Summary

- The macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads. As such, we expect growth momentum of many Asian economies to gather pace heading into 2022. Overall corporate credit fundamentals are expected to remain robust, with earnings growth staying strong—albeit at a slightly slower pace compared to 2021.

- We expect progress on vaccine rollouts, the gradual reopening in several countries and still-supportive fiscal and monetary policies to reinforce the positive backdrop.

- We favour Asian high grade (HG) credits over Asian high yield (HY) as 2022 gets underway, with a slightly more defensive bias pending key catalysts in the form of policy changes in the China property sector. If such changes materialise, there should be scope for higher returns from spread compression within Asian HY. Within HY, we prefer strong BB-rated China real estate credits. Within Asia investment grade (IG), we retain a preference for BBB-rated credits where we see scope for spread compression against the higher quality segments.

- The key downside risks to Asian credit in 2022 include a deeper China economic slowdown, more aggressive monetary policy tightening in the US and developments around the new Omicron variant.

2022 Asian Credit Outlook

Fundamentals

Macro

The spread of the Delta COVID-19 variant through much of the second and third quarters of 2021 weakened domestic demand and accentuated supply disruptions across many Asian and global economies, slowing the recovery momentum which had emerged after the initial coronavirus wave in 2020. However, as we approach 2022, a tentative improvement in the COVID-19 situation across many Asian economies reinforces our view that the setback to growth is likely to be temporary—although we continue to closely monitor developments surrounding the spread of the new Omicron variant. Progress on vaccine rollouts, the gradual reopening across most countries in line with the transition to a “living with COVID” strategy and still-supportive fiscal and monetary policies are expected to lead to a revival in growth momentum in 2022.

We expect the recovery in 2022 to be driven by the services sector, as the sectors hardest hit by the pandemic—such as air travel, leisure and entertainment, accommodation and dining out—revive from the deep slump suffered in 2020 and 2021. Manufacturing activity is expected to remain at a decent level. However, its growth rate may moderate as 2022 progresses due to already-strong growth registered in 2021 and goods exports growth potentially normalising in 2022. While external demand should stay robust, some moderation may occur as the shift from goods to services spending gathers pace globally. This is likely to be a second half story as the clearing of order backlogs and still-firm commodity demand are seen supporting export growth in the early part of 2022. Domestic demand, particularly private consumption, is seen strengthening through the year as mobility restrictions ease further and households become more comfortable engaging in contact-intensive services. Private investment demand is expected to gather momentum as business confidence and consumer outlook improve, and as the current supply chain bottlenecks prompt new capital expenditure across industries including semiconductors, industrial equipment and renewable energy.

In terms of country performance, we expect some divergence across Asia, at least at the beginning of 2022. In China, real gross domestic product (GDP) growth is expected to remain weak in the first half of 2022 before recovering in the second half. Since mid-2021, the Chinese government has embarked on a series of regulatory and credit tightening measures across various sectors, notably real estate, technology and private education, as it pursues “Common Prosperity” and macro deleveraging goals. These policies have exerted downward pressure on economic activity, leading to a sharp growth slowdown in 2H 2021. High commodity prices, manufacturing and power generation curbs to meet environmental goals and sporadic virus outbreaks amid a zero-tolerance COVID strategy have added to the headwinds facing the economy. Although the government has begun to acknowledge these headwinds and has sent signals of possible loosening in monetary, credit and fiscal policies, the drags on economic activity is likely to persist into early 2022 before recovery takes place in the second half of the year. The broad thrust of the structural reforms and regulatory measures aimed at strengthening the long-term resilience of the economy is unlikely to be fully reversed, however, meaning the recovery in China may not be as strong as in previous easing cycles. In India and Southeast Asian economies, strong catch-up growth is expected through 2022 as the economies shift to a living with COVID strategy and gradually reopen amid rising vaccination coverage after the Delta wave disrupted recovery momentum in mid-2021.

We expect monetary policy to remain accommodative in most Asian economies, although some divergence is likely. The more advanced economies, such as South Korea and Singapore, have already begun tightening monetary policy. However, there is room for central banks in other Asian countries to maintain an accommodative stance for longer to support the nascent recovery given still benign domestic inflation as the output gap remains negative. Likewise, fiscal policy is likely to remain supportive of growth as most countries will continue to run sizeable budget deficits. However, given the fiscal capacity expended through the last two years, governments will have to balance that against the need to achieve fiscal consolidation and debt sustainability over the medium term.

