On September 1, 2025, Nikko Asset Management Co., Ltd. will change its name to Amova Asset Management Co., Ltd.

This Fund seeks the net asset value per unit to track the performance of the Nikkei ESG-REIT Index by mainly investing in Real Estate Investment Trust (REIT) securities of the components of the Nikkei ESG-REIT Index.

The Fund is defined as an "ESG investment trust" by Nikko Asset Management based on the "Comprehensive Supervisory Guidelines for Financial Instruments Business Operators, etc.".

Key information

| Name: | Listed Index Fund Nikkei ESG REIT | |

| Code: | 2566 |

Net Asset Value and Performance

Fund Outline

| Fund Name | Listed Index Fund Nikkei ESG REIT Open-end Investment Trust/Domestic/REITs/ETF/Index type |

| Listed Exchange | Tokyo Stock Exchange |

| Issue Code | 2566 |

| Targeted Investments | This fund aims to achieve investment returns that link with the movement of the Nikkei ESG-REIT Index. |

| Date Listed | September 7, 2020 |

| Exchange Trading Unit | 1 unit |

| Trust period | Unlimited (launch date: September 3, 2020) |

| Computation Period | From 9 January to 8 April, 9 April to 8 July, 9 July to 8 October of each year, and from 9 October to 8 January of the following year |

| Closing Date | 8th day of January, April, July and October each year |

| Dividends | As a general rule, the full amount of dividends and other income arising from the trust assets is distributed after deduction of expenses. *There is no guarantee on the payment or the amount of dividend. |

