Snapshot

Investors have been dealing with elevated volatility in asset prices since the pandemic began. A contributing factor that continues to muddy the waters has been the volatility in economic data due to COVID-led distortions. In more recent months, particularly in the US, unseasonal weather patterns have made reading the economic tea leaves even more difficult. US bond yields initially fell in January as data for December 2022 was weaker than expected, but they soon reversed course as stronger-than-expected data followed in February. Asian equities and commodities also sagged; this was partly a normal correction but it was also due to some concern that China demand may be slow to improve despite the country’s easing and stimulus.

Once again, market narratives have been shifting ever more quickly and violently, but the outlook is largely unchanged—US growth is slowing while demand is likely to gather momentum in China and the beneficiaries of China demand across Asia and in parts of Europe. Indeed, this dichotomy was on show as markets began to price this in early March after weak US retail numbers and a very strong China purchasing managers index (PMI).

We continue to watch the US dollar very closely as an indicator of global growth prospects and its recent strength does give us pause. However, the chief driver of the recent uptrend was largely driven by strong economic data in the US, initiated by an outsized January payrolls number leading to a strong repricing of the terminal rate to the upside and a growing belief that rates will stay higher for longer. The dollar was due for a relief rally given the fast pace of its decline since October 2022. But we believe its longer-term trajectory will ultimately turn to weakness as a reflection of better relative growth prospects outside of the US while also supporting global growth overall.