We expect the sovereign credit ratings of most Asian economies to remain stable in 2022, except for Sri Lanka, which faces near-term external repayment risk due to depleted foreign exchange reserves and multiple domestic economic headwinds. The risk of India’s sovereign rating being downgraded to below investment grade has significantly receded with growth recovery, reduced risks in the financial sector and the country’s external strength. Nevertheless, India’s high debt levels remain an area of weakness which the government will need to address in time.

Credit

With economic recovery regaining momentum and credit conditions still supportive, we expect overall Asian corporate credit fundamentals to remain robust across most countries and sectors, although some divergence is likely. Revenue and earnings growth should stay strong, although we expect the pace to moderate slightly from 2021. Financing costs may begin to edge up towards the end of 2022, but they are likely to remain low historically with interest coverage ratios staying high. Overall debt levels, gearing and leverage are not likely to pick up meaningfully as many sectors, in particular the China real estate sector, remain focused on deleveraging and managing liquidity; furthermore, only fundamentally strong Asian high-grade companies are likely to be active in mergers and acquisitions and capital expenditure.

Commodity prices are likely to remain elevated given recovering domestic demand, supporting earnings in upstream industries such as oil & gas and metals & mining, while at the same time exerting some downward margin pressure on downstream manufacturing and services industries. As household incomes and financial prospects remain fragile in the early stage of the recovery, consumer goods manufacturers and retailers in Asia may not be able to pass on higher costs to end consumers as much as their developed market counterparts, resulting in still compressed margins—although their earnings growth may be supported by volume recovery from a low base.

We expect tourism-oriented service companies such as airlines, airports, and mall and hotel operators to experience strong growth in 2022 due to the reopening of borders and low base of comparison. China real estate developers may continue to face soft sales at least in the early part of the year and liquidity pressure could continue to impact the weaker developers in this space. However, there have been tentative signs of Chinese authorities stepping in to stabilise funding access and market sentiment to prevent an overcorrection that could lead to systemic risks. The industry consolidation and sector-wide deleveraging to meet regulatory requirements will benefit the stronger and better quality developers in the medium term. Chinese technology companies may also experience slower growth and margin pressure due to the government’s regulatory measures, although the credit metrics of most companies in this space remain strong.

Asian banks can expect higher net interest margins on rising interest rates, with delinquencies having been less than anticipated despite the reduction of loans under moratorium. Moreover, most Chinese and Hong Kong banks have manageable exposure to the China property sector and remain well capitalised. Indian banks’ asset quality looks set to stabilise on the back of an improving operating environment. Broadly, the outlook is positive for the banking sector with more businesses conducted through digital channels. This is a positive change which will have lasting positive impact for the sector.

We expect to see greater differentiation between Asia HG and Asia HY, as well as within Asia HY, in 2022. On the HY side, the differentiation within sectors will likely continue in 2022. In the near term, weaker developers within the Chinese property sector are likely to continue to struggle due to a loss of confidence from multiple stakeholders. In the medium term, we expect the sector outlook to improve, driven by urbanisation and household formation. We prefer to take a cautious view of the sector as the stronger, higher quality developers will benefit more directly from any easing of government policies. Similar to 2020 and 2021, credit metric trends for Chinese HY industrials are expected to be more credit specific, although tighter onshore credit conditions may exert pressure across the sector. Tight liquidity may also put pressure on select HY companies in Indonesia and India, especially those facing near-term refinancing needs.

We may see more fallen angels in the China HG property sector in 2022, but outside of this segment, we expect to see lower cases of idiosyncratic fallen angel cases compared to 2021. We expect the Asian HY corporate default rate to range between 3.0% and 3.5% in 2022, although much depends on the developments around several highly distressed China real estate companies and the timing of any default events.