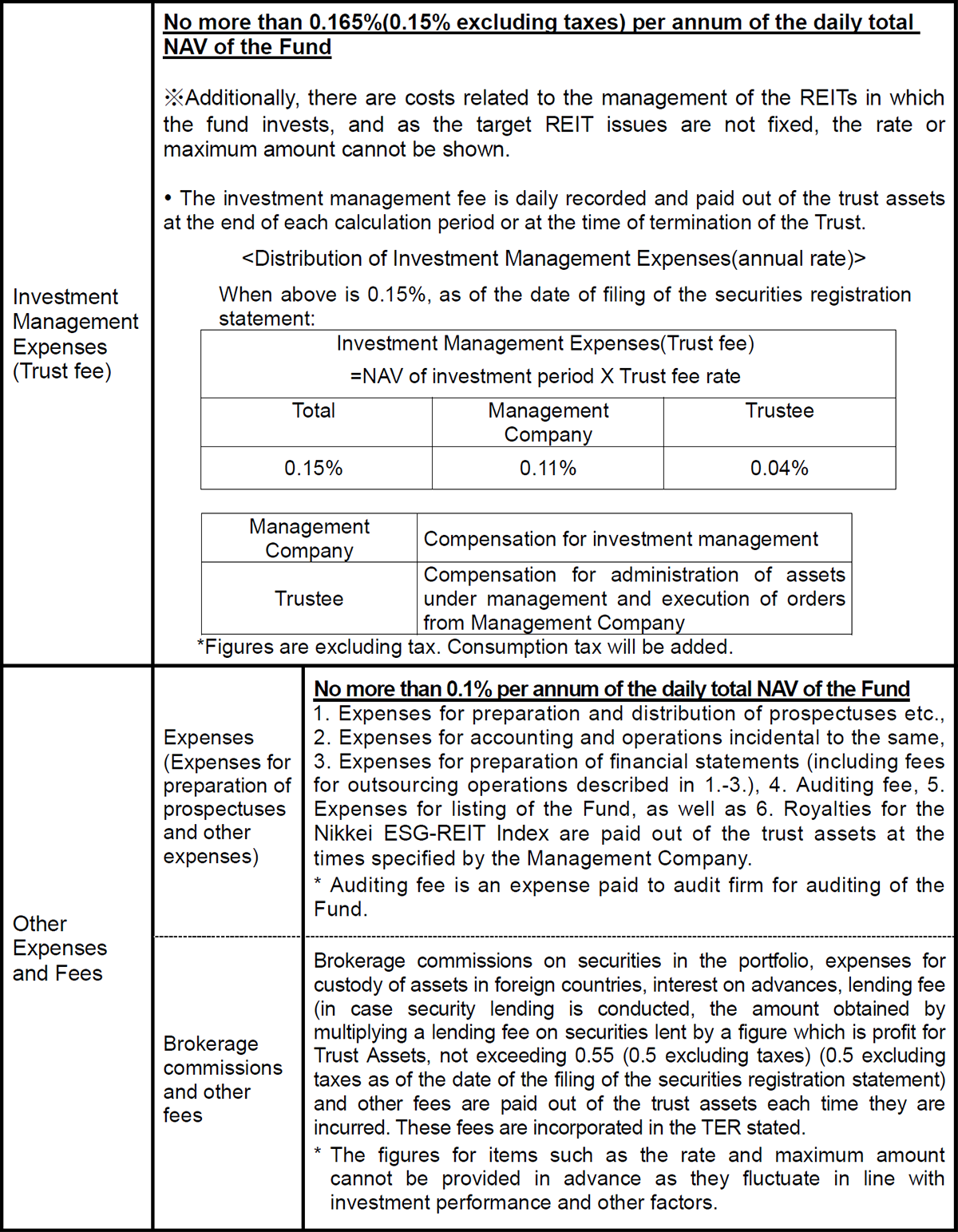

Fund Expenses

■Expenses to be borne directly by investors

| Subscription Fee | Independently set by Distributors *Please contact your Distributor for further information. *Subscription Fee is compensation for explanation and information providing about the Fund or investment environment, and is also including expense of clerical processing of the subscription. |

| Exchange (Buyback) Fee | Independently set by Distributors *Please contact your Distributor for further information. *Exchange Fee is compensation for clerical processing of the exchange. |

| Amount to be Retained in Trust Assets | None. |

■Costs paid indirectly by the customer for the trust assets (paid from the fund)

| TER (Total Expense Ratio) |

0.25% (TER includes Trust Fee, management fee and other costs below) Please refer to the prospectus for details. |

The total amount of expenses of the Fund to be borne by investors varies according to holding length and investment status, and thus cannot be shown.

