Firm US GDP supports Fed’s decision to keep rates on hold for now

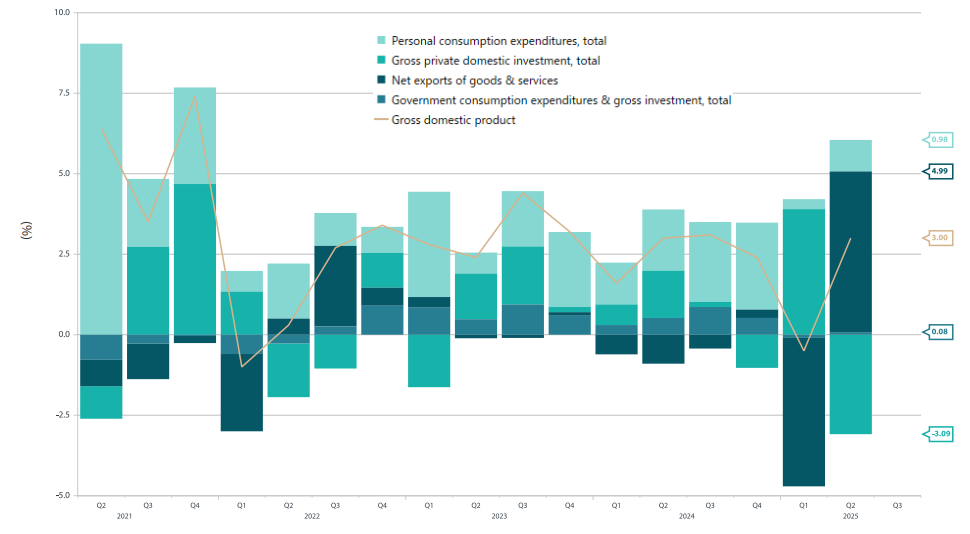

The Federal Reserve (Fed) kept rates on hold on 30 July, maintaining the policy rate in a range between 4.25% and 4.5%, following stronger-than-expected US Q2 GDP data. Although the Fed’s rate decision was widely anticipated, the first double dissent in 30 years—from Fed governors Christopher Waller and Michelle Bowman—highlighted a divergence in outlooks among Federal Open Market Committee voters. Waller and Bowman pointed to early signals of softness in the labour market, although data suggest that economic activity continues to be supported by offsetting factors, even in the post-2 April world. In Q2, US consumption made a positive contribution to growth, albeit less strongly than in late 2024 (Chart 1). However, a significant expansion in net exports—compensating for front-loaded imports in Q1—more than offset a decline in private domestic investment and subdued government consumption. Still, US growth remains influenced by temporary factors, and households may not yet have felt the full brunt of US tariffs.

Fed Chair Jerome Powell acknowledged emerging risks in the labour market but emphasised that employment is closer to one of the Fed’s goals of full employment than inflation is to its mandate of price stability. Supporting Powell’s point, the US core PCE index posted a smaller-than-expected decline, falling from 3.5% in Q1 to 2.5% in Q2, meaning that it is still half a percentage point above the Fed’s target.

Chart 1: US GDP contributions (seasonally adjusted, annualised rate)

Source: Nikko Asset Management, Hutchins Center on Fiscal & Monetary Policy, BEA

Tariff deadline rush underscores reasons to wait and see

A deluge of new information on US tariffs continues to pour in, with the market and the US economy still trying to digest its implications. Tariff rates range widely, from 15% on exports from heavyweight South Korea to a higher-than-expected 25% on Indian goods. The only constant appears to be that tariffs remain subject to upward pressure, although the situation is perhaps not as severe as some worst-case scenarios had projected.

The full economic impact of the newly agreed tariffs remains unclear, but it is likely that the most significant effects of the US tariff war still lie ahead. As we pointed out in Global Investment Committee's outlook: narrowing growth differentials , a New York Fed corporate survey shows that most companies plan to pass on tariff costs, at least partially, and that they typically do so with a lag of one to three months. Since we are not even a month past the initial 4 July “reciprocal” tariff deadline announced in April, further pass-through may still be pending in inflation data.

Of course, the timing of such price rises may not be ideal as the job market has shown early signs of softening. However, repeated micro-adjustments to global supply chains and prices that result in consistent shocks may work against arguments for rate cuts based on labour market weakness. This could be particularly true if consumers internalise such repeated shocks and adjust their long-term inflation expectations upward. It is worth noting that once internalised and passed through into long-term expectations, inflation tends to be sticky. As such, it is not certain if the prevailing effect will ultimately be a decline in demand driven by rising unemployment.

BOJ stands pat but slightly more hawkish on growth and inflation outlook

The Bank of Japan (BOJ), like the Fed, opted on 31 July to remain in wait-and-see mode, keeping its policy rate on hold at 0.5%. However, in its updated outlook the BOJ modestly revised its near-term growth view from 0.5% to 0.6%. In addition, it significantly revised its near-term core CPI outlook from 2.2% to 2.7%. The central bank also modestly upgraded its longer-term core CPI projection; its two-year forward CPI forecast was revised back to 2% from 1.9%.

These revisions, all else equal, provide a greater argument for a more hawkish BOJ compared to May. Meanwhile, the assumption that core CPI will slow from 2.7% in the current fiscal year to 1.8% in the next is highly dependent on the pricing-out of fresh food prices and absence of other inflationary factors going into fiscal 2026. Should prices remain more robust over late 2025 and household purchasing power stay intact, the BOJ may be prompted to bring forward its rate hike timeline. Our central scenario remains that the BOJ is likely to hike rates before the end of 2025.

China’s Politburo also in wait-and-see mode, keeps policy powder dry

Amid the global wave of data, China’s Politburo expressed confidence in the resilience of the Chinese economy but has so far refrained from offering new policy measures. As trade negotiations with the US have now been extended, China could be trying to maintain some dry powder to react to the eventual outcome of the talks—particularly if it poses any additional challenges to external demand.

A key development is the 4th Plenum in October, which will focus on the 15th Five-year plan (2026 to 2030). This event may provide an opportunity for new policy announcements in response to what is revealed after extended China-US trade talks. By October, the need for consumption-focused stimulus may become apparent, particularly if China’s current “anti-involution” campaign—aimed at curbing excessive capacity—proves ineffective in offsetting price declines stemming from households’ soft demand and precautionary savings.