Snapshot

Significant market-moving events have followed in rapid succession from the beginning of 2022, from inflation and rates shocks to a war and commodity shock, a UK pension crisis and now, a regional banking crisis in the US. Such historical events predictably weighed on sentiment and equity valuations. Still, each shock eventually proved to be a buying opportunity—not born out of the familiar “Fed put” but ample liquidity from the massive stimulus to date and the continued post-COVID recovery. Now we are in the advanced stages of significant tightening both from rates and credit availability, so what comes next?

In our view a US recession is likely, though it is unlikely to be deep, for the still strong private sector balance sheets outside pockets of banks that hold commercial real estate loans of questionable value. Central banks have not pivoted yet, nor is it clear how their tightening bias advances their cause as long-term rates defiantly compress while the cost of rate hikes increases for the incentivised deposit outflows in favour of higher-yielding money markets.

Meanwhile, the labour market remains adequate, China demand continues to recover and there are solid reasons to be bullish on tech stocks that are beginning to monetise a new channel of growth in the form of artificial intelligence (AI). In this context, bulls and bears are roughly split, with markets pushing in either direction and defining a range until one side is proven more right.

Energy price pressures do present near term challenges but are unlikely to require any change in monetary policy. Governments might have been overzealous in their aggressive actions to direct capital away from fossil fuels, which is partly driving the various shortages, but solutions do exist to better balance supply with demand while still meeting long-term objectives for net zero emissions.

Currently, we believe that valuations look stretched (mainly in the US) and volatility too low to justify that a new bull market is at hand, given the plethora of risks. We remain constructive on China's recovering demand and new sources of tech growth, but we are cautious for now for the relative complacency that appears not to adequately discount the eventually weaker economic data ahead and now renewed regional bank stress, and perhaps a US debt ceiling battle in the making.

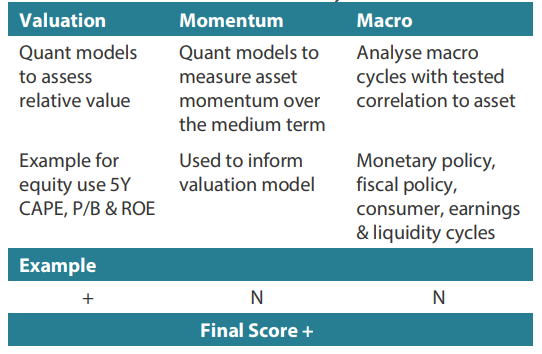

Cross-asset1

We maintained an underweight score for growth assets and a neutral view on defensive assets. While the policy response was sufficient to contain the banking crisis, the combination of higher rates for some time now with tighter credit conditions could be detrimental to growth. The US Federal Reserve (Fed) appears to be nearing the end of its tightening cycle, while inflation is likely to continue to moderate as demand conditions soften at the margin. Still, the labour market remains stable while the private sector balance sheet is acceptable, so easing demand could be gradual until we see a more profound impact on the labour market. Meanwhile, China demand is picking up while earnings have stayed overall resilient for the first quarter (1Q23), so it is important not to be too bearish.

Within growth, we increased developed market (DM) equities to overweight, funding it from a reduction of emerging markets to neutral, driven by far better earnings for now. We maintained neutral positions for commodity-linked equities, listed infrastructure in the form of utilities and an underweight position for REITs, which remain vulnerable. We maintained our relative scores within defensives; we are overweight gold and DM sovereigns, and underweight high yield and investment grade credit.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Is this the calm before the storm or is the return of calm from a storm that just passed? Conventional wisdom drawn from virtually every historical cycle tells us that monetary and credit tightening eventually crimps the labour market and therefore demand, which leads to falling revenue and compressing margins that leads to more job cuts—and so on—until the economy eventually goes into recession. Nothing about this cycle has been normal, and conventional wisdom has repeatedly been proven wrong since COVID struck. While we remain cautious on growth which keeps us conventionally cautious on earnings, we do weigh unconventional outcomes that could change our minds.

Leading indicators continue to point to a recession, but the hard data less so, and while the labour market is beginning to soften and margins have been compressing, top line growth is still appears adequate. Furthermore, cost cutting to date has helped stabilise or improve margins while top line revenue has held up—particularly in US tech. Is the top line about to fall to start a more vicious labour market downturn into recession? Conventionally speaking, it should, but some of the otherwise normal and expected dynamics at play could be slightly different this time.