Valuations

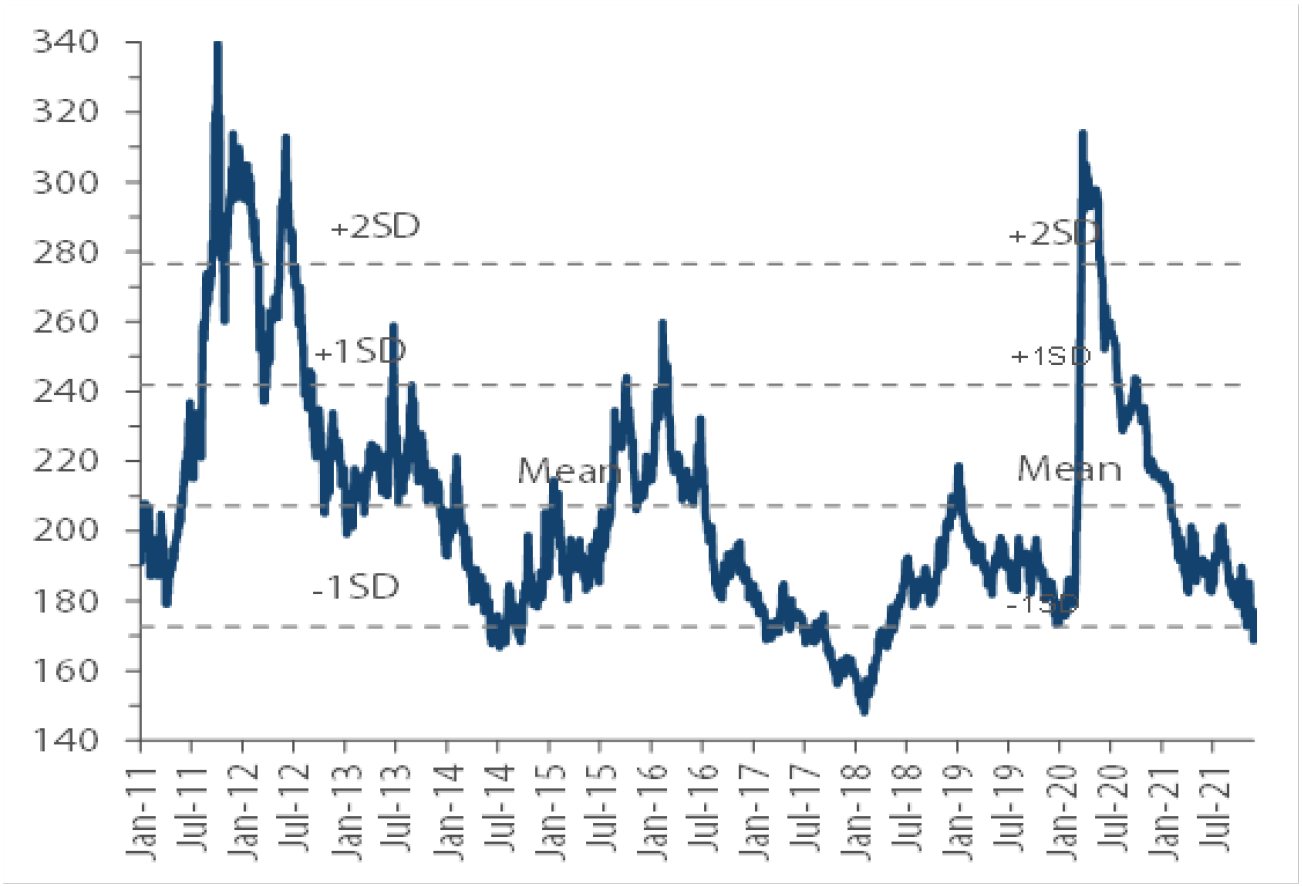

2021 has seen a significant divergence within Asia credit, with Asia HY spreads widening significantly due to weakness in the China HY real estate sector, while Asia HG spreads have continued to tighten despite some volatility through the year. Asian HG spreads currently sit at 169 basis points (bps), about 47 bps tighter than at end-December 2020. Meanwhile, Asian HY spreads are at 809 bps, about 191 bps wider than at end-December 2020. HG spreads have pushed below their historical mean levels post Global Financial Crisis, while HY spreads are meaningfully above those levels.

The spread differential between Asia HY and Asia HG, currently at 640 bps, is significantly above the last five-year average of 375 bps, which makes Asia HY very attractive at first glance. However, there is significant dispersion within Asia HY and the current spread level reflects the wide spread of certain distressed China real estate credits which carry high default risks. While there is certainly scope for Asia HY to tighten on both an absolute basis, as well as relative to Asia HG, such potential can only be realised with a significant turnaround in the China HY property sector, which in turn is contingent on a more material loosening of regulatory and credit policies on the sector.

Within Asia HG, BBB-rated pickup over A-rated is currently at 90 bps, having widened from the end-2020 level of 84 bps, and above the last five-year average of 77 bps. We thus continue to prefer BBB-rated over A-rated credits for the spread pickup amidst robust fundamentals and see China BBB-rated credits as offering good value.

Chart 1: Asian High-Grade Spread

Source: J.P. Morgan, Bloomberg, as of 23 November 2021

Source: J.P. Morgan, Bloomberg, as of 23 November 2021

Chart 2: Asian High-Yield Spread

Source: J.P. Morgan, Bloomberg, as of 23 November 2021

Source: J.P. Morgan, Bloomberg, as of 23 November 2021

Technicals

The technical backdrop for Asian credit is likely to remain subdued in the early part of 2022 before becoming more constructive as the year progresses. With the US Federal Reserve (Fed) having initiated the tapering of asset purchases and potentially poised to begin hiking interest rates in the second half of 2022, the demand for emerging market (EM) debt is likely to be lukewarm at the start the year with investors adopting a more cautious risk stance. Fund flows thus far, however, do not point to any 2013-style taper tantrum, and as more of the developed market monetary policy normalisation is priced in, fund flows into EM may turn more positive. The weakness of the China real estate sector has also dented investor sentiment towards Asia credit to some extent, although most of the outflows may have taken place in 2021. Any meaningful easing of property sector policies in 2022 could result in a sharp return of investor inflows given attractive valuations. In addition, we expect the demand from regional pension and insurance funds to remain robust through the year. Gross supply is likely to be roughly similar to that of 2021 at around USD 350 billion. A large part of the gross issuance will be for refinancing, leaving net issuance at a manageable level of around USD 50 billion. Chinese property USD bond issuances are likely to be limited at least through the first quarter of 2022, although there could be more opportunistic issuances by IG companies to lock in the historically low yields, as well as to fund selective merger and acquisition activities.

Strategy

The macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads. While we continue to monitor developments surrounding the latest Omicron COVID-19 variant, we believe that progress on vaccine rollouts, the gradual re-opening in a number of countries and still-supportive fiscal and monetary policies should revive growth momentum heading into 2022. We expect overall corporate credit fundamentals to remain robust, with earnings growth staying strong—albeit at a slightly slower pace compared to 2021. Asia corporate leverage and interest coverage are expected to remain manageable overall, although some divergence across sectors is likely.

Asia HG spreads have tightened to historical levels, and any further tightening from here will likely be modest. We retain a preference for BBB-rated credits where we see scope for spread compression against the higher quality segments. We expect US Treasury (UST) yields to have an upward bias as elevated inflation and an improving labour market nudges the Fed along the path of monetary policy normalisation. The rise in UST yields could offset the positive impact from any credit spread tightening, resulting in low-single digit positive returns for Asia HG in 2022, with carry again being a prominent driver.

Asia HY spreads are wide both on an absolute and relative basis, and we believe that there is scope for meaningful total and excess returns from spread compression. However, for this to materialise, a key catalyst in the form of significant loosening in the China property sector policy would be required. Although there have been tentative signs of authorities stepping in to stabilise credit access and market sentiment to prevent an overcorrection that could lead to systemic risks, the measures so far may mainly benefit the stronger developers. In the meantime, weak sales and liquidity pressure could continue to impact the weaker developers, potentially leading to more distress or default events. We are therefore inclined to start 2022 with a more defensive bias, preferring strong BB-rated China real estate credits, while awaiting more concrete policy easing measures. Given such a view, we also have a preference for Asia HG over Asia HY to start the year.

The key downside risks to Asian credit in 2022 include a deeper China economic slowdown, which could challenge the country’s macro stability and growth outlook and in turn negatively affect the rest of Asia. Aggressive monetary policy tightening by the US and other major economies in response to prolonged elevated inflation is another downside risk. These risks could lead to a moderation of excess carry, which would be negative for EM credit technicals. Furthermore, economic recovery from the COVID-19 pandemic may suffer a setback due to the emergence of new variants that could reduce the effectiveness of vaccines. Meanwhile, despite some recent positive developments, US-China tensions continue to simmer in the background with Washington adding more Chinese companies to its restricted trade list, citing national security reasons and foreign policy concerns.

Sector outlooks

Financials

Market conditions are expected to normalise in 2022 for banks as well as non-bank financial companies (NBFIs). The upside for the stronger banks, particularly those in Singapore and South Korea, is that there has been fewer than anticipated delinquencies despite the reduction of loans under moratorium; in addition, another supportive factor is the very low allowances which may result in better-than-expected earnings. The banking sector can also expect higher net income margins should interest rates rise. On the flipside, normalisation could also mean the easing of bank deposit inflows on the back of flush liquidity and lower growth in mortgage loans which do not attract comparatively as much capital costs. While the concern at present for the Chinese and Hong Kong banks is their exposure to mainland China’s underperforming property sector, most banks have manageable exposure in the low double-digit percent handle and are well capitalised except for a handful of the joint stock banks. For the Thai banks, which have significant exposure to the tourism industry, asset quality may modestly weaken as support measures unwind. While the potential laggards are banks from the Philippines, where sluggish business confidence and private consumption continue to pose challenges to asset quality, it is worth noting that the country’s economic growth in 3Q2021 was better than expected. In India, risks relating to the deterioration of asset quality have receded, and asset quality looks set to stabilise along with greater credit growth driven by an improving operating environment. Broadly, the outlook is positive for the banking sector and we think it worthwhile to observe the capital structure of the larger players with strong fundamentals. We see minimal non-call risk for these bonds. We also saw both banks and NBFIs conduct business through digital channels in 2021; in our view this is a positive change with a lasting impact on business performance.

In India, we prefer non-gold NBFIs as we expect strong growth on returning demand as infections subside. The gold NBFIs on the other hand are unsurprisingly susceptible to gold prices falling and leading to a smaller asset base. In China, asset management companies (AMC) could be poised to stage a comeback with the completion of the revitalisation of state-owned asset manager Huarong. Elsewhere, a travel surge would benefit the non-life insurers as travel insurance has become essential since the pandemic. More countries are also making it mandatory for inbound visitors to have travel insurance that covers pandemic-related medical expenses.

Real estate

The Chinese property sector has seen heightened volatility in recent months. The sector’s short-term fundamentals have been significantly impacted by tighter government policies, which have simultaneously hit property sales and reduced credit to developers. This has driven several weaker developers to default or to extend the maturities of their debt, while secondary market prices of other developers’ bonds have dropped.

In the near term, we expect sales and liquidity to remain muted, and many of the weaker developers may continue to struggle due to a loss of confidence from multiple stakeholders. In the medium term, we expect the sector’s outlook to improve due to the following factors:

- A gradual easing of government policies restoring developers’ funding access

- An improvement in balance sheets and less reliance on shadow banking as developers have been required to deleverage under government regulations

- Relatively stable underlying demand for property driven by urbanisation and household formation

We expect that the stronger, higher quality developers will benefit more directly from any easing of government policies. In addition, the timing and magnitude of government policy easing, which remains key to restoring funding and confidence to the sector, is relatively uncertain. As a result, we prefer to take a defensive view of the sector and favour investment grade and BB-rated property firms while we have a more cautious view on B-rated property firms.

Infrastructure & transportation

With vaccination rates increasing globally and border restrictions being eased, we expect the credit fundamentals of the Asian aviation sector and related infrastructures to stabilise and gradually improve in 2022. We expect Asia to catch up after significantly lagging the recovery in the US and Europe. With the increasing establishment of vaccinated travel lanes (“VTLs”) and the easing of quarantine requirements, a stronger recovery pace could be expected for both leisure and business travel simply thanks to the region’s pent-up demand.

As for the seaport operators, most companies within our coverage have demonstrated a high level of resilience to external shocks despite the pandemic, as observed from the robust throughput volumes seen in 2021 thus far. We remain constructive on Asian seaport operators in 2022, while actively monitoring for any escalation of geopolitical disputes between China, US, EU, and Australia, which could weigh on trade throughput volumes.