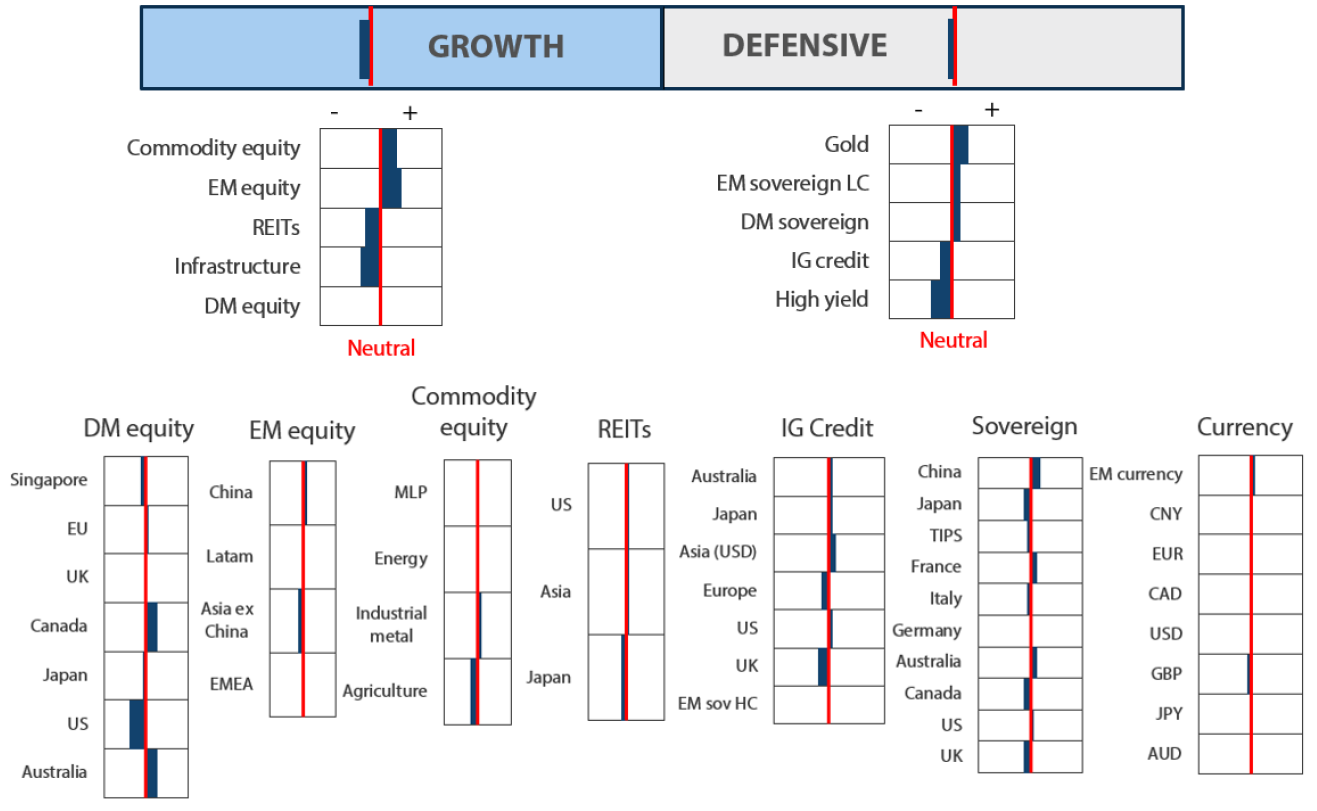

Cross-asset 1

Our underweight views on both growth and defensive assets were unchanged this month. Markets seem quite polarised with roughly equal shares of bulls and bears ready to pounce on any new data that supports their view. This has led to persistent volatility as economic data is difficult to predict while COVID distortions are still playing a role. This month, US activity data came in stronger than expected and failed to show the weaker demand that markets have been expecting just a few weeks ago.

Bond bears have taken the lead with a “higher for longer” narrative, causing both growth and defensive assets to waver. Despite the narrative twists and turns, central bank policy is likely to do its job in terms of quelling demand and facilitate a fall in inflation, but it could take time. Markets may worry that “higher for longer” may mean a deeper recession. However, our base case is that the strength of private sector balance sheets will help guard against a deeper recession.

Within growth, we decreased developed market (DM) equities given the strength of the January rally that seemed overdone and we favour emerging markets (EM) and commodity-linked equities that likely have better growth prospects ahead. Within defensives, we maintained our positions. We still favour DM sovereigns and gold over credit, where demand headwinds are yet to negatively impact credit quality.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

China demand looks to be picking up, evidenced by increased mobility and an impressive bounce in PMI numbers. However, markets have stubbornly stayed weak as a function of some disappointment in economic growth targets in early March; this perhaps suggests that stimulus was less than anticipated and may also be a reflection of concerns over re-emerging US-China geopolitical tensions. An immediate geopolitical crisis nor a significant impediment to China’s recovery do not appear to be on hand, but the confluence of these dynamics does sour risk sentiment—particularly for foreign investors. China is still attractive in the context of valuations and better earnings prospects, but it bears a close watch for any increase in geopolitical tensions to further weigh on risk appetite.

The US equity market is contending stubbornly with high services inflation on the back of a still robust labour market. Now, with the collapse of Silicon Valley Bank (SVB), potential systemic risks have suddenly been brought to the fore. Namely, US regional banks look vulnerable to poorly managed balance sheets that were vulnerable to rising long-term rates. While the US Federal Reserve (Fed) back-stopped the banks’ balance sheets, averting a potential run on regional banks, the ongoing residual stress of regional bank outflows does have the potential to set a negative feedback loop tightening credit conditions that adversely impacts demand.

The macro and risk environment remains extremely fluid and fast moving. While we developed our research scores not long ago printed in the earlier pages of this note, we take into account current conditions to be more negative on growth over the near-term, reducing equity exposure.

Reassessing growth risks

2023 started off with a bang, with virtually all equity markets driven into positive territory in January on the back of renewed optimism concerning a US soft landing, China’s re-opening transitioning to a recovery and European growth potentially on the rebound for having averted a winter energy crisis while seeing improving demand from China. We were sceptical of the US achieving a “goldilocks, no landing” scenario implying softer inflation without a recession, which will allow the Fed to ease rates later in the year. But we were and still are believers in China’s re-opening story benefiting not just the country but also the beneficiaries of its demand including Asia and beyond.

