January 26, 2018

Nikko Asset Management Co., Ltd.

Takumi Shibata, Representative Director, President and CEO

Pursuing fiduciary principles and ensuring customer-first operations is the essence of the asset management business. Firms in the industry must also work to position Environment, Society and Governance (“ESG”) assessments, as well as stewardship activities, at the heart of their investment processes. Stewardship responsibilities regarding the companies in which asset managers invest, including the exercise of voting rights, form an important part of this work. At Nikko Asset Management (“Nikko AM”), we not only do our utmost to fulfil our responsibilities in these areas, but have also established committees that provide monitoring and oversight of our activities as well as necessary advice from outside perspective that is fair and neutral.

Having fully taken on board the import of the Financial Services Agency’s “Principles for Customer-oriented Business Conduct”, we constantly strive to apply the principles to all of our business activities, thus ensuring that they inform our future plans as well as our past and present efforts. As described below, we are now engaged in a variety of initiatives to achieve that goal, including efforts to serve the interests of our individual and corporate customers as well as stewardship, ESG and governance activities.

- Activities for individual and corporate clients

- As an asset management company, our paramount mission is to be useful to our customers in their medium-to long-term asset building. Realizing this mission is not just a case of delivering strong investment management outcomes, however. We also need to put a great deal of effort into every aspect of our services, including imparting accurate knowledge of investment management and the products we offer, proactively delivering timely and appropriate information on market trends, providing products that are suitable for medium-to long-term investment that serves customer needs, and helping customers to manage risks.

Our initiatives in this area, together with the results we have delivered to date, are detailed below.

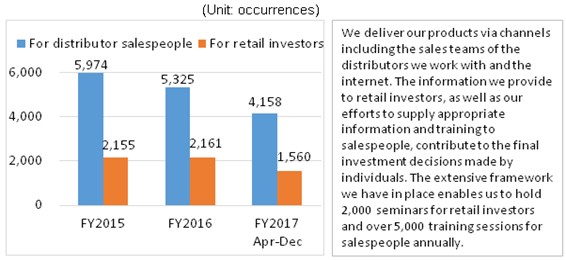

(1) Number of seminars held

We deliver our products via channels including the sales teams of the distributors we work with and the internet. The information we provide to retail investors, as well as our efforts to supply appropriate information and training to salespeople, contribute to the final investment decisions made by individuals. The extensive framework we have in place enables us to hold 2,000 seminars for retail investors and over 5,000 training sessions for salespeople annually.

(2) Information provision under Nikko AM Fund Academy brandMain investment information sources provided as series Frequency Additional information Rakuyomi Twice weekly 131 released in 2017 Koyomi Monthly Gokuyomi Twice monthly Market 5 Minutes Monthly Weekly Market Weekly Data Watch Weekly Follow-up Memo Irregular 11 released in 2017 Global REIT Weekly Weekly Monthly Market Monthly JAPAN in Motion Monthly ※ For the irregularly released information, the number of releases in January-December 2017 is provided as a reference. We strive to contribute to the asset building of customers by providing investment information that is as neutral as possible. Under our Fund Academy brand, we provide fund-related knowledge and information that we judge to be essential, not only to retail investors and distributors but also to non-customers. In addition to the titles shown in the table, our website contains videos, e-learning documents, simulation tools and other such information sources.

(3) Average holding periods of top ten funds for AUMRank Fund name Average holding period (years) AUM (JPY 100M) Fund investment universe/type 1 Nikko LaSalle Global REIT Fund (Monthly Dividend Payment Type) 2.50 7,935 Foreign REIT/active 2 Global Robotics Equity Fund (Annual Settlement Type) 1.92 4,882 Foreign equity/active 3 Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type 5.07 3,736 Balanced 4 Global Robotics Equity Fund (Semi-annual Settlement Type) 3.18 3,556 Foreign equity/active 5 Nikko Developed Countries High Yielding Bond Open (Monthly Dividend Payment Type) 3.54 2,119 Foreign bond/active 6 Nikko Index Fund 225 1.29 1,949 Japanese equity/active 7 Smart Five (Monthly Settlement Type) 7.15 1,927 Balanced 8 Global Fintech Equity Fund 3.54 1,796 Foreign equity/active 9 Greater China Equity Fund (Monthly Dividend Payment Type) 1.58 813 Foreign equity/active 10 Japan Robotics Equity Fund (Annual Settlement Type) 0.77 794 Japanese equity/active ※ Publicly offered funds (open-end, excluding ETFs and MRFs). ※AUMs are as of end-December 2017. ※ Average holding periods were calculated with the simple formula below. Average holding period=Average AUM÷Redemption amount (annualized) (calculation period is 3 months from Oct 2017 to Dec 2017)

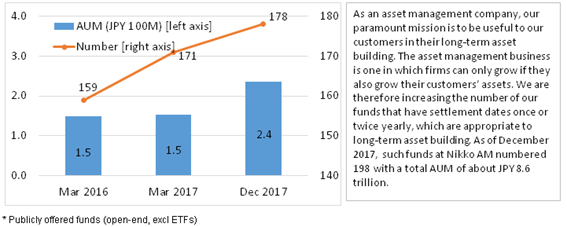

(4) AUM and number of asset-building funds (annual or semi-annual account settlement)

※ Publicly offered funds (open-end, excluding ETFs and MRFs) As an asset management company, our paramount mission is to be useful to our customers in their long-term asset building. The asset management business is one in which firms can only grow if they also grow their customers’ assets. We are therefore increasing the number of our funds that have settlement dates once or twice yearly, which are appropriate to long-term asset building. As of December 2017, such funds at Nikko AM numbered 198 with a total AUM of about JPY 8.6 trillion.

Main publicly offered funds capable of stably delivering medium- and long-term returns that we deem suitable for customers' asset-building needsRank Fund name Fund investment universe AUM (JPY 100M) Japanese Equities/Active Japan Robotics Equity Fund Annual, semi-annual 968 Nikko DC J Growth Annual 209 Foreign equity/active Global Robotics Equity Fund Annual, semi-annual 9,028 Global Fintech Equity Fund Annual, semi-annual 2,087 Developed Markets Capital Emerging Equity Fund Annual, semi-annual 202 Foreign Bonds/Active Nikko Developed Countries High Yielding Bond Open (Growth Type) Annual 125 Balanced Smart Five (Annual Settlement Type) Annual 200 Fine Blend (Growth Type) Annual 119 Nikko Triple Fund (Property Bond Equity) Growth Type Annual 49 ※ AUMs are as of end-December 2017

(5) Initiatives for cumulative investment including cumulative Nippon Individual Savings Accounts

Our efforts to meet cumulative investment needs are not just confined to cumulative NISA, however, as we are also working to promote the use of defined contribution plans, individual-type defined contribution pension plans and general account for such purposes. With these products, we are advocating long-term, cumulative and diversified investments to those who wish to build up their assets. We also provide assistance to distributors for cumulative investment initiatives by not only providing products but also creating and offering a variety of support tools.

Having completed the registration of one of our funds for eligibility in the cumulative NISA system, we are now preparing to obtain the same registration for multiple Exchange Traded Fund (“ETF”) products.

In July 2017, we also held a seminar on cumulative investment strategies for distributors in preparation for the launch of cumulative NISAs, which a total of 70 distributors attended.

(6) AUM and Performance of Japan-domiciled publicly offered funds

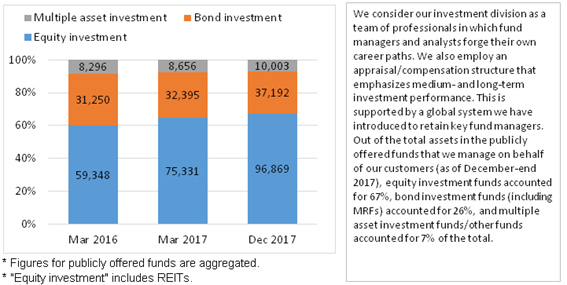

※ Figures for publicly offered funds are aggregated. ※ "Equity investment" includes REITs. We consider our investment division as a team of professionals in which fund managers and analysts forge their own career paths. We also employ an appraisal/compensation structure that emphasizes medium- and long-term investment performance. This is supported by a global system we have introduced to retain key fund managers.

Out of the total assets in the publicly offered funds that we manage on behalf of our customers (as of December-end 2017), equity investment funds accounted for 67%, bond investment funds (including MRFs) accounted for 26%, and multiple asset investment funds/other funds accounted for 7% of the total.

Equity investment funds: largest returns in past three yearsRank Fund name Launch date AUM (JPY 100M) Return (inc. dividends) (%) Since launch 5 years 3 years 1 year 1 Nikko Growing Venture Fund Jul 2003 191 384% 406% 144% 96% 2 Japanese Emerging Equity Open Dec 1996 140 427% 465% 102% 60% 3 Nikko Japan Small-mid Cap Growth Fund Nov 2005 154 137% 374% 92% 49% 4 Nikko Japan Open Aug 1998 455 93% 166% 51% 33% 5 Nikko DC J Growth Oct 2001 209 164% 191% 50% 31% 6 Nikko Profit Return Growth Stock Open Jun 1991 368 108% 190% 50% 31% 7 Listed Index Fund Japan High Dividend (TSE Dividend Focus 100) May 2010 212 127% 131% 41% 18% 8 Listed Index Fund TOPIX Dec 2001 31,434 138% 132% 37% 22% 9 Listed Index Fund 225 Jul 2001 28,341 127% 136% 37% 21% 10 Nikko Pension Index Fund Japanese Equity (TOPIX) Nov 2004 406 106% 132% 37% 22% (Reference index: Japanese equity) TOPIX 111% 29% 20% (Reference index: foreign equity) MSCI All Country World Index (ex. Japan, no hedge, JPY-based) 97% 13% 18% ※ Publicly offered open-end funds. AUMs are as of end-December 2017. Funds with AUMs below JPY 10 billion are excluded.

Bond investment funds: largest returns in past three yearsRank Fund name Launch date AUM (JPY 100M) Return (inc. dividends) (%) Since launch 5 years 3 years 1 year 1 Emerging High Yield Bond Fund Brazilian Real Course Dec 2010 203 51% 41% 19% 12% 2 Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (US Dollar course) Sep 2003 227 135% 49% 11% 8% 3 Asia Corporate Bond Fund A Course (Currency Hedge) Nov 2012 147 12% 12% 8% 3% 4 Asia Corporate Bond Fund B Course (No Currency Hedge) Nov 2012 321 58% 53% 4% 1% 5 PIMCO US High Income Loan Fund (Monthly Dividend Payment Type) No Currency Hedge Aug 2013 124 25% 0% 1% -1% (Reference index) Citigroup World Government Bond Index (ex. Japan, no hedge, JPY-based) 38% -3% 5% ※ Publicly offered open-end funds. AUMs are as of end-December 2017. Funds with AUMs below JPY 10 billion are excluded.

Multiple asset investment funds/other funds: largest returns in past three yearsRank Fund name Launch date AUM (JPY 100M) Return (inc. dividends) (%) Since launch 5 years 3 years 1 year 1 Nikko Japan Trend Select(Hyper Wave) Jan 1995 124 -51% 328% 62% 44% 2 Emerging Plus Growth Strategy Course Aug 2011 126 85% 59% 36% 25% 3 Nikko Ashmore Emerging Markets Tri-Asset Fund Monthly Dividend Payment Type (Brazilian Real Course) Feb 2010 248 60% 43% 25% 18% 4 Nikko GW7 Eggs Feb 2003 628 150% 82% 18% 16% 5 Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type Aug 2003 3,556 105% 58% 8% 6% ※ Publicly offered open-end funds. AUMs are as of end-December 2017. Funds with AUMs below JPY 10 billion are excluded.

10 funds with largest returns in past one year Rank Fund name Launch date AUM (JPY 100M) Return (inc. dividends) (%) Since launch 5 years 3 years 1 year 1 Nikko Growing Venture Fund Jul 2003 191 384% 406% 144% 96% 2 Japanese Emerging Equity Open Dec 1996 140 427% 465% 102% 60% 3 Nikko Japan Small-mid Cap Growth Fund Nov 2005 154 137% 374% 92% 49% 4 Global Fintech Equity Fund Dec 2016 1,796 44% - - 46% 5 Nikko Japan Trend Select(Hyper Wave) Jan 1995 124 -51% 328% 62% 44% 6 Japan Robotics Equity Fund (Annual Settlement Type) Jan 2016 794 51% - - 36% 7 Japan Robotics Equity Fund (Semi-annual Settlement Type) Jan 2016 173 50% - - 36% 8 Global Robotics Equity Fund (Currency Hedge Annual Settlement Type) Aug 2015 4,882 51% - - 35% 9 Global Robotics Equity Fund (Currency Hedge Semi-annual Settlement Type) Aug 2015 3,736 51% - - 34% 10 Greater China Equity Fund (Monthly Dividend Payment Type) Oct 2010 813 66% 91% 17% 34% ※ Publicly offered open-end funds. AUMs are as of end-December 2017. Funds with AUMs below JPY 10 billion are excluded.

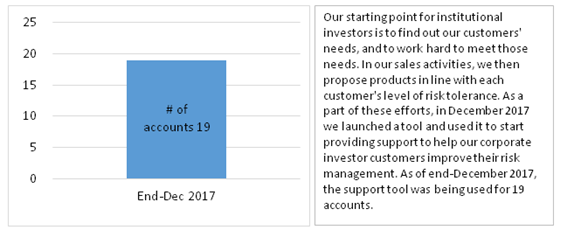

(7) Number of accounts utilizing risk management tool for institutional investors

Our starting point for institutional investors is to find out our customers' needs, and to work hard to meet those needs. In our sales activities, we then propose products in line with each customer's level of risk tolerance. As a part of these efforts, in December 2017 we launched a tool and used it to start providing support to help our corporate investor customers improve their risk management. As of end-December 2017, the support tool was being used for 19 accounts.

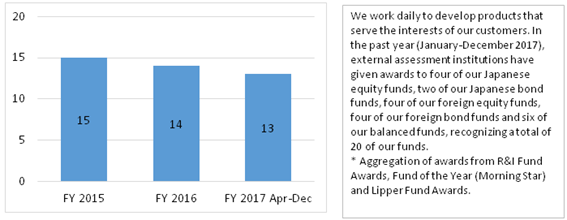

(8) Number of fund awards won

We work daily to develop products that serve the interests of our customers. In the past year (January-December 2017), external assessment institutions have given awards to four of our Japanese equity funds, two of our Japanese bond funds, four of our foreign equity funds, four of our foreign bond funds and six of our balanced funds, recognizing a total of 20 of our funds. * Aggregation of awards from R&I Fund Awards, Fund of the Year (Morning Star) and Lipper Fund Awards. - As an asset management company, our paramount mission is to be useful to our customers in their medium-to long-term asset building. Realizing this mission is not just a case of delivering strong investment management outcomes, however. We also need to put a great deal of effort into every aspect of our services, including imparting accurate knowledge of investment management and the products we offer, proactively delivering timely and appropriate information on market trends, providing products that are suitable for medium-to long-term investment that serves customer needs, and helping customers to manage risks.

- Stewardship activities and ESG

- We believe that it is one of our key responsibilities as an asset manager to help the companies in which we invest to improve the value they offer to investors by vigorously pursuing our stewardship activities including the exercise of voting rights. We constantly work to ensure that our activities are sustained and steadily improved upon. At the same time, we incorporate the concept of ESG into all of our investment management processes and perform assessments of the corporate value of firms—including their non-financial information—in order to promote medium- and long-term improvements as well as sustainable growth, and this approach is useful in our investment decision-making process. We also organized the ESG Global Steering Committee in order to further expand the global reach of our ESG efforts. Comprised of leaders in our investment management operations in Japan and overseas, the committee deliberates over matters such as ESG initiatives, ways of putting them into practice, and new approaches.

Our initiatives and results to date in the above-mentioned areas are as follows.

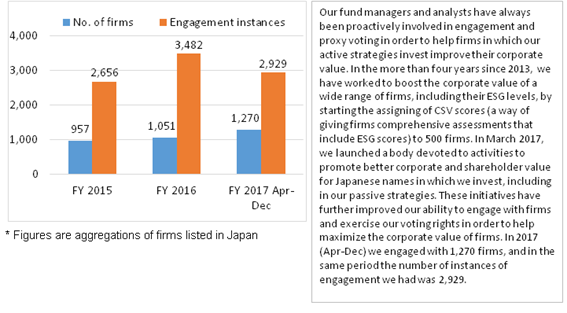

(1) Engagement results

※ Figures are aggregations of firms listed in Japan Our fund managers and analysts have always been proactively involved in engagement and proxy voting in order to help firms in which our active strategies invest improve their corporate value. In the more than four years since 2013, we have worked to boost the corporate value of a wide range of firms, including their ESG levels, by starting the assigning of CSV scores (a way of giving firms comprehensive assessments that include ESG scores) to 500 firms. In March 2017, we launched a body devoted to activities to promote better corporate and shareholder value for Japanese names in which we invest, including in our passive strategies. These initiatives have further improved our ability to engage with firms and exercise our voting rights in order to help maximize the corporate value of firms. In 2017 (Apr-Dec) we engaged with 1,270 firms, and in the same period the number of instances of engagement we had was 2,929.

(2) Voting track record1.Company-generated proposals Proposal July 2016 - June 2017 (For Ref.) July 2015 - June 2016 Yea Nay Subtotal Nay ratio Yea Nay Subtotal Nay ratio Appropriation of surpluses 1,344 140 1,484 9.4% 1,426 64 1,490 4.3% Partial revision to articles of incorporation 597 57 654 8.7% 855 85 940 9.0% Election/dismissal of directors 14,147 3,208 17,355 18.5% 15,085 1,412 16,497 8.6% Election/dismissal of corporate auditors 1,676 174 1,850 9.4% 2,566 360 2,926 12.3% Retirement benefit payments 165 47 212 22.2% 177 65 242 26.9% Revision of executive remuneration amount 511 18 529 3.4% 898 16 914 1.8% Granting of stock acquisition rights (Stock Option Plan) 233 88 321 27.4% 238 51 289 17.6% Granting of stock acquisition rights (anti-takeover measures) 12 120 132 90.9% 12 103 115 89.6% Restructuring 45 8 53 15.1% 49 2 51 3.9% Selection of accounting auditors 44 2 46 4.3% 46 1 47 2.1% Other 306 14 320 4.4% 142 4 146 2.7% Total 19,080 3,876 22,956 16.9% 21,494 2,163 23,657 9.1%

2.Shareholder proposals Proposal July 2016 - June 2017 (For Ref.) July 2015 - June 2016 Yea Nay Subtotal Yea ratio Yea Nay Subtotal Yea ratio Appropriation of surpluses 8 2 10 80.0% 8 4 12 66.7% Election/dismissal of officers 1 53 54 1.9% 1 33 34 2.9% Other proposals (incl. revision to articles of incorporation) 8 149 157 5.1% 11 104 115 9.6% Total 17 204 221 7.7% 20 141 161 12.4% It is our responsibility as an institutional investor to help the companies we invest in to improve their value and grow sustainably through our stewardship activities, including the exercise of voting rights. In addition, we understand the importance of strengthening our own governance and increasing transparency for those outside the company. With this in mind, we established the Stewardship and Voting Rights Policy Oversight Committee in June 2016. Not only is the committee’s chairperson an outside officer, but the majority of its members are from outside Nikko AM, thus ensuring its independence. The committee holds quarterly meetings at which it decides Nikko AM’s policy for the exercise of voting rights from a neutral standpoint, monitors our exercise of voting rights as one of its oversight responsibilities, and provides other forms of guidance.