Inflation and fiscal drivers of revenue and earnings

We are sanguine on tech’s new channels of secular growth centred around AI, but we have struggled to justify already rich valuations on the premise that a slowing economy eventually should hit top line demand consumption and investment. We are not in a recession yet (that we know of), but ordinarily one would expect more broadly negative guidance on earnings than we have seen from the latest round of quarterly earnings releases if a recession is just around the corner.

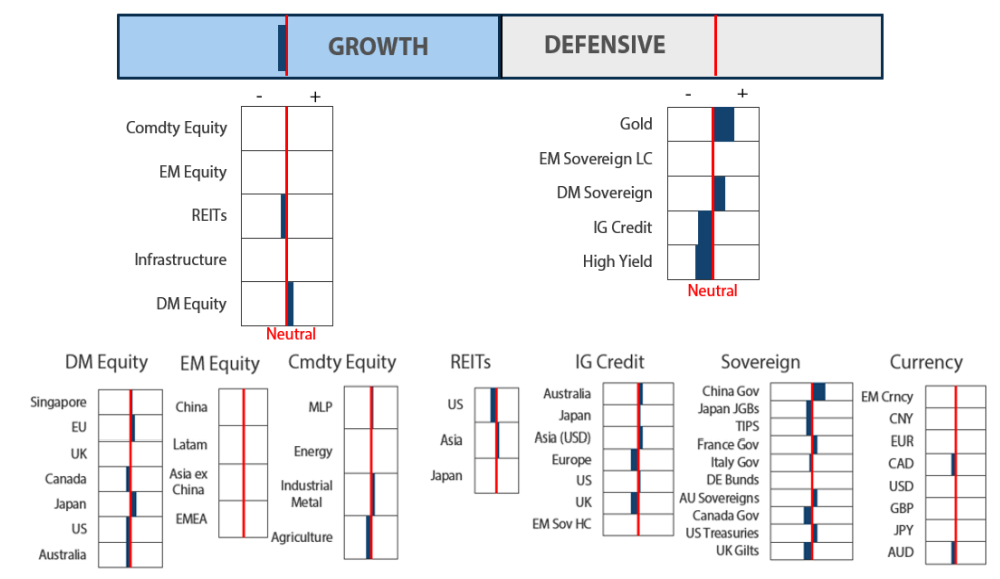

The top line is seen to have held up partly because labour has yet to significantly deteriorate but also because revenues are driven by nominal US GDP growth, which is exceptionally high—nearly 7% year-on-year (YoY) through 1Q23—higher than any 12-month period since 2005. Read: inflation is good for revenues and if costs can be contained, it has a positive effect on margins too. One analyst calls this “greedflation”, noting that companies have been able to preserve profit margins which in itself is also a source of inflation.

Chart 1: US nominal GDP vs. SPX revenue per share

Source: Bloomberg, May 2023

Source: Bloomberg, May 2023

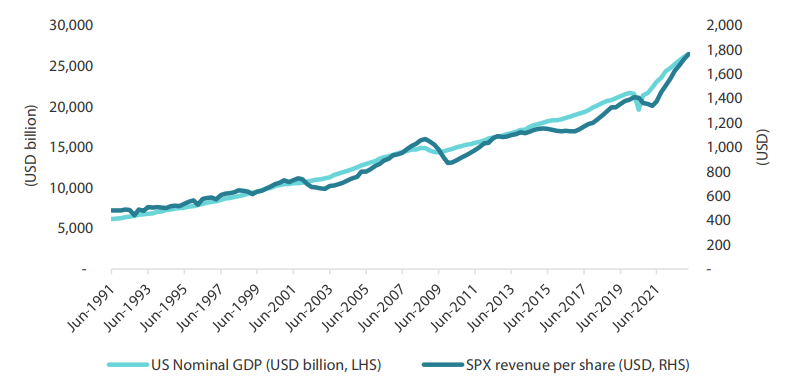

A recession can correct this dynamic, and we expect it will, but not necessarily evenly. Ultimately, the Fed is seen hoping to reduce demand to take down inflation, which centres around US private consumption representing roughly 70% of US GDP (Chart 2). However, while real wage growth has been negative for some time, nominal wages and private consumption have held up. Meanwhile, fiscal spending has stayed firmly in accommodative territory.

Chart 2: A lift from Fed and consumer spending (nominal)

Source: Bloomberg, May 2023

Source: Bloomberg, May 2023

Inflation pressures are easing but while the YoY headlines continue to fall, the month-on-month changes are still above 0.3%. This suggests that the Fed has further to go before inflation can be expected to come down to target. At this point, the Fed is likely done hiking, hoping that inflation will decelerate to lift real yields to tighter territory in due course. Meanwhile, the rate hikes to date are expected to take time to transmit into the economy, while banking stress is already taking a toll on credit availability. Conventionally, an economic and earnings recession could begin in earnest. Unconventionally, it may not, or at least not in an even form. If inflation does not fall to its 2% target, will the Fed opt to hike rates again, or will they choose to lift their target inflation rate instead? Or perhaps AI will solve the labour shortage; for example, McDonalds recently put to test using AI and robots to run a fully automated restaurant in Fort Worth, Texas. We stay conventional in our thinking, but we note the importance of unconventional thinking and position accordingly in a very different cycle.

Conviction views on growth assets

- Bar-belled exposure to growth: : We stay defensive in terms of positioning in defensive sectors like healthcare and consumer stables as well as quality companies both for their strong balance sheets and durable cash flow as well as partaking in secular growth opportunities.

- Cautious on banks: We hold a cautious view of financials at the moment, given that they are at the epicentre of this cycle’s stress. We suspect when the Fed begins to cut rates (whenever that might be), there will be significant opportunities in this space as well as other sectors that have suffered from the tangible elements of the current tightening cycle.

- Beneficiaries of China demand: Beneficiaries of improving China demand are preferred over China equities. Well short of “revenge spending”, consumer confidence is taking time to heal which requires better strength in the labour market. Earnings have disappointed, and while we see solid opportunities ahead especially given the attractive valuations, we remain slightly more patient at present.

Defensive assets

We maintained our overweight view on sovereign bonds within our defensive asset classes. April was an off month

for the Fed and European Central Bank, but other central banks held steady on monetary policy. While we did not

expect either central bank to leave rates unchanged at their respective May meetings, these may prove to be the last

of the rate hikes in this global cycle. Given traditional lags in monetary policy and an expected tightening of bank

lending standards, markets are likely to trend towards lower yields as global growth slows through this year.

High grade credit spreads retreated from their highs in March following a strong response from government authorities to address the stresses in US banking and the difficulties at Credit Suisse. Defaults are still low by historical standards but have begun to rise in the first quarter. Meanwhile, recession indicators continue to point to trouble ahead for the US economy amid an already weak Europe. We expect the twin headwinds of monetary policy tightening and tighter bank lending conditions to increase the pressure on corporate borrowers as 2023 progresses.

Gold has been performing strongly on the back of a weaker dollar and lower real yields, as markets anticipate that the end is near for the Fed’s tightening cycle. Central bank demand has also been strong this year as the diversification of reserves has become more urgent in the wake of US sanctions against Russia that seemed to “weaponise” the reserve currency status of the dollar. This additional demand for gold has reduced available supply at the margin for investment demand that has also been strong.

The state of US bank lending

The US economy has so far shown resilience during the Fed’s aggressive tightening cycle that began just over a year

ago. However, some sectors of the economy have been showing the strains of higher rates. It is no surprise that real

estate has been the most obvious sector to be negatively impacted, but more recently markets have been unsettled

by the failure of three US banks in quick succession and the rescue of Credit Suisse. While banking regulators and

governments have been quick to resolve these threats, cash rates remain elevated and yield curves are still deeply

inverted, leaving in place two contributing factors to these failures.

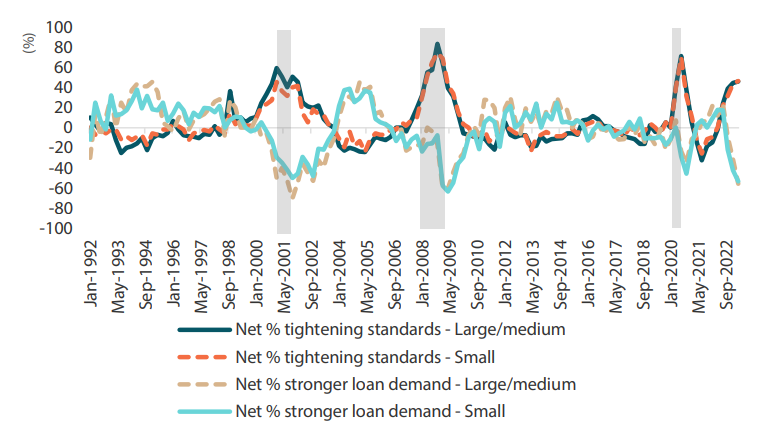

The rapid resolution of these bank failures has certainly been well-received by markets but there is likely to be a longer lasting impact on the US economy. As banks scramble to shore up their liquidity and seek to convince investors that they are healthy and strong, back lending standards are likely to become stricter, reducing the availability of credit to businesses and consumers. Chart 3 shows some results from the quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices conducted by the Federal Reserve Board in April. The credit standards data uses the net balance of the percentage of bank respondents that reported a tightening of standards for commercial and industrial (C&I) loans less those reporting a loosening. The loan demand data shows the net balance of those respondents seeing an increase in loan demand less those seeing a decrease.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

