Summary

- According to Wall Street lore, investors should “sell in May and go away”, but June's rally once again reduces the credence of this strategy. Still, the outlook remains uncertain despite improvements in terms of trade policy tensions and ceasefires. The situation remains fluid, and against such a background we expect Chinese policy support to stimulate consumption and business activities.

- Another reason to be constructive on Chinese equities is the country's favourable liquidity environment, and this could lead domestic institutions to redirect their capital to equity markets for more attractive returns. Elsewhere, India remains a compelling long-term investment opportunity despite short-term challenges; pro-growth consumption policies and structural reforms will likely support Indian corporate recovery.

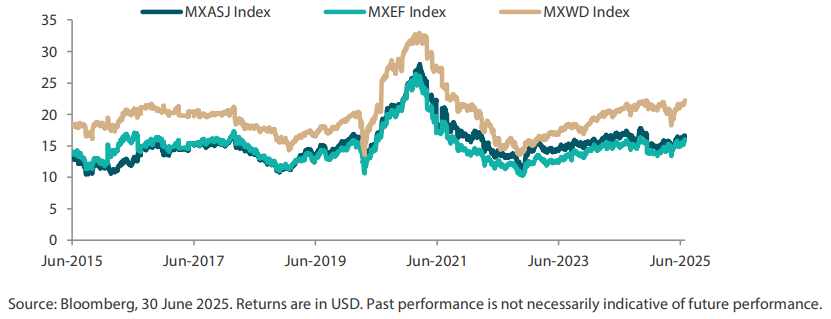

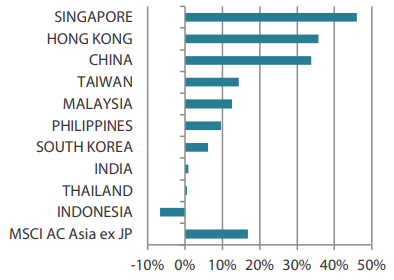

- Markets continued to gain in June, with sentiment buoyed by retreating geopolitical uncertainty and trade tensions, alongside the prospect of a looser monetary policy. Top-performing Asian markets included South Korea (+17.6%), Taiwan (+9.4%) and Hong Kong (+5.9%) while Indonesia (- 5.1%) and Thailand (-3.1%) underperformed.

- While the stock markets of South Korea and Taiwan are among the most sensitive to trade disruption, we have observed several companies already adapting to limit those risks. In ASEAN, amid uncertainties regarding structural reforms and political issues, we prefer the markets of Singapore and Malaysia with their relatively stable politics and tech-driven economic growth.

Market review

Asian markets keep up their upward momentum as we reach the midpoint of the year

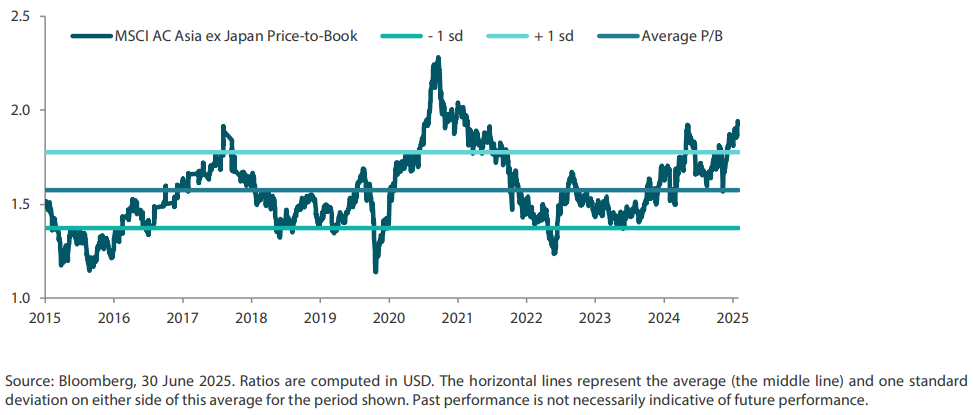

Summer might not have the best reputation for stock market returns, but Asian markets, alongside global peers, were off to a good start in June. Sentiment has been boosted by easing geopolitical risks following a ceasefire between Israel and Iran, hopes that the US will secure trade deals ahead of the 9 July tariff deadline, and optimism that the US Federal Reserve (Fed) could reduce interest rates in the coming months. The MSCI Asia Ex Japan Index advanced 6.1% in US dollar (USD) terms over the month.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

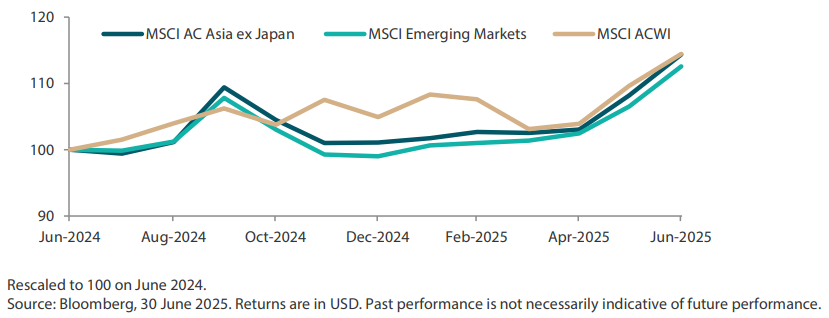

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Regional technology heavyweights surge

The equity markets of tech-heavy South Korea and Taiwan were the region's best performers, as the resurgence of the artificial intelligence (AI) investment theme boosted shares of chipmakers. South Korean stocks were also lifted by anticipation that the new government led by President Lee Jae Myung would implement market-friendly policies. The president pledged to improve corporate governance as part of a drive to improve stock returns. However, there was a slight setback as global index provider MSCI denied South Korea an upgrade to a developed-market status, citing limited foreign exchange reforms and restricted availability of investment instruments. South Korea and Taiwan were also the top performers over the second quarter, as the sharp appreciation of the Taiwanese dollar and the South Korean won against the dollar boosted US-denominated returns.

While the election outcome removed one of South Korea's biggest overhangs impacting its domestic stock market, it is now Thailand which finds itself mired in political uncertainty. Thailand's second-largest party, the Bhumjaithai Party, withdrew from the ruling coalition, citing the risk of a loss of Thai sovereignty and integrity. The decision to withdraw was prompted after a leaked phone conversation between Thai Prime Minister Paetongtarn Shinawatra and Cambodia's former premier Hun Sen, occurring amid an ongoing border row with Cambodia.

Structural reform delays and political uncertainty have caused the ASEAN region to underperform China significantly year-to-date. At the year's mid-point, Thailand was the weakest performer, with its index sliding more than 14% year-to-date, impacted by a decline in tourist numbers, concerns over high household debt, political unrest and corporate scandals. Meanwhile, Indonesia's index delivered a return of 0.4%, with increased volatility in June due to weak GDP growth and consumer sentiment.

Chart 3: MSCI AC Asia ex Japan Index 1

For the month ending 30 June 2025

For the year ending 30 June 2025

Source: Bloomberg, 30 June 2025.

1 Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Chinese policy expected to support to stimulate consumption and business activities

Although they remain volatile, markets continued to recover following the easing of trade tensions. The markets' recovery occurred even in the face of an escalation of conflicts in the Middle East, particularly between Israel and Iran. While there have been improvements in trade policy tensions and ceasefires, the outlook remains uncertain.

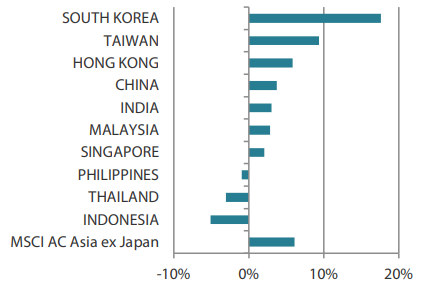

In China, we expect policy support to stimulate consumption and business activities. Early signs of real estate stabilisation and a more active stock market rally from a low base are encouraging. Another reason for optimism in Chinese equities is the favourable liquidity environment. Low government bond yields reflect this and could prompt domestic institutions to redirect their capital into equities for better returns. China's securities regulator is also encouraging more investments in the equity market by allowing state-owned insurers to invest 30% of new policy premiums to the domestic A-share market. Additionally, there are signs of improvement in US-China tariff tensions, exemplified by the trade deal framework struck between the two countries in late June.

Long-term outlook for India remains compelling

India remains a strong long-term investment opportunity despite near-term challenges it faces. Pro-growth consumption policies and structural reforms are expected to support corporate recovery. We view the Indian market's recent correction as a healthy occurrence, that hopefully presents investors with opportunities to invest in some high-quality companies at much more reasonable valuations. While we still maintain a cautious view on India, given the challenges in earnings growth faced by its small-cap companies, we see value in select Indian large-cap names with strong fundamentals.

South Korea, Taiwan firms adapting to changing patterns; ASEAN's long-term potential remains promising

Despite the political instability and public protests, South Korea has delivered index returns nearing 42% year-to-date, on the back of good corporate results and the “Value-up” programme. South Korean companies continue to expand globally and offer attractive valuations. The stock markets of South Korea and Taiwan are among the most sensitive to trade disruption, and we observe several companies already adapting to limit those risks. Singapore and Malaysia remain the preferred markets, as they benefit from relatively stable politics and tech-driven economic growth. We continue to believe in the region's long-term structural transformation potential.

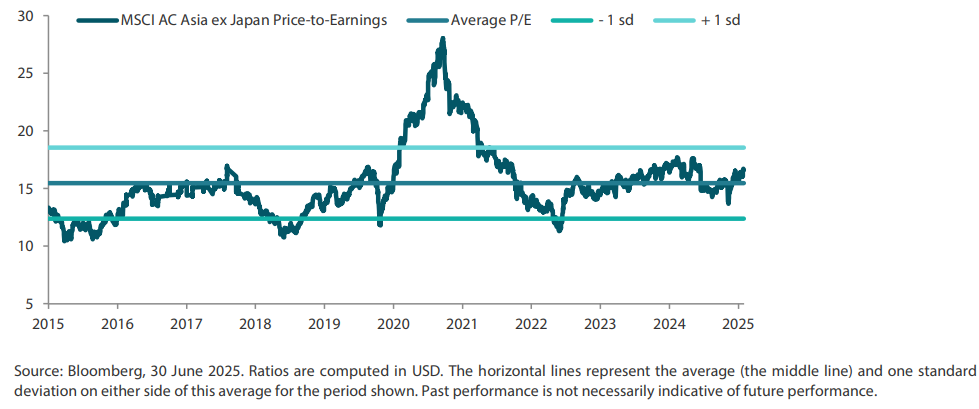

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Chart 5: MSCI AC Asia ex Japan price-to-book