Technology

In the past, leading Chinese internet companies enjoyed spectacular growth due to their monopolistic positions. However, domestic regulations were intensified in 2021 as the government aims to improve market practices on the grounds of fair competition, data security and consumer privacy. We expect tightening of regulations to continue in 2022, resulting in increased competition. In addition to the regulatory environment, we believe that the expected slowdown in macroeconomic activity in some key advertising sectors will result in weaker business growth and lower profit margins for most internet companies. Despite these challenges, most Chinese internet bond issuers have very strong capitalisation and low leverage. Due to their strong credit profile, we believe these companies are well positioned to weather the near-term operating volatility and sector downturn, and we are neutral in our view on the sector.

Consumer hardware companies were resilient performers in 2021 and their credit profiles improved. The resilient performance was driven by changes in consumer demand and the shift towards remote work amid the pandemic. Going into 2022, as the world progresses into an endemic phase, we expect performance within hardware companies to diverge. Some companies are poised to retain strong growth momentum as we see demand for their products— arising from permanent structural changes in consumer behaviour—driving supply conditions to their tightest in many years. We therefore maintain a favourable outlook on these companies. However, other companies are likely to experience weaker growth as front-loaded, pandemic-driven demand may fade due to weaker consumption and higher raw material input costs. In addition, some companies are also being hit by chip shortages and supply chain disruptions and we expect these challenges to continue into 2022. We have a cautious view of companies with less diversified supply chains and limited access to raw materials as we believe they are more prone to business interruptions.

Utilities

During the second half of 2021, we saw global natural gas shortages and record surges in coal prices resulting in power shortages in some of the world’s largest economies and a loss of profitability for thermal power producers. With fuel costs still at elevated levels, we expect such conditions to last well into the first half of 2022. Furthermore, we expect thermal power producers (particularly those using coal) to be weighed down over the medium term by higher regulatory costs and capital spending as they cope with the transition to a low carbon economy.

Within the utilities sector, we have a less constructive view of thermal power producers and have a favourable view of renewable power companies, given the tailwind the latter are likely to receive from the global transition toward cleaner energy sources. Our cautious view towards Asia Pacific thermal power producers is underpinned by elevated thermal fuel costs, higher capital spending, higher regulatory costs and lastly, tighter funding conditions—especially for coal-reliant power producers.

Telecommunication

We expect the industry consolidation observed recently in some Asian telecom markets to continue in 2022. Roaming services are expected to gradually resume as countries reopen their borders. Thus, we see a gradual recovery in revenue and earnings for most Asian telecom operators in 2022. Capital expenditure could remain high due to 5G roll outs and further investments into the broadband network made to meet increasing data consumption. However, we expect most telecom operators to keep their prudent and disciplined capital spending approach, and we thus maintain a stable outlook on their overall credit profiles. We are broadly neutral on the sector.

Oil and gas

Crude oil supply-demand dynamics are seen supporting prices in 2022. Oil supply is expected to remain tight into 1Q2022 and then gradually ease towards the remainder of the year. The supply of oil is expected to increase gradually based on an agreement reached by OPEC+ members in July 2021, leading to an eventual normalisation of oil prices. Demand for oil is expected to reach pre-pandemic levels in 2022 as economies recover and travelling resumes.

In the medium- to long-term, we believe that global decarbonisation efforts will dictate the outlook for oil prices. This will likely place a lid on oil majors’ hydrocarbon investments aimed towards continued exploration and production activity. As notional demand for oil is expected to be inelastic in the initial years, supply-side dynamics are likely to be the main driver of oil prices. In such a scenario, we expect oil prices to remain high and well supported.

Asian oil & gas companies in the upstream segment are expected to enjoy strong profits in 2022 thanks to higher prices and volume recovery. As for the companies in the downstream segment, we also expect their profitability to recover as refining margins improve from a low base. As a result, we believe that credit metrics will remain strong. Asian national oil companies will continue to enjoy strong government support. Despite the structural shift away from fossil fuels, these companies are still expected to be of high strategic importance in ensuring energy security to their net oil importing nations for many years to come. We are neutral on the Asian oil & gas sector.