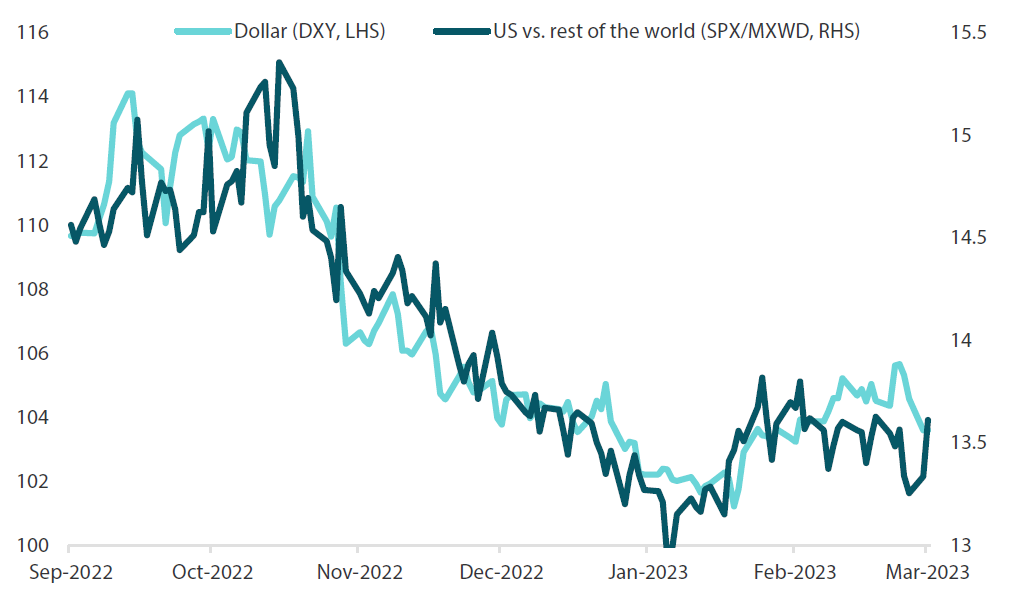

We were not alone in anticipating this growth story, which was also supported by a weaker dollar implying better growth conditions where geographies outside the US typically benefit the most. Equities in the rest of the world did indeed outperform US equities as dollar weakness continued from late October 2022 (also the peak in UST yields) into early February. The revival in dollar strength seems more of a correction given the precipitous decline during the fourth quarter—lifting US equities over the rest of the world. However, dollar strength does give pause when considering prospects for global growth.

Chart 1: Dollar compared to S&P500 vs rest of the world

Source: Bloomberg, March 2023

The dollar has generally been following long-term yields, which both surged in early February following an exceptionally strong US payroll data. The surge continued throughout the month on the back of other relatively strong indicators. We have noted this dynamic in previous writings, ascribing the stronger data at least partially to still highly volatile data that has continued since COVID struck. This is still true, but so far March data has done little to unwind the sense of surprising resiliency in the labour market coupled with stickier inflation than originally hoped.

Add to this quotient of US economic strength a situation in which regional US banks come under strain from rising long-term yields and triggering significant marked-to-market balance sheet deterioration. This does not constitute systemic a “break”, particularly given the Fed’s backstop. But it does shine a light into stresses in the system that potentially introduce new economic headwinds in the form of tighter credit conditions on account of continued withdrawals from other regional banks that hinder credit supply.

The China recovery story is still convincing, but possibly deeper headwinds to US growth is an offset to improving global demand elsewhere. We remain constructive on the global growth prospects for 2023, but risks to this thesis are rising. Coupled with the ongoing Russia-Ukraine war and elevated tensions between the US and China, we remain cautious over the near-term.

Conviction views on growth assets

- Cautious on global equities: Near-term, we remain cautious on global equities given elevated levels of uncertainty concerning systemic stresses in US regional banks while economic data has failed to give the Fed reason to pause in pressing forward with monetary tightening. Coupled with elevated geopolitical stresses from Russia-Ukraine to US-China, for now it is prudent to remain cautious with respect to overall equity exposure.