Investment Restrictions

|

Trustee Companies

|

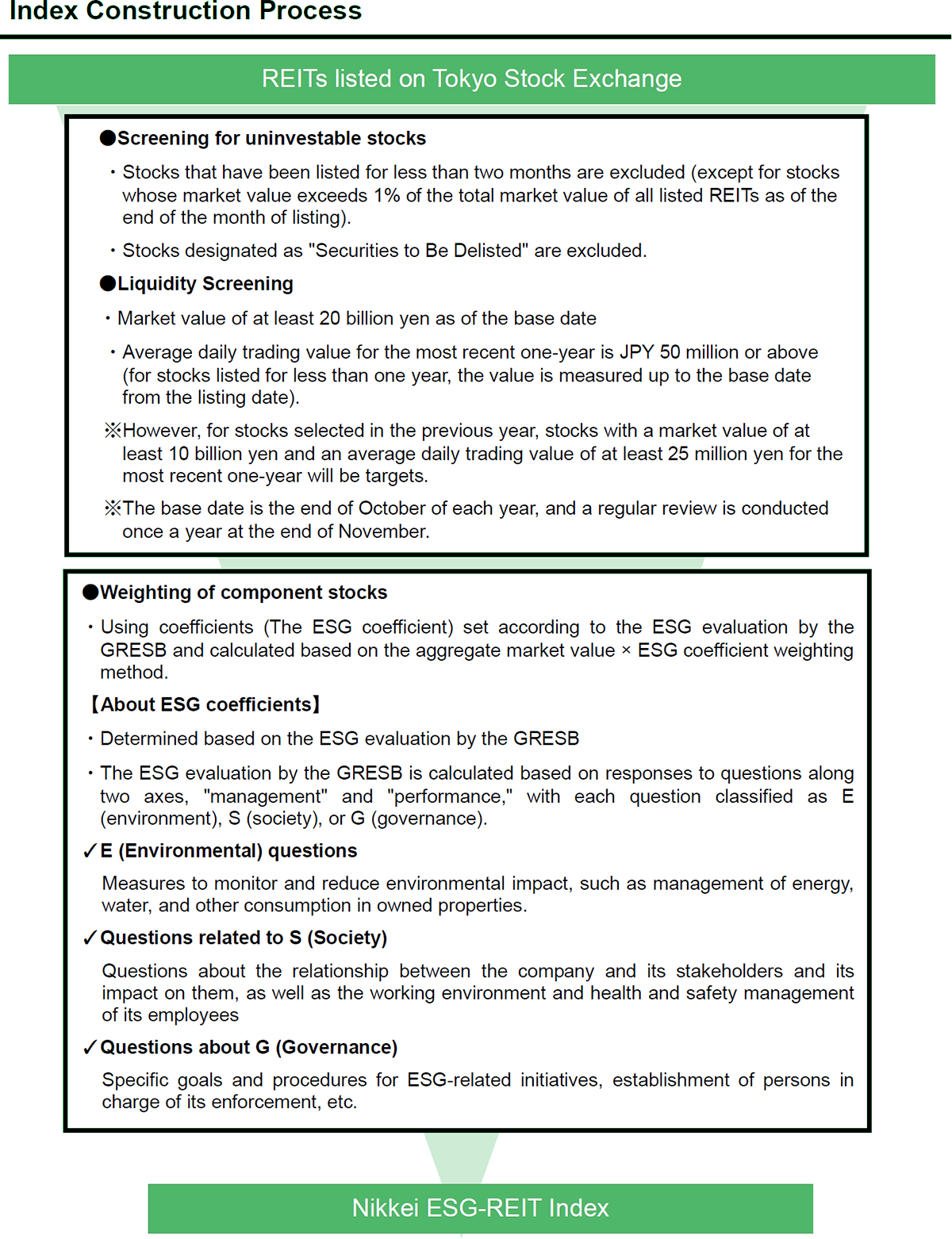

The Nikkei ESG-REIT Index reflects the assessment of ESG (Environmental, Social and Governance) initiatives of real estate investment trusts.

The Nikkei ESG-REIT Index is an aggregate market value×ESG coefficient weighted type index, which applied ESG coefficient granted in accordance with ESG rating by GRESB, an international ESG rating standard, to Real Estate Investment Trusts (J-REIT) listed on the Tokyo Stock Exchange. The Index is calculated with a starting value 1,000 point, the base date November 30, 2016.

The component stocks are adjusted every November, in principle.

Further Information

Japan Exchange Group (JPX)

Japan Exchange Group publishes summaries and lists of the ETFs, as well as other valuable information on their website.

S&P Global

- Listed ETF iNav

Please click this link to see the iNAV.

Nikkei Inc.

*Link to external sites.

Reasons for selecting “Nikkei ESG-REIT Index” as a benchmark

The Nikkei ESG-REIT Index is Japan's first J-REIT index*1 that is calculated by adding the factor of "ESG initiatives," and is an index based on the aggregate market value × ESG coefficient weighted method for REITs listed on the Tokyo Stock Exchange, which reflects the assessment points on E (environment), S (society) and G (governance) by GRESB*2. The benchmark was selected to provide more ESG-conscious investment opportunities because REITs with higher ESG ratings are more likely to obtain higher weightings.

*1 As of the launch of the fund (based on Nikko Asset Management research.)

*2 GRESB is an organization established in the Netherlands in 2009 by European pension funds to evaluate the ESG performance of the real estate sector based on the environmental performance of properties it owns. ESG evaluations are conducted annually, and a rating (5 levels) is assigned. The evaluation items include the establishment of ESG-related internal rules and regulations, the assignment of managers, information disclosure, and other management systems, as well as efforts to measure and reduce energy consumption and carbon dioxide (CO2) emissions of owned properties.

※The above information is as of the end of July 2024 and is subject to change.

※All stocks in which the Fund invests are stocks that are included or have been decides to be included in the target ESG index. The Target Index is calculated with an emphasis on ESG characteristics as shown in the index construction process above.

Copyright, etc. of the Nikkei ESG-REIT Index

The Nikkei ESG-REIT Index is a copyrighted material calculated in a methodology independently developed and created by Nikkei Inc. and Nikkei Inc. is the sole exclusive owner of the copyright and other intellectual property rights in the Nikkei ESG-REIT Index itself and the methodology to calculate the Nikkei ESG-REIT Index;

The trademark rights and any other intellectual property and any other rights in the marks to indicate Nikkei and the Nikkei ESG-REIT Index shall be vested in Nikkei Inc.;

The ETF is managed exclusively at the risk of the Licensee and Nikkei Inc. shall assume no obligation or responsibility for its management and transactions of the ETF.

Nikkei Inc. shall not have the obligation to continuously announce the Nikkei ESG-REIT Index and shall not be liable for any error, delay, interruption, suspension or cessation of announcement thereof; and

Nikkei Inc. shall have the right to change the composition of the stocks included in the Nikkei ESG-REIT Index, the calculation methodology of the Nikkei ESG-REIT Index or any other details of the Nikkei ESG-REIT Index and shall have the right to discontinue the publication of the Nikkei ESG-REIT Index.

All intellectual property rights to the GRESB Assessment data belong exclusively to GRESB BV. All rights reserved. GRESB BV has no liability to any person (including a natural person, corporate or unincorporated body) for any losses, damages, costs, expenses or other liabilities suffered as a result of any use of or reliance on any of the information which may be attributed to it.

About stewardship policy

Nikko Asset Management (hereinafter, "Nikko AM") considers the ESG factors as an integral part of its fiduciary duty to its clients. Engagement (purposeful and constructive dialogue) with investee companies on ESG issues and the exercise of voting rights are the main means of stewardship activities in stock investment, and Nikko AM takes great care to ensure that the exercise of voting rights serves the interests of its clients. In fixed income management, Nikko AM aims to be an active investor by using other stewardship tools, such as engagement with issuers.

Details of Nikko Asset Management's stewardship policy can be found on our website.

- 21 Feb 2025 — Earnings Report for Fiscal Year ended Jan 2025

- 21 Aug 2024 — Earnings Report for Fiscal Year ended Jul 2024

- 21 Feb 2024 — Earnings Report for Fiscal Year ended Jan 2024

- 21 Aug 2023 — Earnings Report for Fiscal Year ended Jul 2023

- 21 Feb 2023 — Earnings Report for Fiscal Year ended Jan 2023

- 19 Aug 2022 — Earnings Report for Fiscal Year ended Jul 2022

- 21 Feb 2022 — Earnings Report for Fiscal Year ended Jan 2022

- 20 Aug 2021 — Earnings Report for Fiscal Year ended Jul 2021

- 19 Feb 2021 — Earnings Report for Fiscal Year ended Jan 2021

A unit stock is a unit in a stock basket that an investor applying for an acquisition through addition contributes to. A unit stock is also a unit in a stock basket that an investor who applies for an exchange receives in trade for a beneficial interest.

This Fund can be applied for as a direct addition and exchange at Authorised Participants in addition to the Tokyo Stock Exchange. In this case, "unit stock" is referred to as a unit. When applying as a direct addition and exchange, please keep in mind that we cannot accept your application on the following dates:

Authorized Participants

- ABN AMRO Clearing Tokyo Co., Ltd.

- BNP Paribas Securities (Japan) Limited

- Daiwa Securities Co. Ltd.

- Goldman Sachs Japan Co.,Ltd.

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

- Mizuho Securities Co., Ltd.

- Nomura Securities Co., Ltd.

- Societe Generale Securities Japan Limited

- SMBC Nikko Securities Inc.

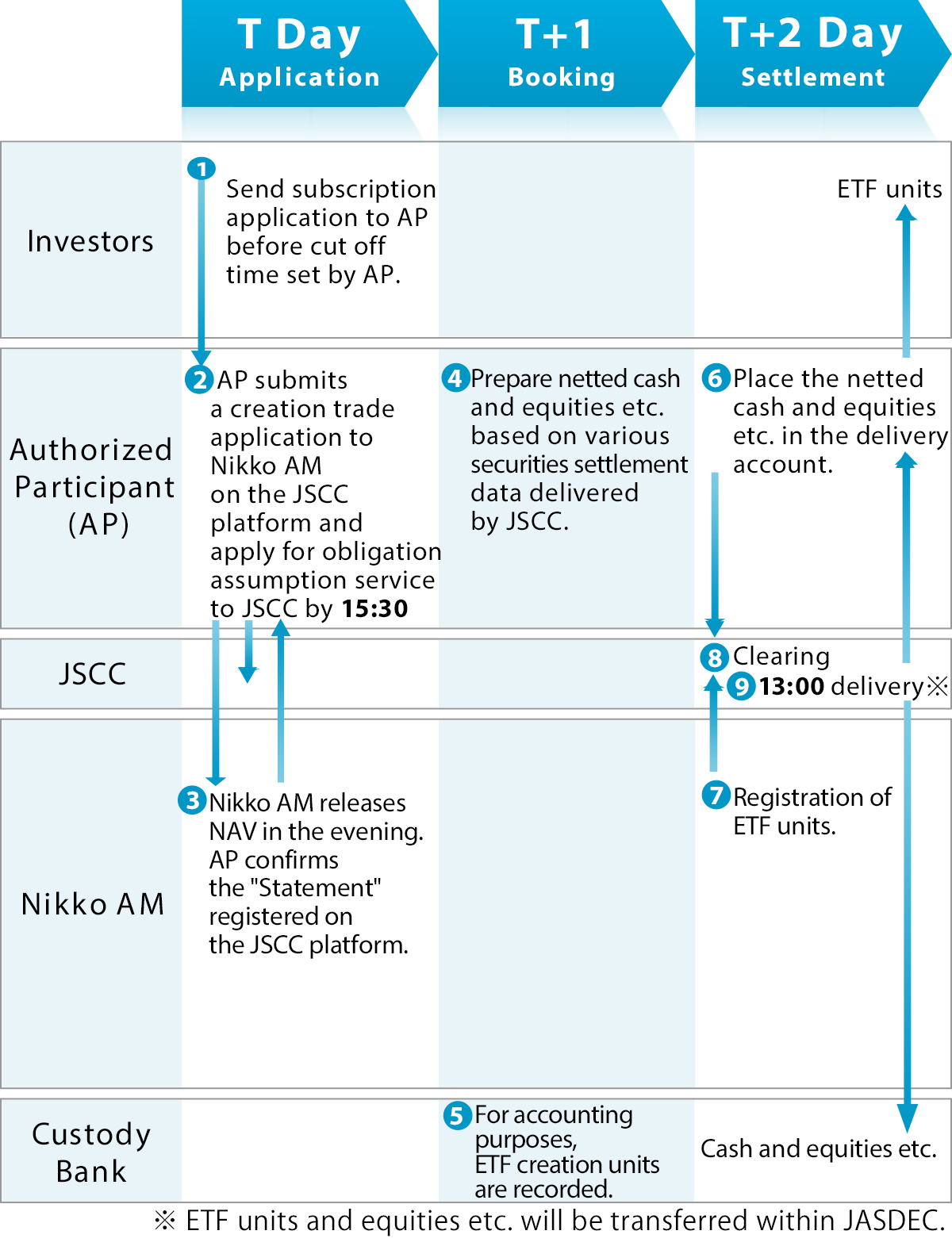

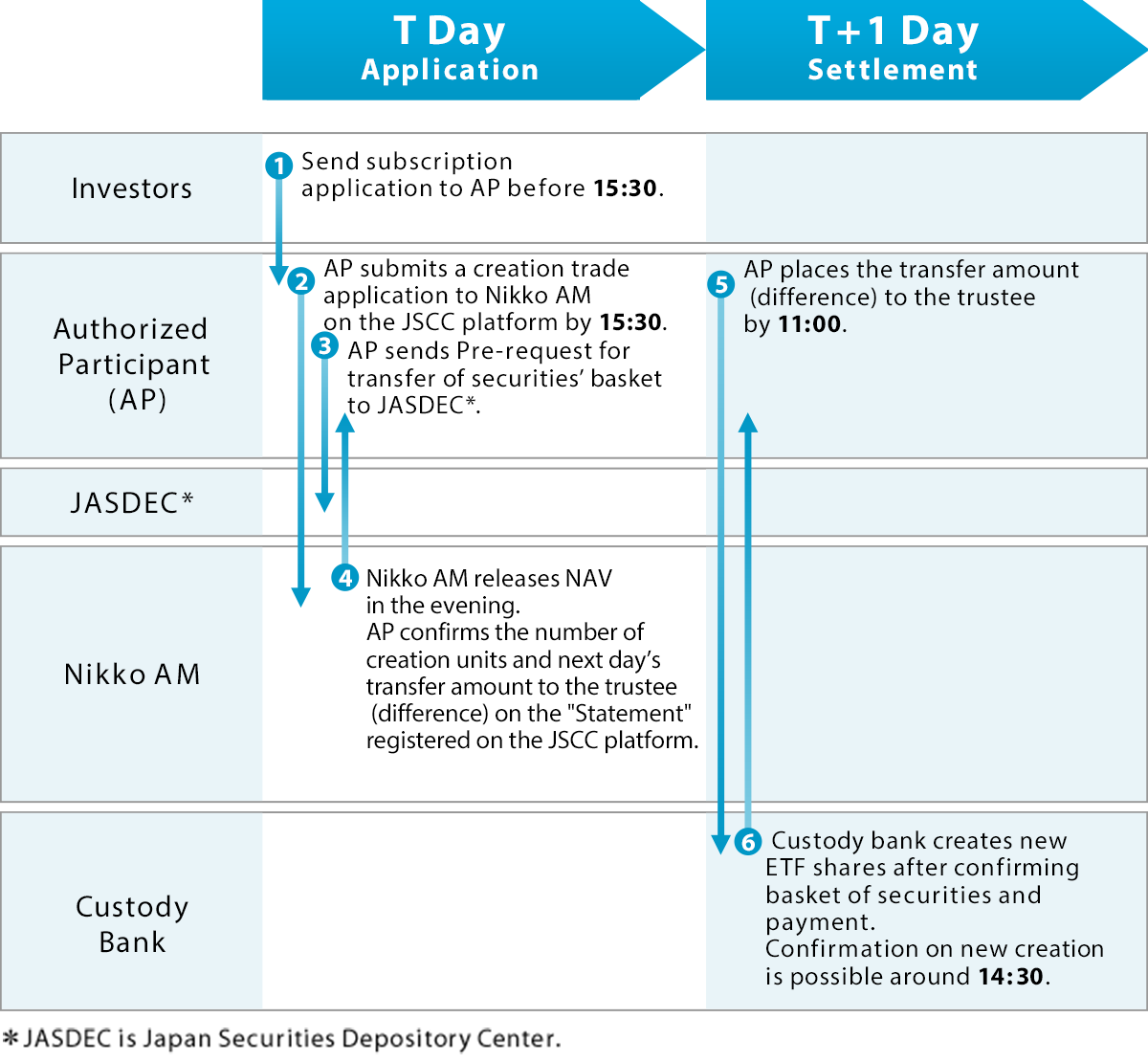

Daily Creation and redemption are based on ETF's NAV calculated in early evening. Confirm non-tradable days by referring to trading calendar on our official homepage. Basket for creation is continually-updated on our official homepage.

Basically sell/buy at last price of T day's market.

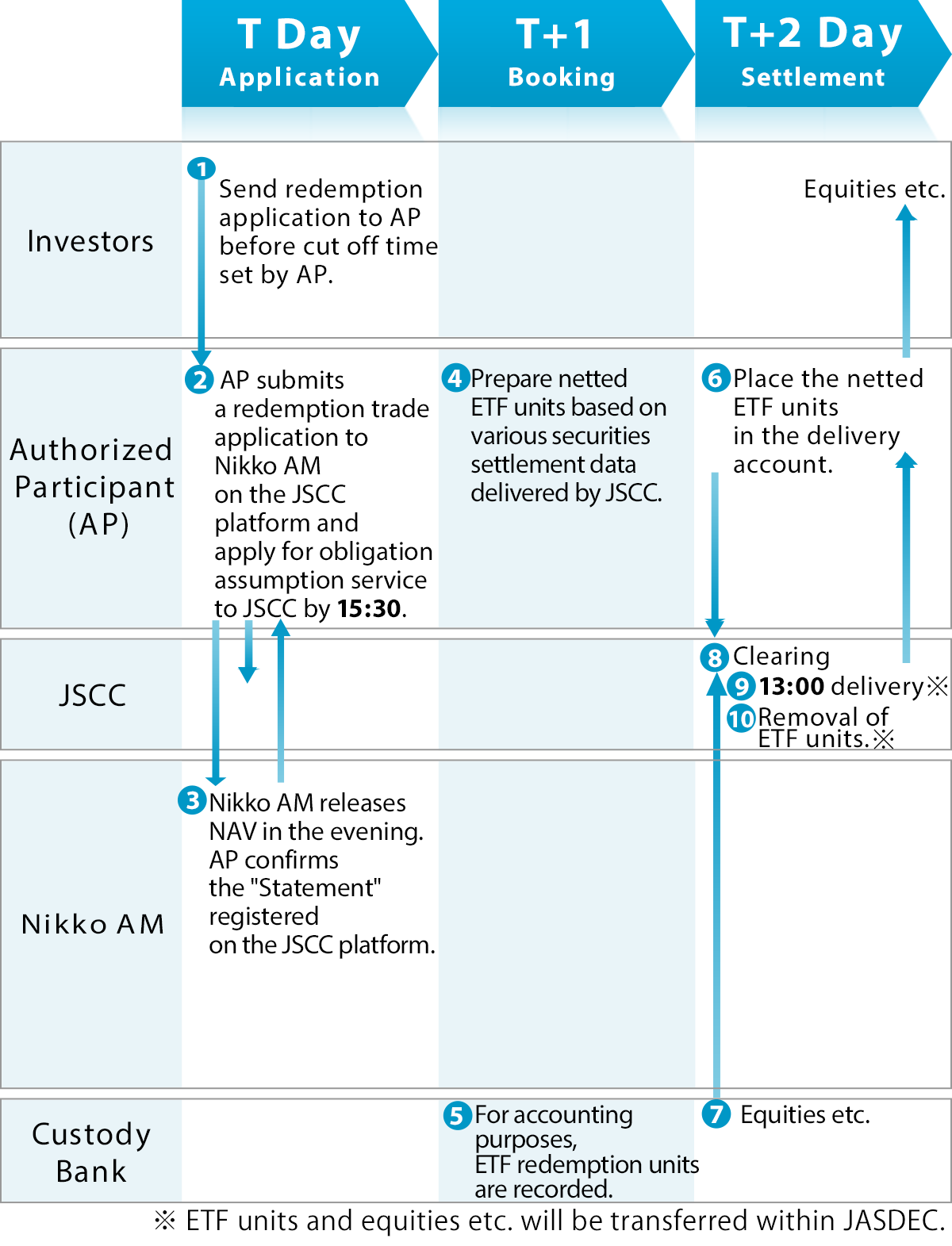

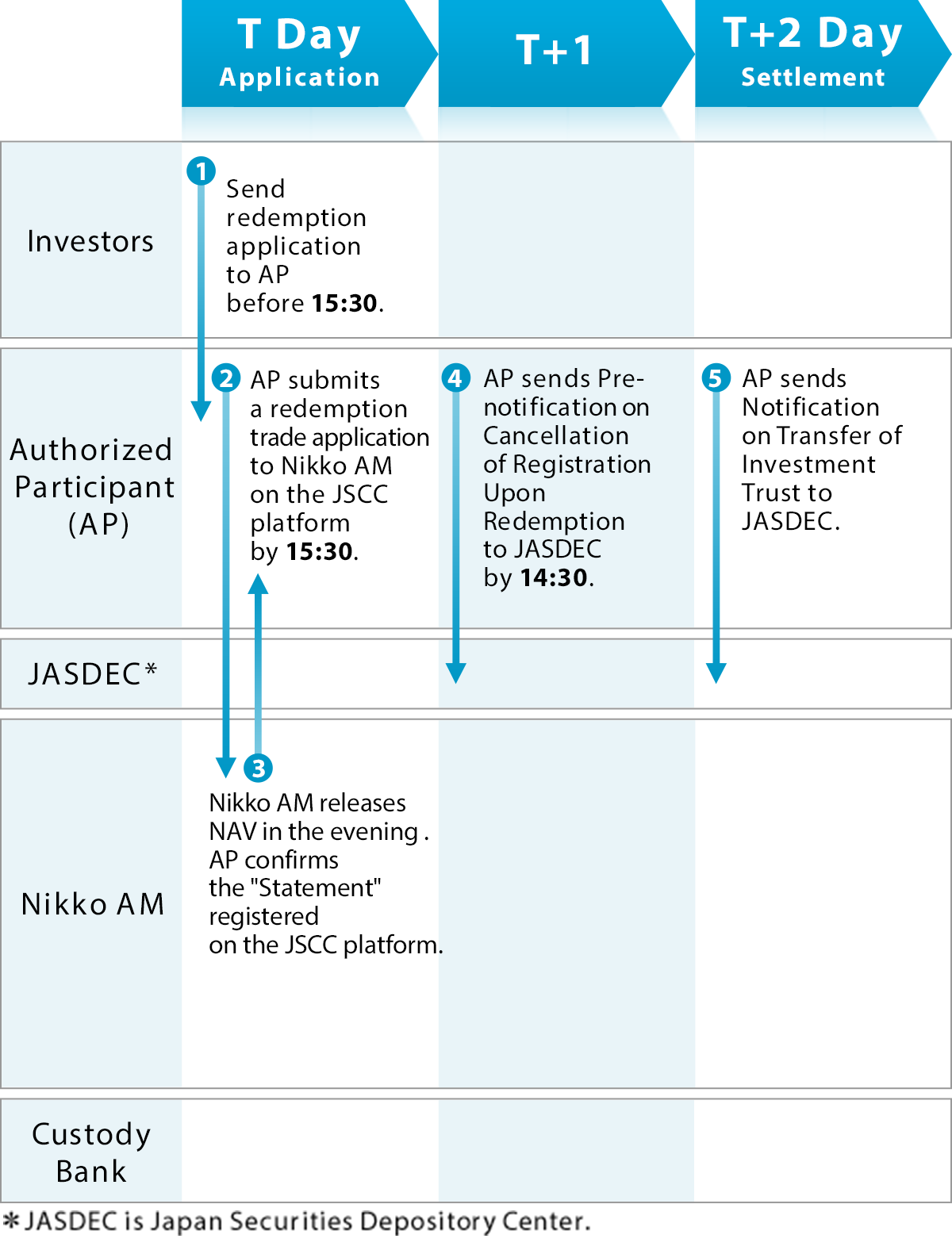

The flow chart below is showing the creation/redemption process for Nikko AM ETFs. Please note that transactions cannot be processed for days on which applications are not accepted.

Creation Flow for In-kind Creation/Redemption Type ETFs(Using obligation assumption service by JSCC)

Creation Flow for In-kind Creation/Redemption Type ETFs(Not using obligation assumption service by JSCC)

Essential Considerations

- Please secure the basket for creation ETF when making application.

- We recommend you to take measures like borrowing stocks in order to secure the basket for settlement for ETF creation.

Redemption flow for in-kind Creation/Redemption Type ETF(Using obligation assumption service by JSCC)

Redemption flow for in-kind Creation/Redemption Type ETF(Not using obligation assumption service by JSCC)

Investors are not guaranteed the investment principal that they commit. Investors may incur a loss and the value of their investment principal may fall below par as the result of a decline in NAV. All profits and losses arising from investments in the Fund belong to the investors (beneficiaries). This fund is different from saving deposit.

The Fund invests primarily in REITs. The NAV of the Fund may fall and investors may suffer a loss due to a decline in REIT prices or deterioration in the financial conditions and business performance of a REIT issuer.

Major risks are as follows:

Price Fluctuation Risk

Income and profits from the sale of real estate and real estate securitized products form the source of earnings for REITs, and REIT prices can fluctuate due to various factors including the circumstances surrounding the real estate, real estate market conditions, trends in long- and short-term interest rates and changes in the macroeconomic environment. Aging and changes in property conditions as well as the loss of or damage to properties from fire or natural disasters can also affect the price. Deterioration in dividends, financial conditions, earnings, and the market environment can cause a decline in the price of the REIT and a loss in the fund.

Liquidity Risk

In a situation where the market or trading volume is small, the price at which a security can be purchased or sold can be greatly influenced by the size of the transaction, giving rise to the risk that a transaction cannot be completed at the price expected from the market conditions, that a security cannot be sold as appraised, or that the transaction volume is limited regardless of the price level. This could lead to an unexpected loss.

Credit Risk

If Real Estate Investment Trusts become or are anticipated to become insolvent or to enter a state of holding excessive debt, there is a risk that the Fun will incur material losses.

Risk Contingent to the Lending of Real Estate Investment Trust Securities

The engaging in security lending incurs counterparty risk (the risk that the lending agreement is not honored or the agreement is canceled due to reasons including a counterparty’s bankruptcy) and could cause an unexpected loss as a result. Even when liquidating the position by offsetting it with the collateral upon the default of the lending agreement or cancelation of the agreement, there is the possibility that the acquisition cost of the security from the market may exceed the value of the collateral due to market price fluctuations. In such a case, the fund would need to make up for the price difference, and therefore incur a loss.

Risks related to ESG investment

Because the Fund invests with an emphasis on ESG characteristics, the NAV of the Fund may differ from that of the market. As a result, the Fund's NAV may fluctuate significantly.

Risk of Discrepancies between Nikkei ESG-REIT Index and NAV

This Fund seeks to match the NAV volatility with that of the Nikkei ESG-REIT Index; however, we cannot guarantee that movements will be identical to those of the Index for the following reasons:

- The potential market impact from the trading, etc., of individual issues when portfolio adjustments are made due to changes in the selected issues on the Nikkei ESG-REIT Index or capital transfers, or the costs borne by the Fund such as trust fees, brokerage commission, and audit costs, etc.

- The timing and amount of payment for the distribution of the Fund will not be completely the same as the distribution from the underlying stocks.

- Fees may be earned for securities lent.

- When derivative transactions such as futures are made, there may be disparity between the price movements of all or some of such transactions and that of the Nikkei ESG-REIT Index.

Discrepancy between the market prices at which units are traded on financial instruments exchanges and the NAV

This Fund is listed on and will be publicly traded on the Tokyo Stock Exchange; however, the market price of units will depend mainly on the Fund's demand, its investment performance, and how attractive it is to investors in comparison to alternative investments, etc. We cannot predict whether the units of this Fund will be traded at the market value, below the NAV or above the NAV.

*The factors that contribute to fluctuations in the NAV are not limited to those listed above.

Additional Considerations

- The provisions stipulated in Article 37-6 of the Financial Instruments and Exchange Act (the “cooling-off period”) are not applicable to Fund transactions.

- This Fund differs from deposits or insurance policies in that it is not protected by the Deposit Insurance Corporation of Japan or the Policyholders Protection Corporation of Japan. Furthermore, units purchased from registered financial institutions, such as banks, are exempted from compensation by the Japan Investor Protection Fund.

- When the Fund faces big redemption causing short term cash requirement or sudden change in the main trading market condition, there can be temporal decline in the liquidity of holding assets, resulting in the risks that Fund unable to trade securities at the expected market prices or appraised prices, or encounters limitation in trading volume. This may result in the negative influence on NAV, suspension of redemption applications, or delay in making payment of redemption.

- The Fund may utilize data provided by ESG assessment organizations in its investment process. The completeness and immediacy of such data may not be ensured due to insufficient information disclosure by the companies in which the Fund invests or from other reasons.

Risk Management System

- The departments in charge of risk management and compliance, which are independent from fund management departments, evaluate and analyze risks and performance, risk management, and monitor the status of legal compliance.

- To maintain an appropriate management system, the departments in charge of risk management and compliance report and make proposals to the committees associated with risk management and compliance, and instruct fund management departments to take corrective actions as necessary.

*The system described above is as of the end of May 2020, and may be subject to change in the future.