Chart 3: Credit standards and demand for US C&I loans

Source: US Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices

Source: US Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices

It is clear from this survey that banks have indeed been tightening their lending standards in the most recent quarter but that it is also a continuation of the trend already underway. The levels for standards to both large/medium and small firms are also consistent with those prevalent in the lead up to prior recessions (shown by grey shading). Loan demand has also continued to drop from all categories and is consistent with past recession levels.

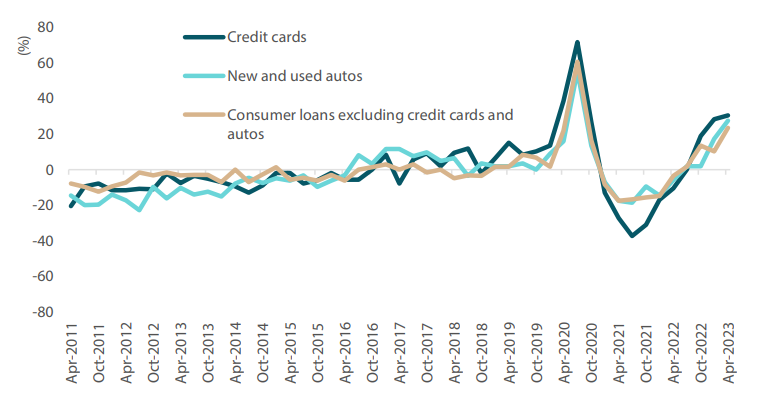

Chart 4: Net percentage tightening standards on US consumer loans

Source: US Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices

Source: US Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices

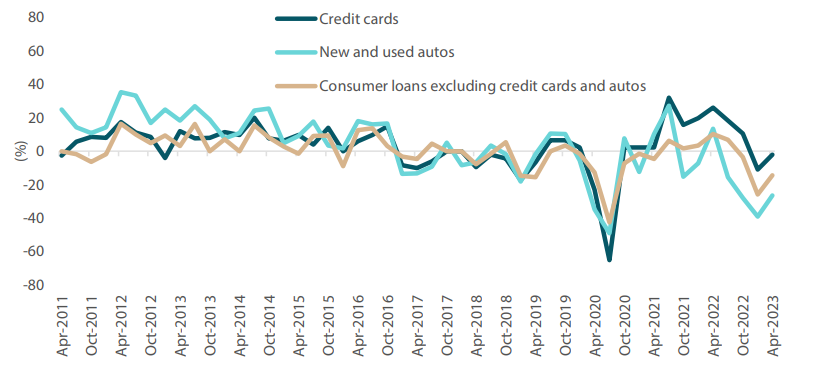

Chart 5: Net percentage reporting stronger demand for US consumer loans

Source: US Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices

Source: US Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices

Charts 4 and 5 show the survey results for consumer loans split into credit cards, auto loans and the rest. Lending standards for consumer loans have also been tightening across the board although demand had a small recovery in the latest quarter. Interestingly, demand for credit card debt has been evenly split with a net balance close to zero while demand for autos and other consumer loans has been weakening. This may indicate a greater reliance on credit card debt as economic growth slows but less demand for bigger ticket consumer items given greater uncertainty. If we combine the message from this survey, of tightening bank lending standards and slowing demand for credit, and other forward-looking indicators that portend weaker US growth, we can continue to expect supportive conditions for defensive assets in coming months.

Conviction views on defensive assets

- Prefer sovereigns over credit: Central bank tightening cycles and banking problems are generally not kind to credit spreads and credit quality. Therefore, we prefer sovereign bond exposures.

- Upgrading China bonds again: China has provided only modest stimulus coming out of the pandemic, reducing upside risk in yields and its government bonds continue to display low correlation to global rate moves.

- Gold can continue to perform : The twin headwinds of rising real yields and a stronger dollar are fast receding, and safe-haven interest is rising, fuelling support for gold prices.

Process

In-house research to understand the key drivers of return: