For Qualified Institutional Investors Only

Investment Philosophy

We seek to generate high returns through a long-term, contrarian approach that identifies undervalued companies likely to undergo transformation.

The mature nature of the Japanese economy makes its stock market highly cyclical, allowing seasoned investors to take advantage of repeated patterns. In this type of market, a consistent application of contrarian value-oriented investment is the most effective way to generate excess returns. We aim to benefit from opportunities in which stocks are revalued by the market.

Examples of undervalued companies that are expected to undergo transformation include:

- Those in “crisis mode” where poor standing in the market compels management/employees to make fundamental changes

- Those whose mindset is changing toward enhancing corporate value

- Those with attractive potential that may be priced into the stock price in the future

Companies that offer goods and services needed by society will generally have business continuity, offer downside protection, and are likely to possess a turnaround catalyst, even if they are temporarily undervalued. Our research seeks to identify such companies that demonstrate these three attributes.

Experienced Team with Long Track Record

Chief portfolio manager Takaaki Harashima has ultimate responsibility for investment decisions regarding the strategy’s portfolio construction. Harashima also leads the investment team. Harashima joined Nikko Asset Management as a sector analyst in 2000. In 2005, he became a dedicated value style analyst, before progressing to a portfolio management role within the team the following year. Takada joined Nikko Asset Management as a sector analyst in 2004. He changed his role to that of a value style analyst in 2006 and eventually became a portfolio manager in 2012.

The Value Strategy Fund Management Team also features value style analysts whose in-depth bottom-up research provides a level of insight that allows the team to invest with conviction and effectively avoid "value-trapped" stocks. The accumulation of years of such research contributes significantly to the strategy's success. The team is also supported by Nikko AM’s robust equity research platform, consisting of a team of experienced sector analysts.

Key Characteristics

Japan Value Equity Team

Chief Portfolio Manager &

Head of Japan Value Team

Senior Portfolio Manager

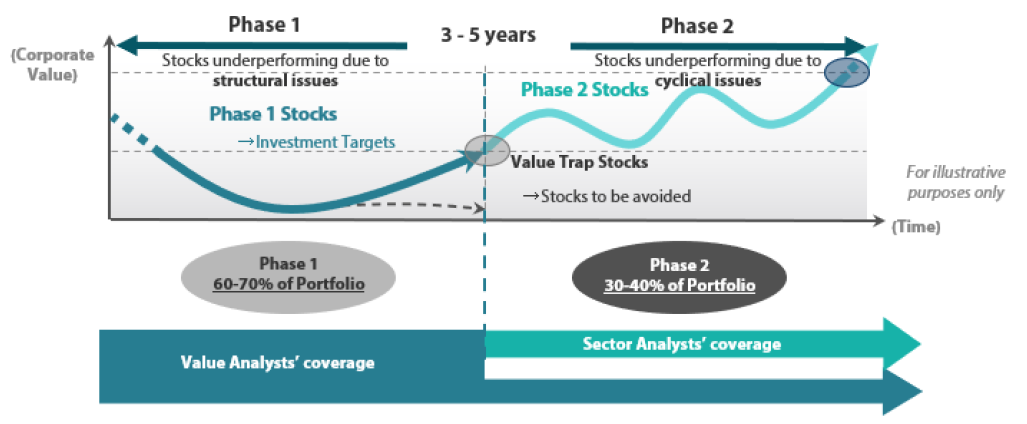

Focus on Turn-Around Catalysts

We seek to understand whether poor stock performance is due to a structural or cyclical issue, and invest in companies that we believe are underperforming due to structural issues, but possess a turn-around catalyst—what we call "Phase 1" stocks, which are the main focus of the strategy and comprise around 60–70% of the portfolio*.

“Phase 2” stocks are companies that resolve their structural issues in Phase 1 and start to generate positive cash flow in Phase 2. They comprise approximately 30–40% of the portfolio*.

Phase 1 Stocks:

Stocks underperforming due to structural issues , but have a turn-around catalyst

Focus on the catalyst to turn stock price around

- Structural change due to the company’s own efforts (supply side catalyst)

- Structural / environmental change in the market (demand side catalyst)

Does the company have products / services / human resources that are needed by the market to capture new demand?

Phase 2 Stocks:

Stocks underperforming due to

cyclical issues

Assessment of type of cycle and position within cycle

- Cyclical factor due to economic cycle

- Cyclical factor due to product life cycle

- Cyclical factor due to time lag between upfront investment and recovery

- Cyclical factor due to business cycles unique to the company

* Weightings of Phase 1 and Phase 2 stocks are subject to change, depending on market conditions.

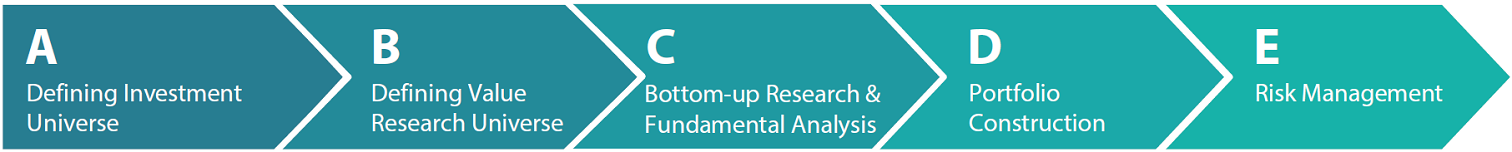

Investment Process

Examples of “ESG Soft Integration” Portfolio Holdings

The strategy identifies major secular trends that are related to anomalies or societal issues, including various environmental and social challenges, and aims to select companies that offer potential (i.e. products or solutions) to address such issues while remaining undervalued. These four are examples of such companies, shares of which are currently held by the strategy.

Kawasaki Heavy Industries

Industrial equipment manufacturer; while known as maker of industrial equipment ranging from motorcycles to ships, it possesses core technologies related to every stage of the hydrogen value

chain; the firm can produce, store and transport hydrogen and then using it to generate power. It has also jointly developed a robotic-assisted surgery system which promises to reduce healthcare

costs for both the government and individuals.

Sumitomo Forestry Group

Comprehensive housing and wood product manufacturer whose operations include forest management, the processing and distribution of lumber, construction of wooden buildings and biomass power

generation. It operates a sustainable value chain focused on wood (so called “wood cycle”) and contributes to decarbonization of society through its experience in forest management and ecosystem

conservation.

Ajinomoto Group

Seasoning maker which introduced “umami” (savoury) taste to consumers worldwide; through its plant-based protein supplements and other products has contributed to healthy diets and richer

lifestyles while also implementing a sustainable bio-cycle for its amino acid production; due to its contributions to society, the company, in our view, represents the “S” (social) aspect of ESG

principles.

Kyowa Hakko Kirin

Pharmaceutical and biotechnology company with the world’s most advanced technology in antibody medicines; firm develops innovative specialty drugs to treat rare illnesses.

ESG soft integration is defined as integrating ESG outcomes through methods such as internally defined ESG scores, best in class investment, and engagement.