- Watch the dollar: Somewhat unusually, the dollar weakened in the wake of the SVB value, which is usually a source of strength in a “risk off” environment. This time around, the overpowering driver was the strong compression in rates expectations. However, the outlook is less clear and still data dependent, revolving around US economic indicators and the potential emergence of stress in regional banks or elsewhere. While the dollar would likely weaken if rate expectations declined, deepening concerns about global growth would be expected to lead to further dollar strength. In our view the direction of the dollar is a clear signpost for growth expectations ahead, which we watch very closely.

Defensive assets

We maintain our positive view on sovereign bonds this month. Returns have completed a round trip from a positive start in January back to slightly negative for the year. The roller coaster is reflective of volatile economic data and the swings in narrative between firmly held views expecting higher rates and lower rates. For our part, we expect the more bond-supportive themes of falling inflation and weakening growth data to win out in coming months. While DM rates are likely to remain volatile, EM sovereign bonds also offer attractive opportunities. EM central banks are more likely to cut rates later in 2023 amid declining inflation pressures.

The positive risk sentiment that greeted 2023 has waned in recent weeks and credit spreads have halted their tightening. Growth in the dollar-bloc economies has proved resilient but Europe and the UK are notably softer. Tighter monetary policy impacts economies with a lag so we expect the economic headwinds to grow steadily in the coming quarters, making trading conditions difficult for companies. While credit quality remains robust across the ratings spectrum, we remain cautious on corporate bonds ahead of a potential global slowdown.

We maintain our constructive view on gold at the top of our hierarchy of defensive assets. The disinflation process has proven to be bumpy with the recent bout of strong US data strength pressuring both rates and the dollar higher, creating headwinds for gold. However, growth prospects are improving outside of the US as China reopens, reducing demand for dollars and lending support to gold.

Dollar-bloc central bank divergence

In March 2020, the Fed, the Bank of Canada (BOC) and the Reserve Bank of Australia (RBA) lowered their respective bank target rates to near 0%. Two years later, these central banks began to remove their monetary policy accommodation in earnest. The Fed and the BOC moved aggressively, and in lockstep, to begin raising their target rates in March 2022, followed by the RBA a few months later. All these central banks were responding at the time to the sudden economic disruptions presented by the pandemic but as we approach the late innings of this tightening cycle, their approaches have begun to deviate.

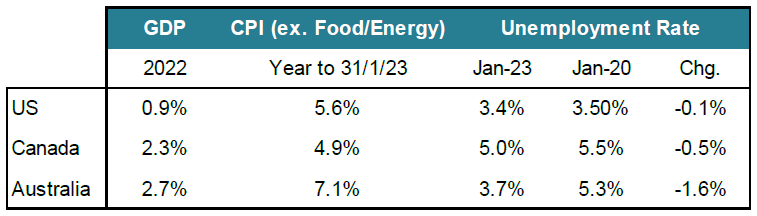

Table 1 shows three important economic statistics for the US, Canada and Australia. GDP growth in all three countries were near or below trend in 2022. US growth was the weakest over the year but its growth improved in 4Q 2022 relative to the other two. On inflation, there was a wide range with Australia having the highest core inflation and Canada the lowest. The unemployment rate was historically low in all three countries, but it is also interesting to consider the change from pre-pandemic levels. Employment is certainly strong across the board but unemployment in the US and Canada is only similar to pre-pandemic levels, while Australia is significantly stronger.

Table 1: Dollar-bloc economic statistics

Source: Bloomberg, March 2023

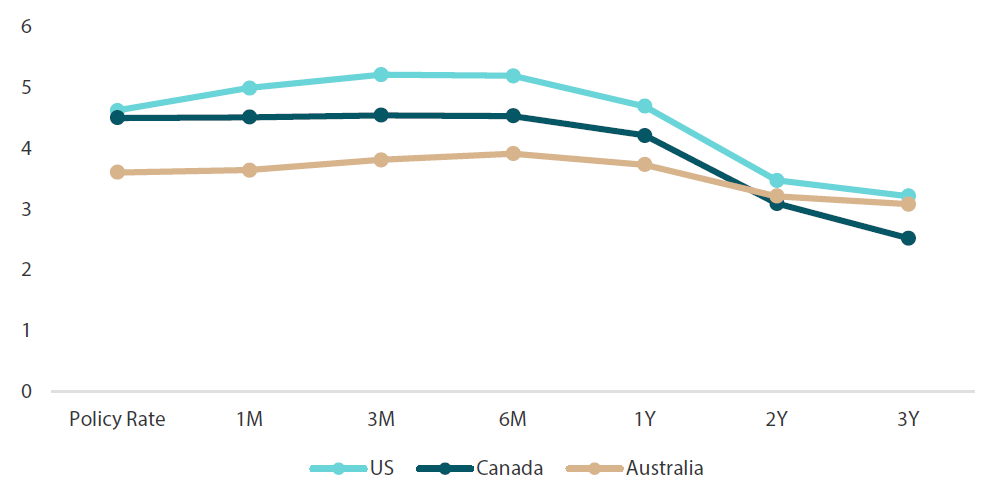

The point we draw from taking this high-level review of the economic climates in these three dollar-bloc countries is that the circumstances facing their respective central banks are quite similar. All three are experiencing tepid GDP growth, high core inflation and historically low unemployment. Given this backdrop, we might expect the central banks to be employing similar monetary policy strategies. While that has certainly been the case so far, the Fed’s strategy today is to continue pushing its target rate higher over the next six months. Conversely, the BOC has already signalled a pause in its tightening campaign and the market expects one more 25-bps rise from the RBA before it also pauses. Chart 2 shows the market implied path for target rates for each of the Fed, BOC and RBA.

Chart 2: Market’s implied central bank rate paths

Source: Bloomberg, March 2023

It is these late stages of a rate hike cycle when the risks of tightening too much begins to rise. From past cycles we observe that changes in a central bank’s policy rate impacts its economy with a lag. Given this lack of an immediate response, the risk of oversteering on rates is very real. When we compare the expected rate changes yet to come from these three central banks, all facing similar economic backdrops, it is the Fed which appears most at risk of overtightening. Conversely, the BOC and RBA seem to be most at risk of not tightening enough. For our part, we think that the less aggressive rate profiles expected from the BOC and the RBA are taking better account of the potential impact on growth and inflation from past rate hikes. It is the Fed that we fear is likely to raise rates too high in this cycle, should it deliver on its “higher for longer” strategy.

Conviction views on defensive assets

- Prefer sovereigns over credit: The late stages of central bank tightening cycles are generally not kind to credit spreads and credit quality. Therefore, we prefer sovereign bond exposures.

- Gold can continue to perform: The twin headwinds of rising real yields and a stronger dollar are fast receding, and safe-haven interest is rising, fuelling support for gold prices.

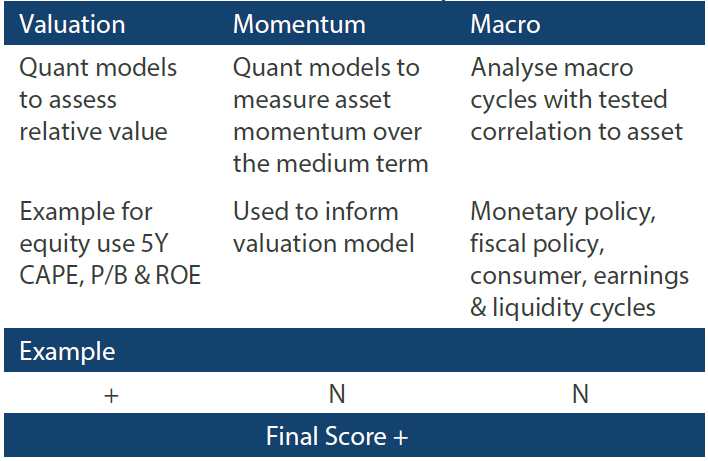

Process

In-house research to understand the key drivers of return: