant future growth (Chart 2).

Chart 2: Business models of pharmaceutical companies and contract companies

Source: “CDMO overview” by Mizuho Securities Equity Research senior analyst Shinya Tsuzuki, page 6, 13 December 2022

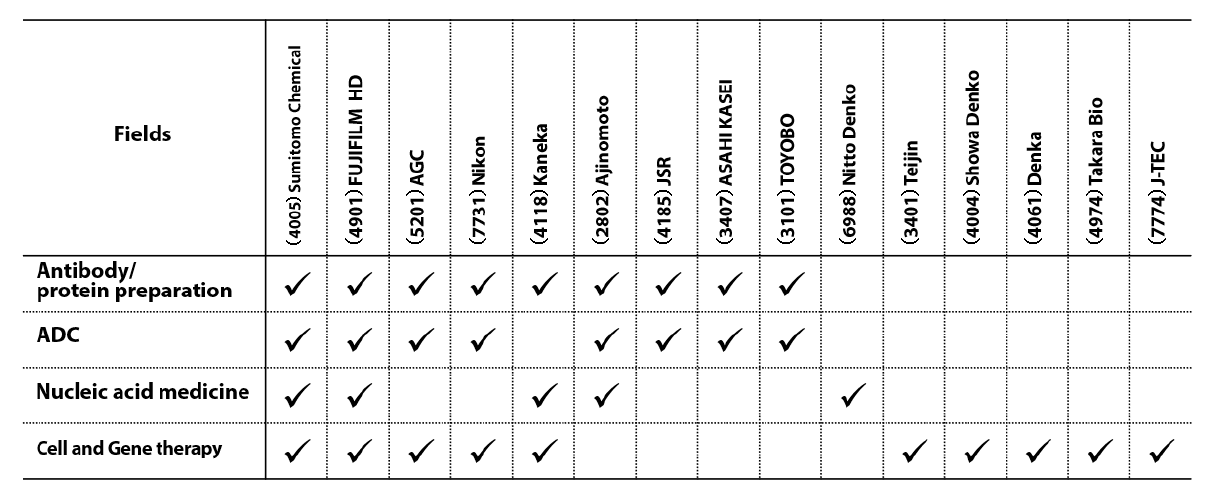

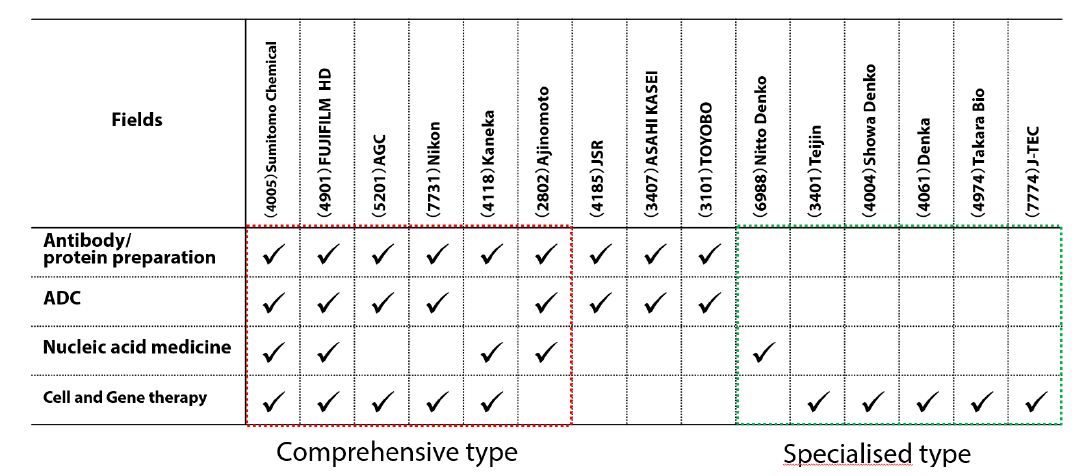

Biopharmaceuticals are the main focus of CDMO business, with antibody drugs currently accounting for a particularly large proportion of such operations. Fields that are further upstream, such as gene-based therapeutic technologies and nucleic acid drugs, are thought to have significant future potential.

Chart 3: Main forms of participation of majors in CDMO field

Source: “CDMO overview” by Mizuho Securities Equity Research senior analyst Shinya Tsuzuki, page 5, 13 December 2022

Why do we need a gene-based approach?

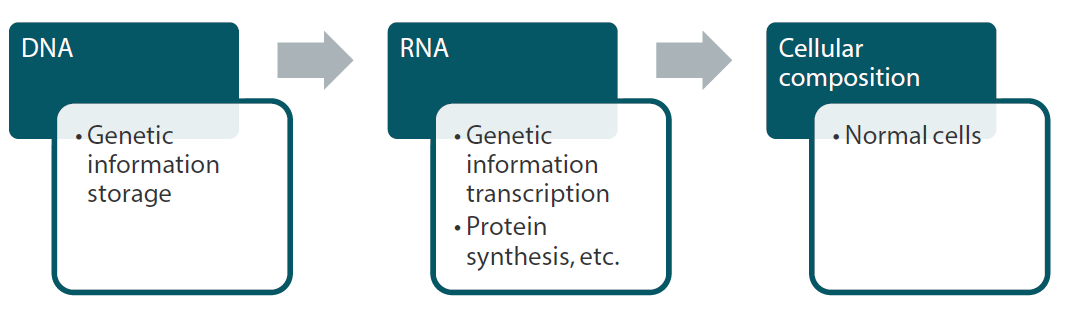

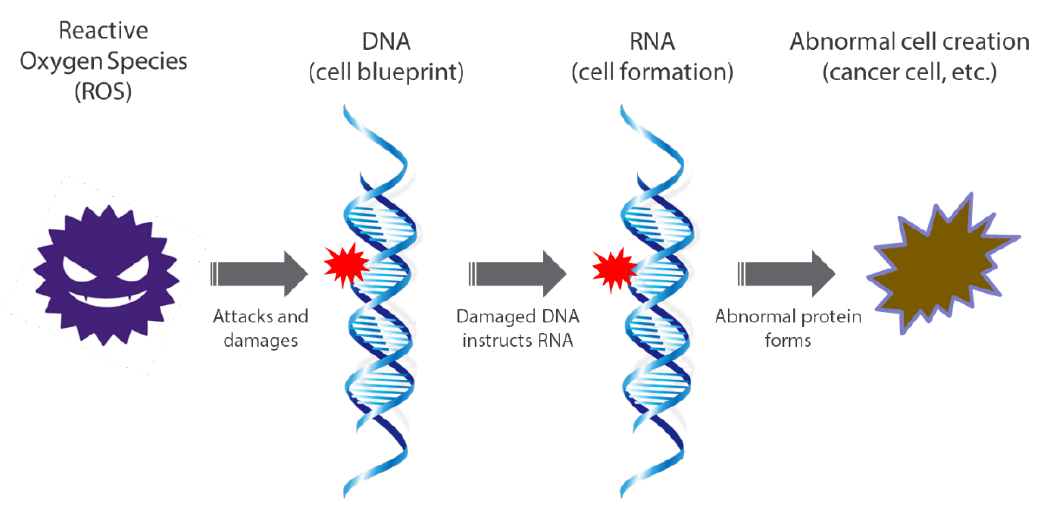

Human bodies are estimated to be comprised of nearly 40 trillion cells, which in turn are made up of proteins. Each cell contains a nucleus, and each nucleus contains DNA and RNA, which make up our genes. DNA provides the blueprint for the creation of new cells based on the genetic information each person has inherited. RNA functions as a kind of factory by creating the proteins that constitute cells by making copies of the blueprint based on instructions from DNA (Chart 4).

Chart 4: Relationship between genes and cell composition

Source: Nikko Asset Management

DNA provides a blueprint containing information including our personalities and preferences, as well as the makeup of organ cells and whether offspring are to be created. However, it also has a brittle quality that makes it vulnerable to damage from external factors. Damage to DNA leads to the creation of abnormal proteins due to the copying of mistaken information, resulting in an inability to regenerate healthy cells. This causes abnormal cells to proliferate, resulting in cancer, illnesses of the brain or blood and various other refractory diseases. Given that that the risk of such conditions historically tends to increase in line with various impacts associated with aging, we have come to see them as part of the human lifespan. In recent years, however, there has been a sharp increase in refractory diseases caused by mutations in damaged genes among younger generations. The largest factors behind this surge are thought to be substances known as reactive oxygen species (ROS). Oxygen is absorbed into the body through breathing. Most of the oxygen is turned into energy, but approximately 2% is converted to ROS. One aspect of these substances is that they act extremely aggressively on the human body by damaging DNA (Chart 5).

Chart 5: Detrimental effect on cell composition from ROS

Source: Nikko Asset Management

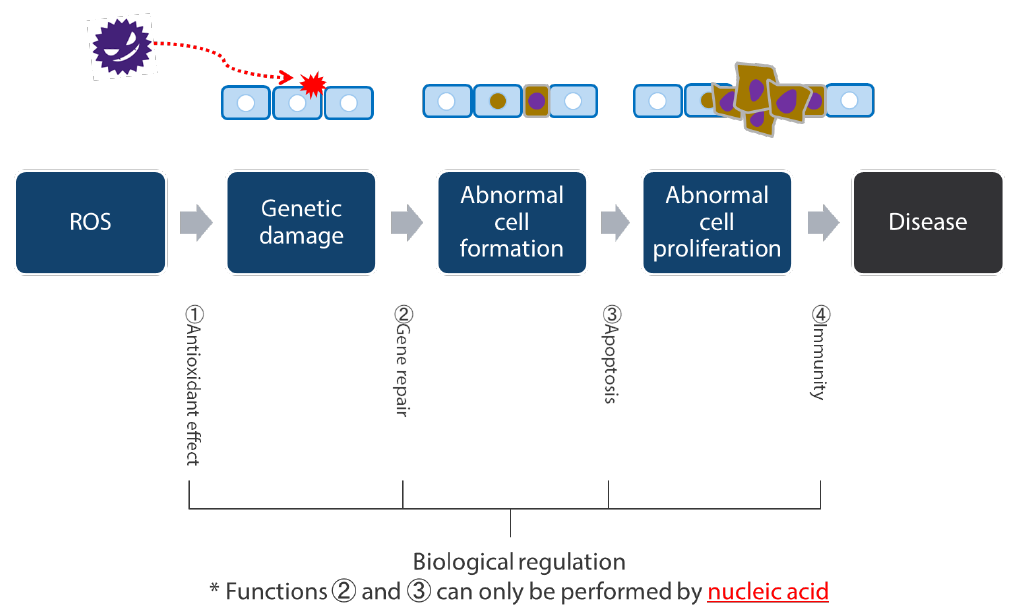

The human body has an inherent function for eliminating this kind of risk known as “biological regulation”. As an example, it is said that over 5,000 cancer cells alone are created each day by the impact of ROS in the human body. But our bodies are protected from the risk of various diseases from these cells by the following four daily functions of biological regulation: (1) the antioxidant effect, (2) gene repair, (3) apoptosis (promotion of death of abnormal cells) and (4) immunity (Chart 6).

Chart 6: Biological regulation abilities humans possess

Source: Nikko Asset Management

In recent years, however, our natural biological regulation function has not been able fully counter the surge in ROS in our bodies and the related increase in genetic mutations caused by environmental changes. This has caused a jump in early-onset cancer cases as well as refractory diseases such as rare conditions and muscular dystrophy. Large changes in our environment, such as irregular life habits, stress, food additives, pesticide residue, tobacco, electromagnetic waves and ultraviolet rays have a significant causal relationship with ROS (Chart 7). At the same time, the impact of ROS is reportedly responsible for at least 90% of modern diseases.

Chart 7: Risks from external environmental changes are surging

Source: Nikko Asset Management

The severity of genetic mutations is due to the fact that they vary from person to person; as such, it is difficult to create a response that addresses the almost infinite number of mutation types. This means that only a small number of patients can be covered even if a significant amount of time is taken to develop new pharmaceuticals. In order to address this situation, it becomes necessary to create and supply a large volume of customised biopharmaceuticals capable of treating various mutation levels in a short period of time. We hold the stocks of CDMO-related companies in our portfolio based on our belief that the CDMO approach is one model case of how such social issues can be addressed.

Portfolio exposure

The biopharmaceuticals market has seen rapid growth centred on antibody drugs that act selectively on abnormal cells since the late 2000s as a result of the products’ relative lack of side effects (Chart 9).

Chart 8: Global biopharmaceuticals market performance and forecasts

Source: “CDMO overview” by Mizuho Securities Equity Research senior analyst Shinya Tsuzuki, page 4, 13 December 2022

At the same time, we have reaped significant benefits from over ten years of including Kyowa Hakko Kirin, one of the global leaders in antibody drugs, in the portfolio. Looking ahead, gene-based therapeutic technologies as well as the field of drugs utilising nucleic acids, which play a large role in DNA repair, are expected to experience significant growth. In order to obtain further returns in the next ten years, we are currently actively including companies expected to make the most of these kinds of new modalities, such as Fujifilm and Nitto Denko, in the portfolio (Chart 9).

Chart 9: Main forms of participation of majors in CDMO field

Source: “CDMO overview” by Mizuho Securities Equity Research senior analyst Shinya Tsuzuki, page 8, 13 December 2022

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

Fujifilm is growing a global presence in the CDMO business field. In 2011, the company purchased two contract development organisation entities from Merck of the US and established a CDMO-oriented business (FUJIFILM Diosynth Biotechnologies). Fujifilm then acquired US contract manufacturing organisation Kalon Biotherapeutics in 2014 and a production subsidiary of US-headquartered Biogen in 2019. Fujifilm now ranks alongside Genprex of the US and Samsung Biologics of South Korea as one of the world’s leading CDMO operators.

Nitto Denko operates a CDMO business centred on drug discovery and outsourced production in the nucleic acid drugs field. The company occupies a unique position as the sole owner of a drug delivery system (DDS) technology enabling the insertion of genes into cells, which is the most important function for nucleic acid drugs. Nitto Denko has established a strong nucleic acid drugs supply chain. This includes its demonstration of a therapeutic technique for cirrhosis of the liver through joint research with Japan’s Sapporo Medical University in 2008 as well as its acquisition of Avecia Biotechnology, a nucleic acid drug production contractor in which it previously held a share of over 50%, in 2011.

Impact of mRNA vaccines

The launch of Pfizer’s mRNA vaccine for COVID-19 in 2022 had a significant impact on the industry. This was due to the fact that the technology had originally been developed as a cutting-edge cancer therapeutic technique. Cancer is very difficult to cure given its tendency to proliferate through genetic mutations from abnormalities that are unique to each patient. This technique offers a breakthrough approach in which antibodies are produced in response to each patient’s genetic mutations based on constant analyses of their blood. By supplying Pfizer with the technology through a business tie-up, independent German bio-venture company BioNTech was able to apply its cutting-edge therapeutic technique to COVID-19. This enabled supplies of the drug to be rolled out in the astonishingly short timeframe of just 11 months from development. The achievement overturned current thinking on what is achievable and has the potential to completely transform the drug discovery market in five to ten years’ time. We are greatly looking forward to seeing many more such successes emerge from the CDMO platform. We feel that they will provide hope to many refractory disease patients in their continuing search for new treatments.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.