Introduction

Japanese equities scaled impressive heights in 2023, with the TOPIX and the Nikkei Stock Average reaching their highest levels since 1990 and outperforming almost all global peers to become the envy of the developed world. We expect 2024 to be a year of domestic consolidation and long-term reform measures, where markets are driven more by Japan-specific events than by global factors. After decades of deflation, we see Japan as finally breaking out of this cycle in 2024, as it enters a virtuous cycle of price increases and wage hikes.

Wage increases to kick-start domestic growth

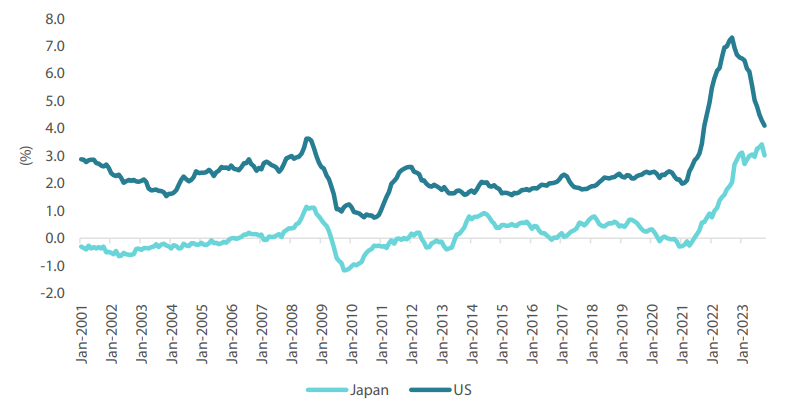

Japan is on the cusp of transitioning to an inflationary environment (Chart 1). In 2023, this inflation was largely supply-side driven, influenced by factors such as higher commodity prices, which are global in nature. However, for 2024 we anticipate an important shift from supply-side inflation to a more balanced scenario where demand-side factors, such as wage increases and consumer spending, begin to play a more significant role.

Chart 1: Trimmed-mean CPI year-over-year percentage change

Source: Bank of Japan, Federal Reserve Bank of Cleveland as at October 2023

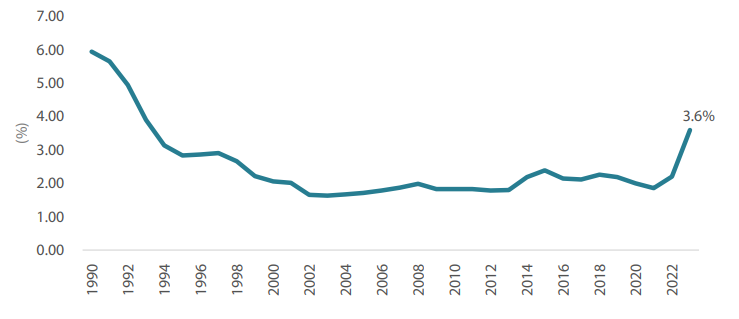

Japanese Prime Minister Fumio Kishida is intent on ensuring wage hikes create a virtuous cycle of growth and distribution in the Japanese economy. His “new form of capitalism” agenda considers wage hikes to be critical based on the belief that higher wages would underpin consumption and allow firms to hike prices. In a November meeting with the heads of business and trade unions, Kishida requested these bodies hike wages from 2023 levels as part of 2024 "shunto” negotiations (Chart 2). Shunto translates to “spring wage offensive”, and refers to the annual wage negotiations between labour unions and company management teams ahead of the fiscal year starting in April.

Chart 2: Percentage wage increases following shunto spring wage offensives

Source: Minister of Health, Labour and Welfare of Japan

Kishida's calls for sustained wage increases echo those of the Bank of Japan (BOJ), which has stressed that durable inflation must accompany sustained wage gains before it can end ultra-low interest rates and take concrete steps towards policy normalisation.

So far, these efforts appear successful. In an encouraging move, Japan’s largest national trade union Rengo will be demanding “over 5%” wage hikes (up from “around 5%” this year) and the largest industrial union UA Zensen is seeking an even higher 6% total wage increase, of which 4% will be base pay hikes, at the shunto negotiations. And ahead of shunto, major beverage maker Suntory indicated plans to offer employees average monthly pay hikes of around 7% in 2024 for the second straight year, aiming to retain talent in a tight labour market and offset rising inflation. The government is also pressing customers of small-to-medium-sized enterprises (SMEs) to accept price hikes, a crucial component in hiking SME employee wages, as SMEs are not as profitable as large companies and the room to hike wages is considered small.

The Japanese government has ambitions to raise the national minimum wage by 50% by mid-2030s. It is also believed that this will have a positive effect on raising not only the low-income segment but, more importantly, the median salary for Japan. Long-term expectations of wage hikes are important for domestic consumer sentiment; people need to feel confident they will be able to afford to buy goods and services going forward. For investors, this shift represents a change in the fundamental dynamics of the Japanese economy. Sectors that benefit from increased consumer spending, such as retail, consumer goods and services, may therefore look increasingly attractive to investors.

Consumption to remain buoyant

While wage hikes are going to be front and centre in Japan’s economic agenda, it is worth focusing on the increasing number of part-time workers in the workforce, which affects overall wage statistics. Since these workers typically earn lower wages than full-time workers, their growing presence in the labour market can make average wage growth appear slower than it actually is. This is largely due to the methodology used in calculating wage growth statistics, which is a weighted average of full-time and part-time workers.

In this instance, more part-time workers in the labour market may mean lower year-on-year wages in percentage terms, but in reality, these part-timers are paid salaries and will contribute to growing household income. Moreover, a household’s total income, which includes earnings from both full-time and part-time jobs, determines its disposable income—the amount available for spending or saving. This is consistent with the recent resilience in consumption in Japan, despite real wages (wages adjusted for inflation) being negative for the past 18 months. In the meantime, we expect wage growth to continue, just as we expect inflation to slow down in 2024. It implies that the purchasing power of households may increase, supporting stronger consumption and economic growth.

It is also worth noting that during the pandemic, Japanese households accumulated savings estimated at about 50 trillion Japanese yen due to reduced opportunities for spending. These “forced savings” are expected to be spent in the future, further supporting consumption.

BOJ monetary policy normalisation to continue

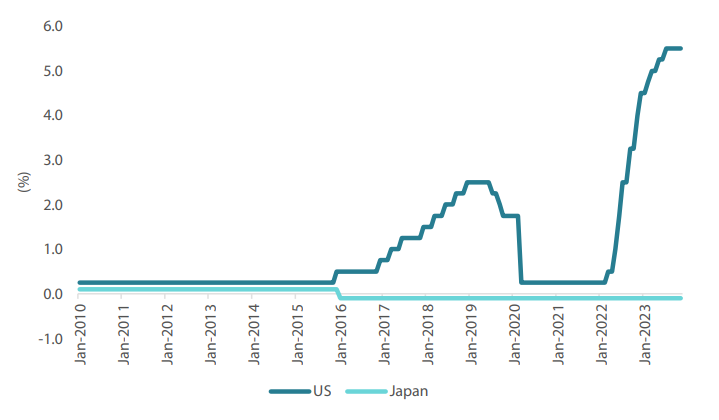

In 2023, the BOJ made significant strides in phasing out its yield curve control (YCC) policy. As we look ahead to 2024, the next anticipated step in this gradual process of policy normalisation is the exiting of the negative interest rate policy, with the BOJ policy rate currently standing at minus 0.10% (Chart 3). This is expected to be a focal point of the BOJ's actions early in 2024.

Chart 3: Japan, US policy rates

Source: Bloomberg as at end-November 2023

The BOJ's moves towards policy normalisation are likely to be closely aligned with the stance of the government. This alignment can be traced back to the policy accord established between the government and the BOJ in 2013, which emphasises a cooperative approach to managing the country’s economic policies. This approach is continuing to bear fruit. Importantly, any policy adjustments made by the BOJ will likely be executed in a measured and gradual manner. This cautious approach is designed to prevent any abrupt disruptions in the financial markets. Therefore, we believe that there is no immediate cause for concern regarding a rapid “tightening” of monetary policy. Instead, in our view the BOJ’s actions should be viewed as a shift from an “accommodative” stance towards a “less accommodative” one, signifying a gradual transition towards a more normalised economic environment.

Tokyo Stock Exchange gets tougher in addressing capital efficiency

The Tokyo Stock Exchange (TSE) has taken a proactive stance to enhance capital efficiency within the Japanese stock market, and we expect this initiative to gain momentum in 2024. In March 2023, the TSE urged companies to improve management practices with a focus on cost of capital and stock prices by applying a three-phase approach (analysis of the current situation, planning and disclosure, and the implementation of initiatives).

From January 2024, the TSE will be taking a tougher approach to monitoring and incentivising corporate compliance with these three factors. This will include publishing a list of companies complying or not complying with the initiatives. We expect this transparent reporting to help investors and stakeholders to track the progress of individual companies.

The TSE has also committed to knowledge-sharing and best practice guidelines which it hopes will share valuable insights for companies looking to improve their management practices. In our view, the TSE’s initiatives will help to promote transparency and accountability, and will help to align corporate interests with those of their investors, making Japanese equity markets more attractive to a global investor base.

The benefits of M&A, shareholder activism and hostile acquisitions

As highlighted previously, Japan’s push for corporate reforms, and the cultural imperative driving them, are forcing companies to change their behaviour. At the same time, the increasing prevalence of activist investors has been pushing companies to re-evaluate their operations and strategies, and to potentially unlock hidden value. To further fuel this trend and revitalise the mergers and acquisitions (M&A) market, the Ministry of Economy, Trade, and Industry (METI) has introduced new M&A guidelines. These guidelines are designed to create a more conducive environment for M&A activities, potentially increasing deal volumes and unlocking additional value within the market.

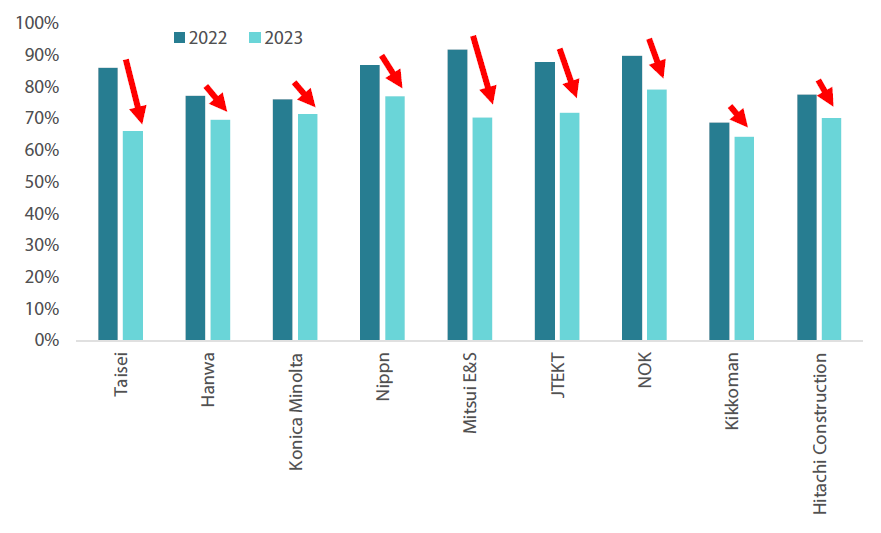

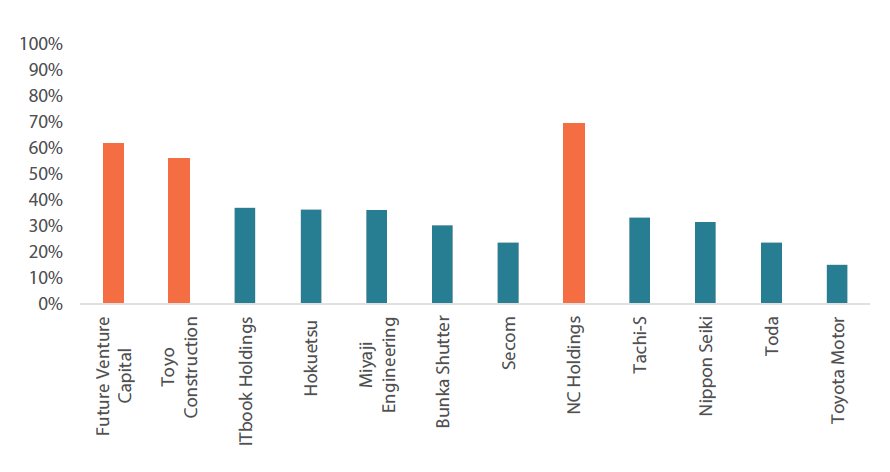

Chart 4: Agendas proposed by management: percentage of votes for

Source: Nikkei

Chart 5: Agendas proposed by shareholders: percentage of votes for

Source: Nikkei

In addition, by promoting transparency, fairness and efficiency in M&A processes, METI aims to encourage both domestic and international investors to actively participate in the Japanese M&A market. This could lead to increased competition for target companies, potentially driving up valuations and incentivising companies to explore strategic alternatives.

One notable example is the successful acquisition by Nidec Corp—the world’s premium maker of electric motors—of Takisawa Machine Tool Co in November 2023. Such acquisitions can lead to significant shifts in ownership and strategy within the Japanese corporate landscape. In essence, the confluence of activism, hostile acquisitions and METI's new M&A guidelines helps to create a dynamic environment in which companies are under much greater scrutiny to deliver value to their shareholders. As a result, Japanese companies are increasingly motivated to maximise their worth.

More value to be unlocked in 2024

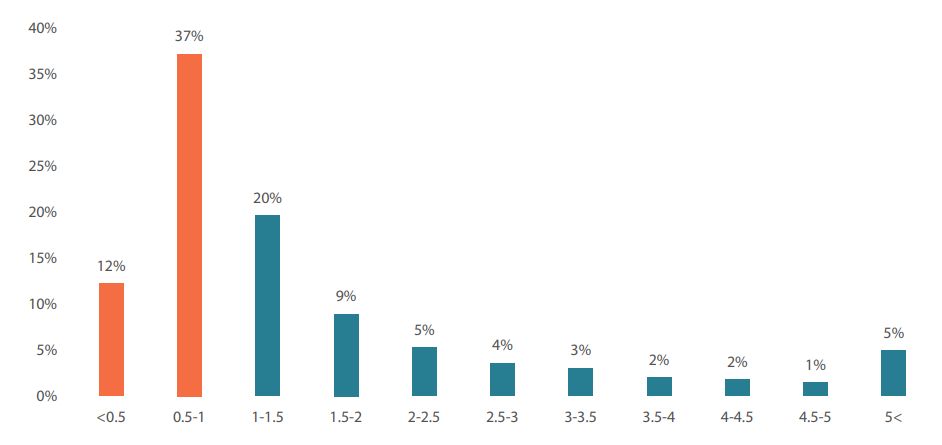

Despite the rally in the broader market, Japanese value stocks—characterised by their favourable fundamentals and attractive price metrics—continue to be undervalued when compared to book value (Chart 4). This trend holds true across all market capitalisation segments, but particularly in the small- and mid-cap space where many companies are still trading at significant discounts and have room to move much higher in 2024. By focusing on these undervalued small and mid-cap value stocks, investors stand to benefit from substantial price appreciation as these stocks move closer to and above their intrinsic book values.

Chart 4: Distribution of companies with respect to price-to-book

Source: Bloomberg as at 30 November 2023

Summary

In our view, Japan’s success in recent years should continue and consolidate in 2024. In 2024, the government will be waiting for the right moment to officially announce victory over deflation, although the exact timing of this will largely be a function of political dynamics. Even so, it appears Japan’s policymakers and politicians are aligned, and the exit from deflation and the normalisation of monetary policy should therefore be well orchestrated. We expect this positive backdrop to augur well for Japanese companies, many of which are achieving more commercial success and benefitting from better corporate governance than ever before. As a consequence, Japan is likely to remain a promising destination for global investors who should still be able to find some attractively valued opportunities relative to the rest of the world.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.