Key points

- We believe that strong or improving ESG performance is essential for generating higher sustainable returns

- We focus on factors deemed most material to returns – in terms of both risks and opportunities

- We also assess materiality through an Asian lens, cognisant of differences in ownership, culture, and stages of development vis-a-vis developed markets

- The most attractive opportunities are typically those that start from a low base, but with high and significant “ESG Change” – a key criterion in our assessment

- We believe ESG analysis on companies should be performed primarily by the same investment analysts who are responsible for the fundamental bottom-up research, backed by dedicated ESG resources and independent data providers

Introduction

Few investment ideas have captured investors' imagination as quickly and broadly as ESG investing. In particular, the adoption of ESG investing has accelerated sharply in recent years. In a Macquarie survey of 180 asset managers responsible for US dollar (USD) 21 trillion in assets, the proportion of respondents, who said ESG factors either “governed” or “had significant influence” over investment decisions, rose to 71% in 20211 , up from 42% in 2019.

Such has been the ubiquity of ESG in the investment sphere that there is now more intense scrutiny as a result. Criticisms around greenwashing, which were already commonplace, came to a head when the offices of German asset manager DWS were raided over such allegations. On a separate front, Russia’s invasion of Ukraine brought into focus other hard questions, like whether European governments should temporarily revert to more pollutive coal power in order to stop buying gas from Russia. Or whether it is acceptable to invest in the defence industry, as some of their products can be vital for self-defence against an invading force.

We consider such pushbacks to be necessary developments. The rapid advance of ESG as a hot investing trend has led to a profusion of interpretations of what ESG actually means, which becomes a potential source of confusion and contradiction. This is especially so as investors navigate a world of diverse and shifting causes and issues, ranging from climate change to democratic freedoms. There has never been a time when an investor needs to be more clear-headed about what ESG investing stands for and what it is supposed to achieve for its stakeholders.

“Global warming”, “going green”. I don’t know what all this means. – “Wake up America” by Miley Cyrus

ESG in Asia

ESG matters when investing in Asia. As bottom-up investors focused on company fundamentals, we have always considered this statement to be a given, long before it became the latest fad. From incorporating E, S, and G assessments into our company investment theses in 2012 to picking companies serving under-banked rural communities in India, and researching the renewable energy boom in Thailand, both in the mid-2010s, we have long considered ESG factors as integral in what drives stock returns.

In recent years, the increased focus on ESG has validated our beliefs. Yet, the complex and fast-changing economies and societies that make up Asia, i.e. the very characteristics that make Asia a rich source of investment alpha, continue to be a challenge confronting investors looking to apply ESG analysis across Asian asset classes. This is a good thing, as investors who can do this successfully will likely add even more value to alpha generation.

