Nikko AM’s Fixed Income - Core Market products are actively managed using fundamental top-down and bottom-up research, to create products with diversified portfolios. The team draws on fundamental analysis as the primary contributor of returns and complements selection and allocations with other drivers, including interest rates and currencies.

Our Philosophy

The investment team believes that markets are not entirely efficient and fundamental research reflected in high conviction duration, currency, credit and yield curve calls is the key to delivering positive returns for clients.

Key Differentiators

- We do not have a home bias; nothing pre-occupies portfolio construction - our well-established fixed income teams in US, Europe, Singapore, Japan and Australia allows us to develop a holistic and balanced view by drawing on local expertise and on-the-ground research of these teams

- We employ a pragmatic approach and deploy our resources to areas where we see value

- We are innovative. Country research and Risk Management are supported by proprietary quantitative models which allow us to focus on alpha generating ideas

- We are communicative. Regional teams communicate both formally and informally to share information and research. This additional insight allows the team to execute quickly once they have made a decision.

The Head Portfolio Manager – Core Markets Steve Williams, sits within the wider Global Fixed Income team in London. The team consists of 12 investment professionals with extensive investment management experience.

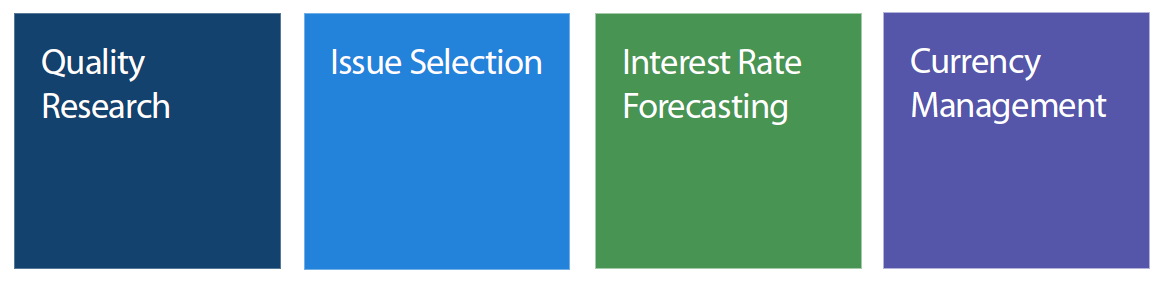

The team has significantly broadened over time to support the strategies’ growth and cater to institutional portfolios. One of our biggest advantages is the fluid interaction across these four categories and the ability to execute decisions quickly, once a team decision has been made.

“The team is continually reviewing its product line up to cater for global demand and has been able to develop new solutions that are focused on higher yielding and higher credit quality solutions that meet client needs for a positive yielding investment.”

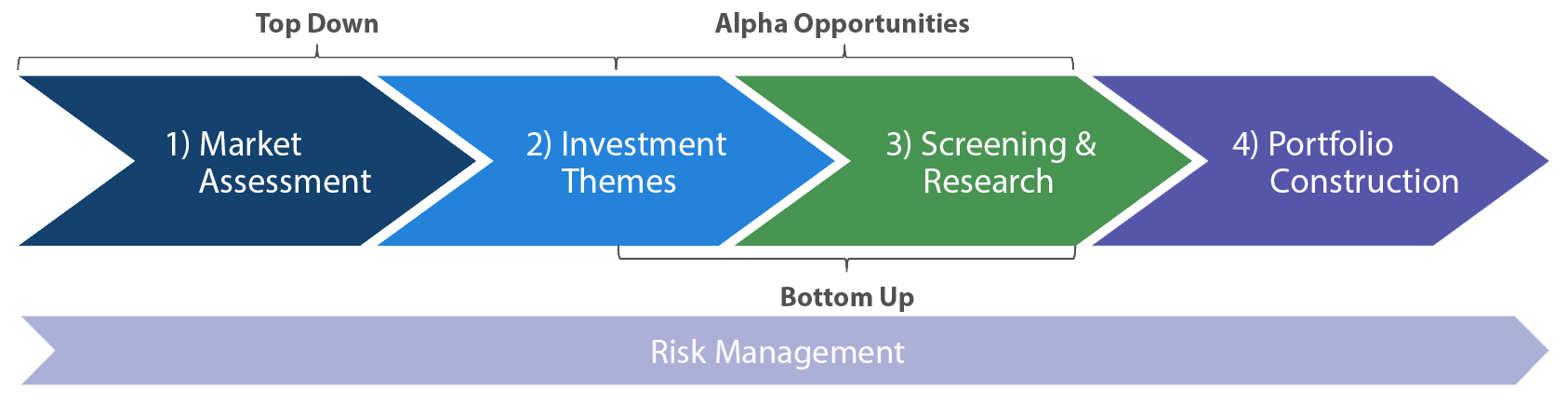

The investment team uses a consistent investment process that incorporates quantitative and qualitative inputs from experienced investment professionals. The four step process is disciplined and transparent, which engages the team in a collaborative process to generate ideas and construct a high quality portfolio.

Embedded Risk Management

Ongoing risk management is integral to the entire investment process with constant dialogue between our investment and independent risk management teams in ensuring that risks are identified, evaluated, monitored and mitigated. For the Emerging Market Debt strategy the investment management team is responsible for Systematic and Unsystematic risk in the portfolio. The investment risk team is responsible for the monitoring and escalation of risk.

Nikko AME's risk management department closely monitors market, credit, operational and portfolio management risk and takes appropriate measures to minimise the impact of potential risk. The risk management process starts with Risk Budgeting and the Risk Management Department which conducts independent, detailed analysis of portfolio risk and characteristics, as well as performance attribution and peer group analysis. The risk process consists of risk budgeting and monitoring with clearly detailed escalation procedures at every step.

The Risk Management Department truly understands the investment management process and therefore feedback and a meaningful dialogue between the investment team and risk managers takes place as part of the firm’s continuous communication flows.

Customised Solutions

- Negative interest rates in Japan and Europe have caused a significant increase in demand for bespoke global fixed income products.

- Since 2016, Nikko AM's Global Fixed Income team have launched the following products catered for institutional clients:

- US Municipal Bond

- US Investment-Grade Corporate

- Government National Mortgage Association (GNMA) Strategies

- Danish Covered Bonds

- Swedish Covered Bonds

“Building on strong client relationships and our extensive investment skills, the team have been able to tailor specialised investment solutions for our institutional clients.”