With borrowing costs expected to decline in 2024, Asian real estate investment trusts (REITs) have the makings of a multi-year growth story that global investors may find hard to ignore.

Asian REIT market still has plenty of room for growth

The Asian REIT market is the second-largest REIT market globally, but there is still plenty of room for growth. As REIT regulations and listing processes become increasingly market-friendly in newer REIT markets, we expect more asset owners to securitise their real estate into REIT products, driving greater investor interest.

More regions, and more types of real estate

That interest is partly due to the fact that Asian REIT investors can gain broad exposure to different countries—each with their own distinct real estate market—while also gaining access to several types of property with different return characteristics. For example, Asia is where non-traditional assets such as data centres are benefitting from secular artificial intelligence (AI) and big data themes. These “new economy” assets are critical for the digital age, and while they are typically constrained by limited power supply, this only serves to enhance their value as an asset class with multi-year attractiveness.

Similarly, the demand for logistics facilities is closely tied to the rise of e-commerce and the consequent increase in warehousing needs. This trend underlines the robust nature of logistics as an asset class within the REITs universe, promising sustained growth as e-commerce continues to expand its footprint.

Positioning for lower rates: REITs are direct beneficiaries of lower rates

While the performance of Asian REITs was hampered during the rising rate environment, there are several reasons why they will be well positioned when rates begin their path towards normalisation.

First, the supportive backdrop created by lower rates would have a buoyant effect on capital values across real estate sectors, in turn spurring a recovery in transactions, as more investors are encouraged to enter the market seeking higher yields than available in the bond market. Lower rates also mean a cheaper cost of capital. REITs often rely on debt for acquisitions and developments, and reduced rates mean they can acquire new properties more accretively, adding assets to their portfolios that immediately contribute to earnings, enhancing value for investors.

Reduced interest expenses also mean REITs can service their debt more comfortably and potentially take on additional leverage if needed to capitalise on growth opportunities while maintaining a healthy balance sheet. Lower rates also help by driving down interest expenses and leading to growth in distribution per unit. This, in turn, translates into an increase in the cash flow available to return to investors, bolstering the overall appeal of REITs as an income-generating asset class.

Resilience in a “higher for longer” rates environment

At the same time, Asian REITs remain an attractive asset class even if higher interest rates persist for longer. REITs are a useful hedge against inflation due to their rental income, which usually includes fixed annual increases, helping to ensure that the income generated by REIT-owned properties grows over time, potentially in line with or above the rate of inflation. Additionally, lease agreements with tenants frequently incorporate cost pass-through clauses, allowing property owners to transfer some inflationary costs back to the tenants. For instance, in a market with strong fundamentals such as Singapore, this translates into a robust capacity for REITs to mitigate inflationary pressures. As costs rise, these can be partially or fully passed through to tenants, ensuring that the income from REITs remains stable or even increases, thereby preserving and potentially enhancing investor value despite the eroding effects of inflation on purchasing power.

Nikko AM’s approach to Asian REITs

At Nikko AM, we look for Asian REITs that are attractively-valued with positive fundamental changes and strong sustainable returns. We look for growth in new economy sectors (such as data centres), and companies with management executing a strategic turnaround. We currently prefer commercial REITs with exposure mainly to Singapore, as their operations have been resilient, and they are better leveraged for a rate-driven recovery.

An example is a Singapore-listed REIT owning a diversified property portfolio including logistics properties, high-spec industrial properties, business parks and general industrial properties. In our view, such a REIT can successfully “future-proof” its portfolio by recycling older assets at a premium to invest in higher-quality assets.

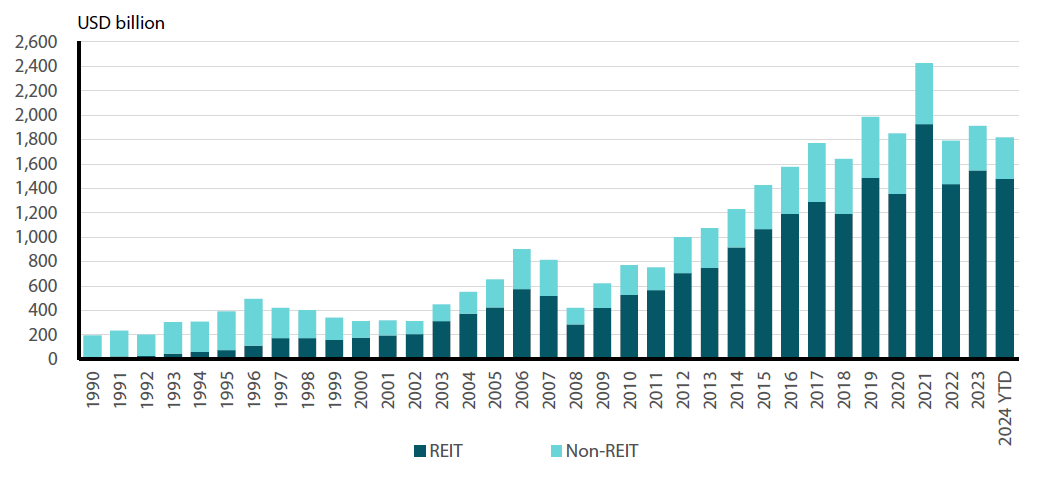

Over the past 15 years, the growth of global listed real estate has been led by the emergence and expansion of the REIT asset class. But right now, Asian REITS offer considerable upside for investors worried about a prolonged higher-rate environment or who want to take advantage of long-term opportunities as rates begin to fade. This is particularly timely, considering REITS also offer a substantial yield spread of 320 basis points compared to bond yields, and with attractive valuations and considerable potential for price appreciation.

Chart 1: Growth of global listed real estate driven by REIT markets

Source: FTSE EPRA NAREIT, Bloomberg, Datastream, EPRA, UBS as at 29 February 2024

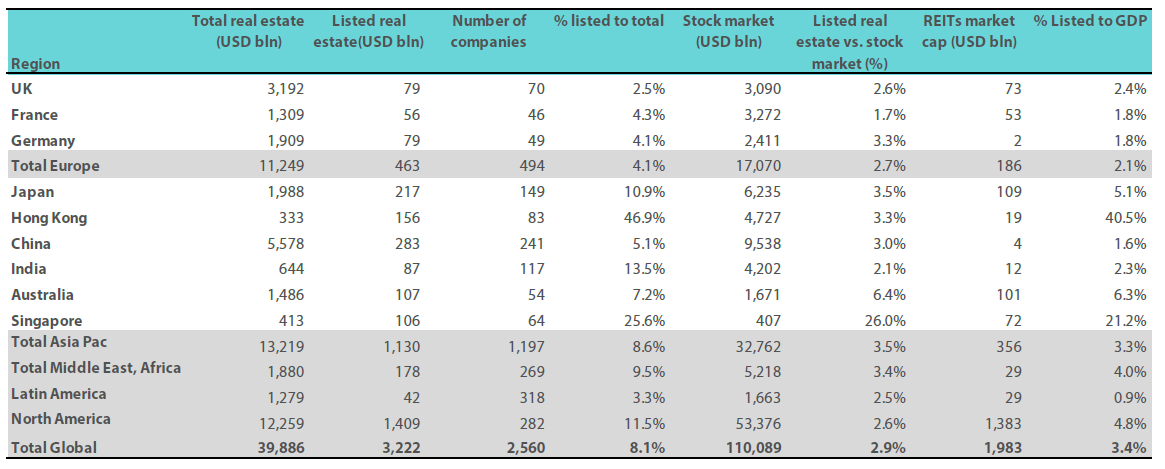

Table 1: EPRA Total Markets Table

Global listed real estate: 8.1% of the total real estate and 2.9% of equities

Source: EPRA, UBS as at 4Q 2023

UBS and other third parties are the owner of the copyright of the charts. All rights reserved. Reproduced with permission. May not be forwarded or otherwise distributed.

Note: Total real estate (high quality commercial) estimated using 45% of GDP, based on a formula devised by Prudential Real Estate Investors, as published in “A Birds Eye View of Global Real Estate Markets.” In developing countries, the figure is lower. Listed Real Estate is that portion held via a listed form.