(3) ESG initiatives

Since launching the Nikko Eco Fund in 1999, which invests in environmentally friendly firms and is Japan’s first Socially Responsible Investing (“SRI”) fund, we have incorporated ESG factors in all of our investment management processes based on our understanding that they contribute to medium- and long-term corporate value. We also constantly introduce new initiatives in order to put our ESG activities into practice more effectively. Since August 2013, we have been applying the principle of Creating Shared Value (“CSV”; the practice of creating value for society and firms by aligning efforts to solve societal issues with corporate interests and pursuing both goals simultaneously) by having our analysts formulate unique CSV scores that incorporate comprehensive assessments of firms’ financial standings, market competitiveness levels and ESG initiatives, and use them in their stock selections. We currently formulate scores for the 500 stocks listed on the Tokyo Stock Exchange and are working to assess more names in the future. We have already built up a track record of over four years of assessment and engagement based on our analysts’ close engagement with the 500 firms whose CSV scores we assess and their daily work to improve corporate value including ESG.

Our other initiatives are as described below.

Principles of Responsible Investing (PRI) ratings from assessment institutions 2017 2016 2015 Approach to responsible investing (overall assessment) A+ A+ A+ Incorporation of responsible investing in listed stocks A+ A A Active ownership in listed stocks Engagement A+ A A Exercise of voting rights A+ A+ B

Funds focused on Socially Responsible Investing (SRI) 投資対象 Fund name AUM (100M JPY) Japanese Equities Nikko Eco Fund 98 Nikko DC Eco Fund 8 Foreign Bonds Nikko World Bank Bond Fund (Monthly Dividend Payment Type) 224 SMBC Nikko World Bank Bond Fund 24 World Bank Green Bond Fund 57 ※ AUMs are as of end-December 2017. ※ Open-end, publicly offered funds.

- We believe that it is one of our key responsibilities as an asset manager to help the companies in which we invest to improve the value they offer to investors by vigorously pursuing our stewardship activities including the exercise of voting rights. We constantly work to ensure that our activities are sustained and steadily improved upon. At the same time, we incorporate the concept of ESG into all of our investment management processes and perform assessments of the corporate value of firms—including their non-financial information—in order to promote medium- and long-term improvements as well as sustainable growth, and this approach is useful in our investment decision-making process. We also organized the ESG Global Steering Committee in order to further expand the global reach of our ESG efforts. Comprised of leaders in our investment management operations in Japan and overseas, the committee deliberates over matters such as ESG initiatives, ways of putting them into practice, and new approaches.

- Governance activities

- Our role as an asset manager is not only to seek improvements in the governance of the firms in which we invest but to continuously ensure that our own governance is at a world-class level. Our activities in this area, which are described below, stem from our conviction that the three pillars of governance are management governance, voting rights governance, and fund governance.

We position our governance activities among the most important of our corporate activities, and all of our efforts in regard to voting rights governance and fund governance—as well as the obvious example of management governance—are directly reported on to our Board of Directors. Furthermore, based on our conviction that the best governance can only be achieved with scrutiny from outside, we strive to maintain independent oversight by appointing even more outside directors to our Board of Directors than the number required of listed firms, and by ensuring that our voting rights governance and fund governance are monitored by committees that not only consist of a majority of outside members but have their chairpersons appointed from among those outside members.

(1) Management governance

Our business operations are presided over by a senior management team that is well versed in the asset management business. At the same time, we ensure high levels of independence and transparency in our governance by having four independent outside directors in our Board of Directors, three of whom are pure outsiders who have no capital relationships with the company.

We also cultivate relationships with the distributors we work with that are cooperative in a way that transcends mere capital ties by striving to provide all of them with the best products and services.

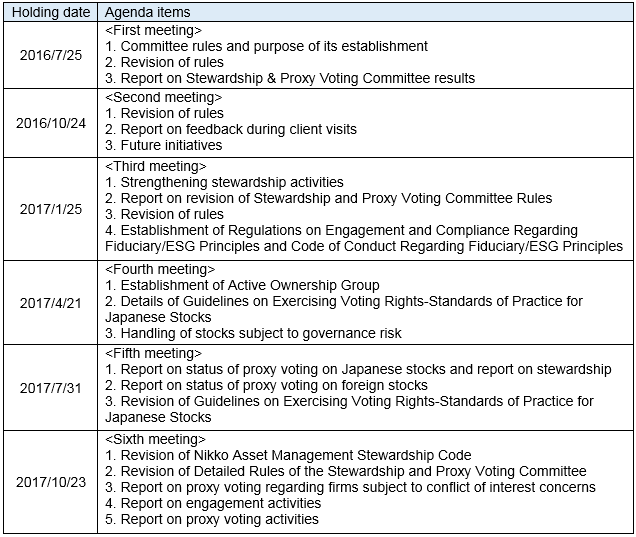

(2) Voting rights governance

We established the Stewardship and Voting Rights Policy Oversight Committee in June 2016 as a way of improving transparency in our stewardship activities such as engaging with firms and exercising voting rights as well as strengthening our governance. Drawing the majority of its members from outside the company, the committee is the first such third-party body to be established at a Japanese asset management company. It holds meetings once a quarter in principle and provides a venue for outside committee members to have lively discussions on how Nikko AM exercises its voting rights. The committee has held a total of six meetings so far.

Objectives

The Stewardship and Voting Rights Policy Oversight Committee (the “Oversight Committee”), the majority of whose members are from outside Nikko AM, was established in order to improve transparency and strengthen governance in the company’s engagement with firms, as well as stewardship activities such as exercising voting rights.

Roles

The Oversight Committee’s role is to oversee our stewardship and proxy voting activities from a third-party standpoint as a body whose members are mostly from outside the company. Specifically, the Committee provides oversight to the Stewardship & Proxy Voting Committee (the “Voting Committee”). The Voting Committee had its name changed in September 2016 from its former name of the “Stewardship and Voting Rights Policy Committee”. The Voting Committee’s role was also clarified at the time of the name change.

Main agenda items

(3) Fund governance

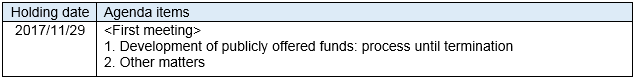

We established the Fund Advisory Board, whose members are also mostly from outside Nikko AM, in September 2017. The Fund Advisory Board meets every quarter in principle. At its first meeting in November, outside committee members had lively discussions on Nikko AM’s fund governance.

Objectives

We established the Fund Advisory Board in order to equip Nikko AM with an operational framework governing development processes and post-launch operations for the funds it launches—particularly for publicly offered funds—that incorporates fair and knowledgeable perspectives from outside the company while also being coherent and transparent to customers. The Fund Advisory Board is also intended to provide suggestions and advice on how to increase customer convenience and truly serve customers’ interests.

Roles

(1) Monitoring of publicly offered funds (development process, performance review, etc.)

(2) Checking approach to managing conflicts of interests

(3) Reviewing decisions made regarding new and existing funds

(4) Other matters deemed necessary by the chairperson

Main agenda items

- Our role as an asset manager is not only to seek improvements in the governance of the firms in which we invest but to continuously ensure that our own governance is at a world-class level. Our activities in this area, which are described below, stem from our conviction that the three pillars of governance are management governance, voting rights governance, and fund governance.

Engagement regarding fiduciary principles and ESG principles are continuous efforts that will never come to an end, and all officers and employees at Nikko AM will continue making their utmost efforts to put the principles into practice. We will continually provide updates on those efforts.