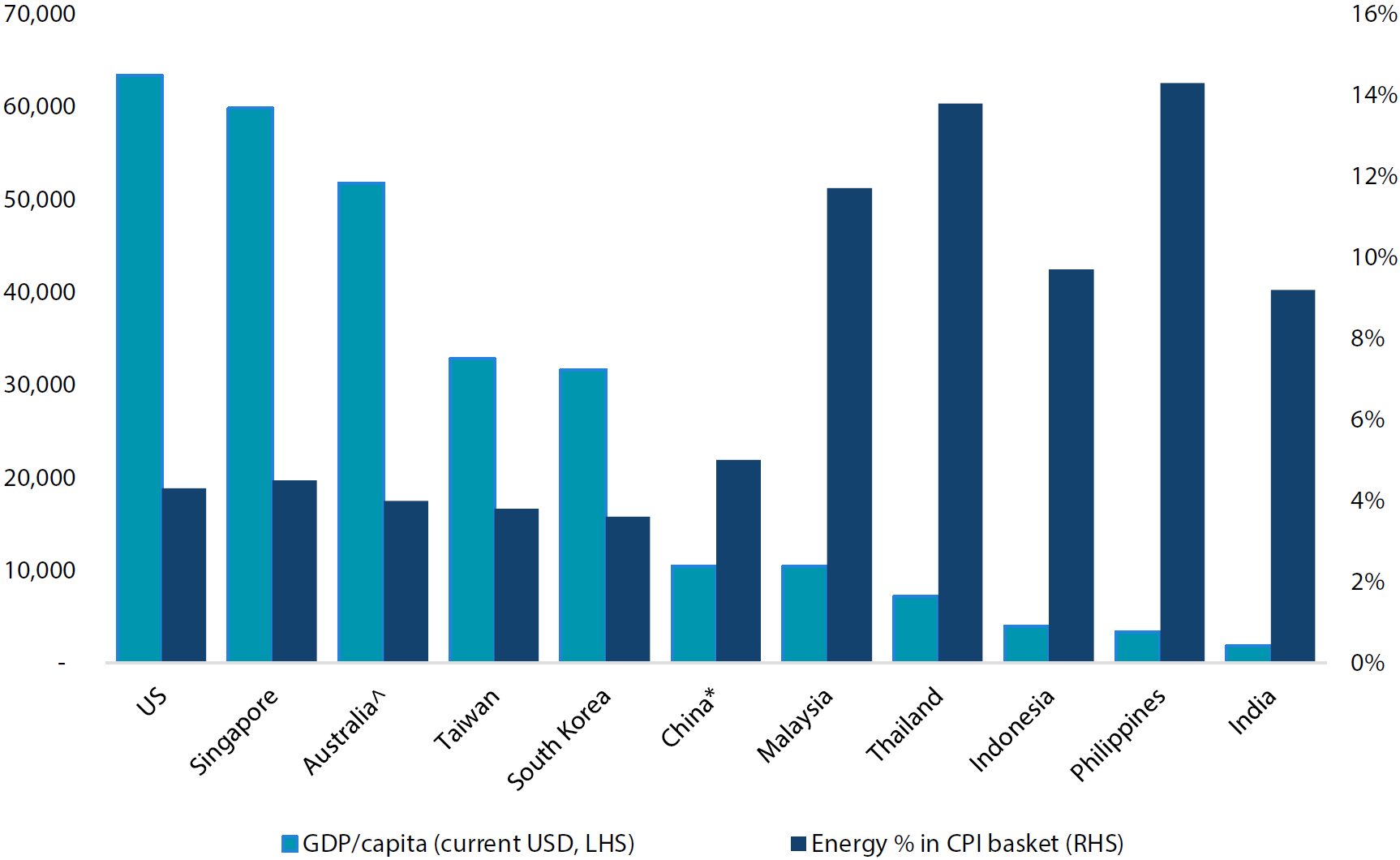

Part of the reason for this complexity is the diverse stages of economic development in Asia, where GDP per capita can range from as low as USD 1,500 to as high as USD 60,000. Such disparity leads to vastly different economic and social priorities, as well as the broad spectrum of opportunities and risks among ESG factors. Lower-income countries could present opportunities to access basic necessities, such as food, power, infrastructure and financial services. In contrast, higher-income ones may prioritise dealing with the adverse effects of climate change or an over-reliance on private tutoring.

Chart 1: GDP per capita in Asia, percentage of energy in CPI basket

Source: World Bank, Local Central Banks, HSBC, Nikko AM. *Stopped reporting basket in 2011, estimated, ^Part of transport, estimated

Source: World Bank, Local Central Banks, HSBC, Nikko AM. *Stopped reporting basket in 2011, estimated, ^Part of transport, estimated

There is also deep cultural diversity within Asia (and versus the developed markets), with countries having varied backgrounds regarding their religious beliefs, political ideology, and economic models. The challenge for ESG-conscious investors is often to disentangle the universal ESG factors needed in evaluating each investment opportunity from specific values and political views, where an unbiased stance is more appropriate.

Asian companies often have ownership structures that differ from those in developed economies. In Asia, majority ownership, either by the state or founding families, is predominant. Assessing governance must then be conducted less according to market-oriented norms, but by applying a more granular understanding of the objectives, character, and motivations of the majority owners, whether state or private.

What we do

While there is no doubt that investors need to incorporate ESG into their investment processes, there is little consensus as to exactly how this should be applied. Approaches range from hard exclusions to overlaying external ESG frameworks and ratings to internal research. On our part, we found it most meaningful to start with what we believe - that strong or improving ESG performance is essential for generating higher sustainable returns. This simple belief drives how we incorporate ESG into our fundamental research.

First, our belief that ESG performance drives higher sustainable returns leads us to focus on specific factors that are material to returns, now or in the foreseeable future. These material factors, usually numbering between three and five, are highly specific to the company or sector being researched. We have developed a materiality matrix based on SASB for this purpose. In our opinion, including too many ESG factors in the analysis only dilutes and obfuscates what we consider critical to our investment thesis. Our view is well-supported by academic research.

Studies show material ESG factors matter more to stock performance2

Khan et al. (2016) showed that companies performing best on crucial ESG issues outperformed those in the bottom quartile. However, strong performance in less relevant ESG issues did not lead to superior financial performance. These results were later corroborated by Kotsantonis and Bufalari (2019) and van Heijningen (2019). Expanding on these studies, Consolandi, Eccles and Gabbi (2020) showed that while ESG rating changes have a consistent impact on equity performance, the market seemed to reward more those companies operating in industries with a high level of ESG materiality concentration. That is, the market does not believe that having too many significant targets is credible.

Next, we consider ESG factors to be both a source of opportunity for shareholder returns and potential risk. We extensively research major ESG issues, such as energy transition, corporate governance, and labour standards to uncover opportunities and risks and determine which companies are likely to be winners or losers. Importantly, we believe that a negative factor, like fossil fuel exposure, can be a positive opportunity if management is committed and have explicit targets to significantly reduce its carbon footprint or to accelerate the end-of-life of its pollutive assets.

Finally, we believe that ESG analysis on companies works best when performed primarily by the same investment analysts responsible for the fundamental bottom-up research. They are helped in this process by the internal ESG team is the best approach in the Asian equity market in our view. In our opinion, these analysts are best placed to assess the impact of ESG factors on company fundamentals and shareholder value. The research analysts leverage off Nikko AM’s team of ESG specialists, who complement their understanding of important global ESG issues and developments amongst other things. In addition, Nikko AM’s ESG team takes the lead in areas such as firmwide ESG policies, frameworks, initiatives, regulatory matters, organising ESG resources for investment and risk personnel, and enhancing our firm’s understanding of important emerging global ESG developments.

Putting this all together, ESG is embedded into our investment process by making it a key pillar of our scores for Sustainable Returns and Fundamental Change, the two most essential attributes we assess in a company, together with valuations2. External ESG ratings and research from third-party providers, while helpful, are often backwards looking, data dependent and lacking in insight; they are used purely as background references. Our ESG scores and inputs are produced entirely by the analysts covering the stock.

Our ESG process prioritises direct company engagement, which we think is a better source of ESG insight than just data alone. This is especially so as ESG disclosures by Asian companies often lack consistency and availability. Importantly, we believe that active engagement allows us to inform investee companies about what ESG factors we consider important and how they are evaluated. This helps management to incorporate these insights into their ESG goals and disclosures.

Our job is to find a few intelligent things to do, not to keep up with every damn thing in the world. – Charlie Munger

Stock example: AC Energy

AC Energy (ACEN) is the listed energy company of the Ayala Group and one of the most progressive developers and owners of renewable energy capacity in Asia. It currently owns 3,445 MW of renewable energy capacity in Asia and Australia, forming 87% of its total power generation portfolio. The company has ambitious plans, with a renewable energy pipeline of about 18,000 MW at various stages of development. We expect this build-out to drive significant earnings growth for ACEN when they come online.

We spotted AC Energy as a potential investment when its parent company, Ayala Corp, acquired a controlling stake in power generator Phinma Energy in 2019. We followed the deal with interest after Ayala announced that the acquired entity (eventually renamed AC Energy) would become the group’s renewable energy platform. After waiting for restructuring plans to be firmed up, we initiated an investment in April 2021.

Within our materiality framework, the most obvious and material ESG factor for ACEN is the immense opportunity for renewable energy in its addressable markets. We also identified other material factors, such as emission risks from its legacy coal power capacity and issues associated with producing solar panels. These include the energy-intensive nature of their production, which is captured in ACEN’s Scope 3 upstream emissions, and labour standards employed by their producers, mostly located in Xinjiang, China.

Engagement was vital throughout the evaluation and monitoring of our investment in ACEN. Our first discussions with management focused on a detailed evaluation of the renewables opportunity and the company’s ability to exploit them. Subsequent discussions included how ACEN leveraged the Asian Development Bank’s pilot Energy Transition Mechanism for its coal plant, which allowed the asset to access low-cost borrowings in exchange for a commitment to accelerate its end-of-life. The mechanism will be critical in eventually divesting the plant altogether.

Latest engagements with management fleshed out our concerns around the labour standards employed by the solar panel makers in Xinjiang and how that could impact their use in markets that are sensitive to the issues. We suggested that management further evaluate the potential risks in these markets and take measures to mitigate them from the supply chain. We will monitor these developments in our future engagement.

We currently have positive ESG indicators and good change scores for ACEN. This contrasts starkly with third-party rating providers’ poorer-than-average scores. We believe their analysis lags, particularly around how the company is mitigating and eventually exiting its coal power assets, with some key milestones already having been reached. We also have a more optimistic view of ACEN’s governance quality, having been long-time followers of the Ayala group of companies and its key executives.

It’s not easy bein’ green. – Kermit the Frog

Future directions and conclusions

We have no doubt that ESG investing will continue to develop, evolve, and mature, with investors also having to adapt how they integrate ESG into their investment processes. In a time of significant change and plurality for ESG investors, we are committed to our focused and rational approach. We are convinced that this best serves our duty as stewards, not only of our client's capital but also of the Earth and its communities.

A diverse team for a diverse and complex region

In our opinion, a diverse team is the best approach to investing in a varied and complex region like Asia. The Asian Equities team at Nikko AM consists of 18 investment professionals representing 10 primary nationalities, with proficiency across most major Asian languages. Notably, the team also features rich diversity across cognitive strengths, cultures and demographics. We believe this comprehensive diversity and mutual respect is essential to fostering a broad range of viewpoints and offers a deep reservoir of varied and localised insights.

1 “2021 ESG Survey Report” - Macquarie Asset Management

2 "Harnessing Change: An investment philosophy for Asia" 24 May 2022

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.